People, Ideas & Objects Tactical and Strategic Changes, Part I

In a recent eight part series we documented how People, Ideas & Objects, our user community and service providers were structured to achieve success in oil and gas across North America. This may have been mistitled as I was not so much documenting how People, Ideas & Objects et al were planning on being successful, but how it was that we were structured to ensure success in terms of profitable oil and gas exploration and production. This new series is taking that thinking to the next level to discuss how we have amended our strategies and tactics to deliver that success to an industry that is in desperate need of real profitability. That’s currently managed by a handful of self interested and conflicted bureaucrats who have proven they’ll do nothing about anything, except their enhanced executive compensation. Why are we doing this, what’s changed and is today any different than any of the past decades these bureaucrats have been in control? Yes, things have changed dramatically, and this post will document the situation. This series will also document what People, Ideas & Objects are doing as a result of these changes, and we are now making recommendations to others to begin their own personal processes of change and begin the transition to the environment we are building.

In granting the bureaucrats the honor of proceeding with the development of the Preliminary Specification People, Ideas & Objects were able to provide them with the credibility they needed to move forward with their operations. Many may feel I’m overstating my case here, that I’ve inflated my self worth. I don’t think so and it is not my intention. What I’ve done is patiently waited for them to act and it is through their inaction that the Preliminary Specification as a solution to today’s issues came into clearer focus. The contrast is evident, dramatic and obscene due to their inaction. Bureaucratic resistance to our solution only increased and there was never any consideration otherwise. Their issues have now fallen well outside the domain of anyone’s control.

Thucydides’s ancient warning that “It is the habit of mankind to entrust to careless hope what they long for, and to use sovereign reason to thrust aside what they do not desire”

Victor Davis Hanson

I am looking at the landscape of the oil and gas industry from the point of view of the destruction that has been caused by the inaction of these self serving bureaucrats. Profitability in an industry is the only worthwhile pursuit in business and anyone associated with oil and gas over the past number of decades will understand that principle intuitively from this point forward. We should thank the bureaucrats for their real life lesson on such an important topic. Without profitability within the producer firms everyone suffers. The shareholders pursuit of earnings is the reason the North American economy is the strongest ever and has the resilience and effectiveness that it does. It may appear selfish and narrowly focused on those with capital however it works out very well for all concerned. And when it is corrupted as it has been in oil and gas it is an ongoing tragedy of unending misery. It is not me who is overstating my case; it’s the bureaucrats that have abused their position to the greatest extent seen in North America. If I speak of granting the honor and credibility to the bureaucrats that they need, I am only representing all of those that have been affected by bureaucratic inaction and their corruption. Every opportunity has been granted to bureaucrats since I published the Preliminary Specification in December 2013. And they have abused them all. This last opportunity was an overt calling to proceed with the Preliminary Specification under the “issue mitigated, nothing litigated” expression. This began on June 2, 2020 and has been a constant theme on this blog. Seeking to provide the bureaucrats with a means in which to avoid their personal risk of being sued for their inaction regarding the July 1986 documentation of overproduction, or unprofitable production, by North American producers that OPEC had sought to resolve. This issue has so destroyed the industry and has been present each and every day since at least July 1986. And the fact that the Preliminary Specification was published in December 2013 as the solution to that issue. Our good friends, the bureaucrats who are the members of the Boards of Directors and Officers of the producer firms, have sworn to uphold their fiduciary duties and are therefore culpable and guilty.

I still have not spoken of the change that I see causing the revised strategic and tactical changes People, Ideas & Objects are implementing. And it’s not to keep you in suspense but there are many things happening and we will get to the triggering event in this post. However, there will be more posts in this series that reflect the other changes that have been made. First I want to start by stating the conclusion of these changes and then get on to the triggering event.

The first change People, Ideas & Objects are conducting is that we are cancelling our program of “issue mitigated, nothing litigated.” Bureaucrats are no longer welcome here to proceed with the development of the Preliminary Specification. They have done nothing, and the fact is they will do nothing so there is no loss here on their behalf. Their pursuit of consolidation, drilling, their unauthorized diversion into clean energy and “capital discipline” are evidence of their plans for the future. This was their choice to maintain the status quo. Therefore it will from now on be known as “nothing mitigated, issue litigated.” There are consequences to inaction, all of us who are associated with oil and gas are experiencing that. It’s now time for those who are actively engaged in inaction to feel it too. Our December 4, 2020 blog post asked “Who’s Going to be the Bigger Fool” in the future? Will we be sitting here in five, or ten years with the same set of circumstances and the same viable scapegoats being parotted by these bureaucrats? There is no question in my mind that the question stung and the answer was and is a resounding “not me.” The game is up for the bureaucrats and no one is being taken for a fool anymore. It’s also at this time that I’m reminded of a Winston Churchill quote.

You can always count on Americans to do the right thing - after they've tried everything else.

Who will proceed with funding the Preliminary Specification? To quote a famous politician “At this point, what difference does it make.” What People, Ideas & Objects, our user community and their service provider organizations need is access to the oil and gas revenues of the industry. Producers need to have some skin in the game. Otherwise we will fail as a result of a lack of their willing and necessary participation in the user community. They can not hand a critical aspect of their business off to someone else and expect it to be done appropriately. We also have no capacity whatsoever to provide any investor of ours with any means of a reasonable return or expectation of a return due to the destruction that has been caused in the oil and gas ERP market space as a result of past malicious actions by bureaucrats.

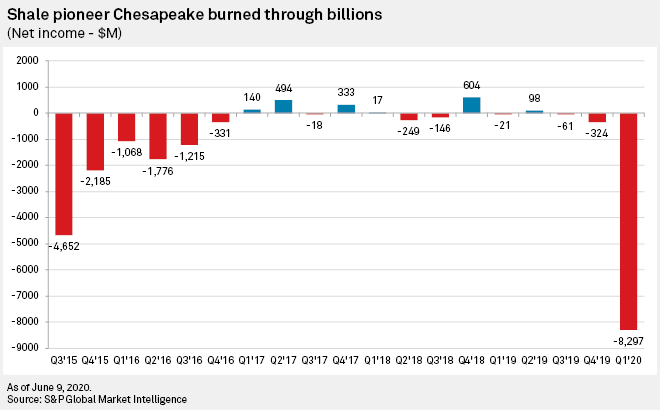

In 2015 we saw the beginning of an investors strike that has continued and become a protracted issue for oil and gas. Producers had grown to depend on the annual stock offering as a means to literally pay the light bill throughout the entire calendar year. Dilution of last year's investors, and all their other investors, fell into the memory hole known affectionately as “history” by these bureaucrats, saying “don’t worry about it.” There is nothing more critical than investors abandoning management by walking out on them. The reason People, Ideas & Objects have had to be patient is due to the virus providing a viable scapegoat for the past year. But prior to that, a few years ago private equity and Warren Buffet saw an industry that was in pretty rough shape, in desperate need of some capital and rehabilitation. Warren Buffet made his “ultimate contrarian bet” as he called it into Occidental Petroleum and then promptly saw what obviously scared him to the point of quickly selling out of all his Occidental holdings. Private equity hung in there a little longer and have now exited the industry as well. Banks have extended themselves in the industry to the highest level they can tolerate. Producers working capital continues to evaporate. It is for the lack of a better saying, the end of the road for our good friends the bureaucrats. Maybe the Biden administration will help? From Forbes.

The demand for shale producers to become self-sufficient with less reliance on outside capital is intensifying.

The withdrawal of private equity, long a crucial investor in the shale sector, will take a significant toll on many shale companies, particularly smaller producers that lack strong balance sheets.

Why is it that People, Ideas & Objects, our user community and their service provider organizations are standing there, at the ready, hat in hand, offering our services in hopes that the bureaucrats who caused all this damage, do the right thing and fund the Preliminary Specification to save the bureaucrats personal empires for them? I can’t find a reason why we’re the last ones here in support of these despicable people. By supporting the bureaucrats and offering them the Preliminary Specification we are working at cross purposes to those who are the shareholders of the producers. It is the investors that we have supported and identified as the critical resource that the industry needs to guide it through these difficult times. Their actions, and their ultimate action of leaving the industry is fully supportive of what we needed to happen for our Preliminary Specification to become a reality. Profitability is the only criteria that is going to resurrect the industry and provide the financial resources for all those that have been so betrayed by the despicable self dealing bureaucrats. Why is it now that People, Ideas & Objects, our user community and service providers are actively betraying those that we’ve needed, wanted and indirectly participated with us in removing the bureaucracy. Our olive branch to the bureaucrats would have given them a life line that may have instilled another generation of their franchise with the caveat that they would have been able to “muddle through” more easily, and enjoyed the bounty of a truly profitable industry at the expense of those shareholders.

What needs to be done is a purge of these people from their lofty positions and away from the producers check books. It’s time to choose sides in America, are you with the shareholders, which after all are John Q. and Jane P. Public, or are you with the bureaucrats? Corporate America who recently came out in favor of political initiatives that have nothing to do with their products or services profitability. Who’s corporate objectives have morphed into the Democratic Parties key issues of race and climate. To suggest they’ve lost the script is undeniable. It’s time for change.

The long and short of all of this is the declaration of total, irredeemable failure of the North American producers at the hands of the bureaucratic mismanagement. People in the industry who want to stay with the status quo are able to do so, and participate in the development of the Preliminary Specification as their long term career transition away from these failed organizations. Please follow the application process defined here and understand that the user community has always been considered to be part-time positions. The source of user community members long term value and day to day compensation is designed to be fulfilled through the service provider organizations you’ll need to develop. Don’t let the bureaucrats' disease of inaction infect you.

We’re setting out the framework of two different types of producers in the oil and gas industry. The first type will be bureaucrat free and as a result successful and profitable oil and gas producer by using People, Ideas & Objects, our user community and their service provider organizations. The second will be an extension of what exists today in the slow process of chronic destruction. I see the bureaucrats as the chaos and we’re the opportunity. When bureaucrats find themselves alone, and not just alone but wrong on so many fronts, I’m not going to be their last good friend that’ll help them out.

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. Anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.