People, Ideas & Objects have acknowledged that our campaign from October 2023 to May 2024 was misguided. We now realize that our approach was unreasonable from the start. Expecting a decision to replace the established oil & gas organization with the Preliminary Specifications vaporware, despite its quality, was unrealistic. This insight is the main takeaway from our campaign. We have always known that officers and directors are unlikely to change. What we perceived as their obstinance was actually our own unreasonable belief that such a switch to the Preliminary Specification would be considered in a reasonable world.

The reasonable man adapts himself to the world: the unreasonable one persists in trying to adapt the world to himself. Therefore all progress depends on the unreasonable man.

George Bernard Shaw

Moving forward, our approach will evolve. We will highlight the deficiencies and failures of the current system to contrast and promote our solution. By offering the Preliminary Specification as an alternative in the marketplace of ideas, we aim to secure the need for change. The need in the marketplace is becoming apparent to others, suggesting that our strategy might be appropriate. However, while this might address some timing challenges in our product development and delivery, it does not fully resolve them. The industry's needs are evolving rapidly and will remain pressing in the near future. Offering an insurance policy in the form of an alternative at hand is our objective.

Highlights of Our Campaign

The issues we raised during our campaign turned out to be the key deliverable. There are many serious, and what People, Ideas & Objects suggest existential, issues facing the industry. These issues have been systemic for decades, arising from a myriad of reasons. None of these have begun to be addressed since our Preliminary Specification entered the marketplace in August 2012. Over time, these issues have become material, with significant financial consequences for all producers in the North American oil & gas industry.

Pricing of Oil & Natural Gas

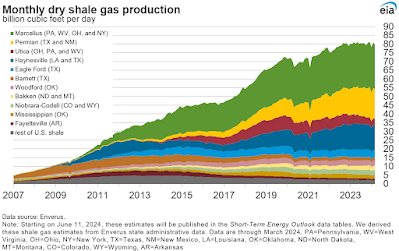

People, Ideas & Objects have documented that both oil and gas have been overproduced since the late 1970s. The first significant evidence of this was the oil price collapse in 1986. After the 2009 financial crisis, producers began overproducing natural gas at volumes exceeding previous levels. This overproduction was driven by the prolific nature of shale and the industry's outdated view that natural gas is merely a byproduct of oil. People, Ideas & Objects challenges this perspective, arguing that the severe financial consequences of overproduction demonstrate that natural gas is not a mere byproduct.

Following the 2009 financial crisis, overproduction of natural gas intensified, causing its price to collapse far beyond the traditional 6 to 1 heating value ratio compared to oil. By 2024, this ratio had soared to as high as 50 to 1, reflecting the extent of overproduction from shale development. People, Ideas & Objects calculated the difference between the natural gas revenue the industry should have realized at the 6 to 1 ratio and the actual discounted revenue. The total loss amounts to $4.1 trillion, with realized revenues during the shale gas production period totaling approximately $3.253 trillion. This represents the loss of the commercial value of 764.8 TCF of natural gas, reinforcing that natural gas is not a byproduct.

The waste of assets in North American natural gas is unparalleled. Trillions of dollars and trillion of cubic feet of gas have been squandered, while industry leaders maintained that only they could understand and manage oil and gas operations. These executives, enjoying what People, Ideas & Objects describes as “creative executive compensation,” perpetuated their mythology with a lavish lifestyle, ignoring external advice.

Investors, frustrated with poor returns and performance, began withholding financial support from producers in 2015. This drastic measure, typically the last resort for shareholders, should have prompted firms to address shareholder concerns. However, nine years later, no substantial action has been taken, suggesting the message from investors has been ignored.

People, Ideas & Objects have proposed a solution through our Cloud Administration & Accounting for Oil & Gas software and service, which introduces a process of disintermediation to focus on a culture of preservation, performance and profitability. Despite the clear need for change, this solution has been overlooked since 2012, during which the majority of the $4.1 trillion in waste occurred. Similar waste likely exists in the oil sector, though it is harder to quantify the true value of a barrel of oil. Given that oil & gas provide significant mechanical leverage, it remains one of the world's most valuable resources, essential to our advanced economy, political influence and way of life.

LNG

The revelation that North American producers failed to benefit from the development of LNG export markets is shocking. Since 2016, U.S. LNG exports have grown to 12-14 BCF/day, representing approximately 12-14 percent of U.S. natural gas production. This growth allowed entities outside the industry to purchase inexpensive onshore natural gas, ship it free on board to Europe and Asia, and sell it for up to five times its cost.

Producers were initially unaware of this opportunity and the associated business terminology until we highlighted the issue. This prompted a rush among many producers to secure long-term LNG facility contracts, aiming to sell their natural gas at North American export prices and capture the “global” natural gas prices in Asia and Europe. These contracts also presented a chance to establish commercial natural gas prices in North America. By late 2023, numerous LNG facility contracts were announced. However, existing long-term contracts held by external parties locked producers out of operational LNG facilities, including those under construction and some awaiting regulatory approval. As a result, producers ended up signing contracts for non-existent LNG facilities, ones not under construction, not approved by regulators, and merely conceptualized on entrepreneurs' desks.

We began discussing this issue in early October 2023. The market’s rapid action stemmed from significant monetary deficiencies and the previous recklessness of officers and directors. By late December, the Biden administration recognized that this situation conflicted with their policies, leading the president to declare a halt on further LNG facility approvals by regulators, thereby closing off the opportunities that officers and directors sought to secure.

How was the opportunity to establish North American natural gas pricing based on global prices actively avoided? For years, producers touted the value of LNG exports but did not realize any incremental value. They essentially gave away their gas at substantial discounts compared to the sales prices realized by others soon after purchase. This promotion of LNG was hollow, resembling little more than a parade of officers and directors lining up behind CEOs, who, as parade marshals, boasted their accomplishments with “big, beautiful balance sheets.”

There is only one method left for the producers to eliminate the value being siphoned off by others. To implement the Preliminary Specification across North America and assure that all natural gas is produced profitably everywhere and always. That way the margins being realized by those with the existing LNG contracts will find that what was once a profitable business will become risky and marginal.

Chronic Lack Of Profitability

Chronically low oil and gas prices, punctuated by occasional collapses and even negative prices, have led to repeated boom-and-bust cycles in the oil and gas industry. People, Ideas & Objects view these cycles as unnecessary, especially considering that oil and gas are scarce resources that must be managed responsibly for future generations. This requires ensuring that these resources are produced profitably, always and everywhere, based on an accurate and timely accounting. An accounting that understands that a capital intensive industry's products will generally pass their costs, which are predominantly in the form of capital, to the consumer. Furthermore, the consumer value proposition from oil and gas is critical, as it underpins a prosperous economy at low costs, with significant economic and political consequences if disrupted.

Low oil and gas prices can be attributed to overproduction by North American producers. In essence, overproduction equates to unprofitable production. Producers may claim profitability, but this is often due to accounting methods that fail to accurately account for the substantial capital costs involved in exploration and production. The dependency on external investor cash for annual spending has led to a cycle of overcapitalization, overreported profitability, and subsequent overinvestment, ultimately increasing the industry's productive capacity beyond the actual profitability threshold of oil and gas production. For commodities like oil and gas, which follow the principles of price makers, this overproduction leads to precipitous price declines from these incremental barrels.

Additional difficulties for the oil and gas sector are imminent. When natural gas was trading around $1.60 (or 50 to 1) in early 2024, we projected that achieving a 10% profit would require a price of 6 to 1 compared to oil. Producers fail to realize the economics that producing at $1.60 necessitates the profits of nine volumes of profitable gas, if that should ever occur, to offset the losses incurred on each volume produced today. This lack of basic business understanding highlights decades of poor business management, marked by slogans like “building balance sheets,” “putting cash in the ground,” and “muddling through.” Basic business concepts such as free-on-board and netback pricing are often unfamiliar. If not for the convoluted methods of accounting produced by officers and directors they would have seen the waste of assets and chronic deterioration of cash. Business can not afford to produce at such losses for long, yet oil & gas has been at this for over four decades. Aided by specious accounting that deceived investors of their cash. Spending is not a business model.

Producers have a solution in the form of the Preliminary Specification, which addresses this issue and ensures profitable production everywhere and always. Profitable production should reflect the replacement cost value of the produced barrel of oil, which People, Ideas & Objects believes to be the true cost of oil and gas. The financial resources needed to drive the industry forward over the next 25 years are significant. Investors lack both the vast resources necessary and the desire to provide further capital. Therefore, profitability is the only long-term sustainable and substantial financial resource capable of meeting the industry's needs.

Capital Costs

A significant portion of our $25.7 to $45.7 trillion value proposition is derived from the more effective use of capital within the industry. In capital-intensive industries like oil and gas, the largest portion of the consumers product costs comes from capital. Accurate and timely reporting of these capital costs, and passing them on to consumers through the income statement, is essential. The Preliminary Specifications enhanced performance reporting can achieve this, a capability that current producer systems lack.

Since at least 2006, People, Ideas & Objects have highlighted issues in recording and recognizing capital costs. Despite discussions and proposed benefits, no substantial changes have been made industry-wide. The current methods have become culturally entrenched, showing no signs of change. We advocate for the rapid recycling of capital costs on a 30-month basis to meet the industry's capital needs for the next 25 years.

Profits are the only substantial source of capital capable of funding the industry's future requirements. Current officers and directors have mismanaged capital, betraying investors, bankers, and service industry representatives. Producers face rapid monthly cash drainage, an issue we have repeatedly pointed out. Without annual capital injections from investors to stabilize cash reserves, producers have encountered cash crises, exacerbating their problems.

We estimate $20 to $40 trillion of our value proposition is attributed to capital recycling. Rather than relying on investors for these resources, People, Ideas & Objects believes that the approximate $2 - 3 trillion levels of property, plant, and equipment recorded on producers’ balance sheets, when recycled repeatedly, are sufficient. If these capital assets were profitably recycled every 30 months, they would generate enough cash from oil and gas sales to fund future capital expenditures, bank loan repayments, and investor dividends. However, this logic seems lost on current officers and directors of producer firms.

Absent and Unmotivated Leadership

In 2021, during the COVID crisis, producer officers and directors declared that shale would never be commercial. This declaration set the stage for their pivot away from the oil and gas industry toward the unaccountable clean energy sector. They anticipated that they would only need to report to environmental activists like Greta Thunberg and could attribute any lack of financial performance to their efforts to save the planet. This charade unfolded in board meetings across the industry, with purported investor pressure driving the demand for change. This theatrical performance was documented at the Exxon annual meeting.

Read more in the original documentation:

[Shakespearean performance at the Exxon annual meeting].

They were correct in stating that shale would never be commercial—under their administration and management. One might wonder if this declaration was a response to the wide distribution of our white paper, “Profitable North American Energy Independence — Through the Commercialization of Shale,” published by People, Ideas & Objects on July 4, 2019. Alternatively, perhaps our paper did not resonate well in their circles.

Skydiving Without a Parachute

People, Ideas & Objects initially adopted an all-or-nothing strategy, urging the industry to choose between our vaporware ERP system and their outdated systems. We now recognize this approach was unreasonable. Instead, we should have offered a competitive solution to address the industry’s issues. The Preliminary Specification focuses on the business challenges of oil and gas producers, and we believe these issues have now reached a critical point where choices need to be made. We are now offering the industry an insurance policy to support it in the event that the current administration continues to fail. To illustrate, I reference a quotation from Henry Kissinger’s last book, “Leadership: Six Studies in World Strategy.”

The strategy of forcing a choice between us and the existing systems was likely inappropriate. The desire to impose such a stark choice did not justify the associated risks. However, is it now prudent to proceed without an alternative in hand?

People, Ideas & Objects offer a compelling value proposition based on the business model defined in the Preliminary Specification. We have mentioned the trillions of dollars our value proposition provides and assert that we will focus on dynamic, innovative, accountable, and profitable oil and gas operations for producers, positioning ourselves as the primary, quality choice of ERP system.

As Margaret Thatcher noted regarding government administrations, democratic societies have options, while dictatorships ensure they are the only choice, often securing over 90% support in elections. People, Ideas & Objects are not dictators. Regrettably, we were drawn into emulating the same type of dictatorship that officers and directors have imposed on the industry for the past four decades.

Consolidation

The chronic lack of profitability in the oil and gas industry, along with its root causes and resolutions, has been detailed in the Preliminary Specification. Despite these insights, producers are turning to consolidation as their solution. This approach contrasts sharply with the global trend towards decentralized organizational structures. The consolidation of North American oil and gas producers seems out of sync with the broader business world.

These issues are cultural and systemic, originating in the late 1970s and becoming evident with the first oil price decline in 1986. The industry seems lost, unsure of how, where, or what to do to achieve profitability. Are they truly committed to oil and gas? What is the plan for these consolidated producers? We have seen no clear strategy. How will they organize without infringing on People, Ideas & Objects' Intellectual Property? Consolidation might have been effective in the 1950s, but in today’s fast-paced, AI and Internet-driven world, these producers are likely to fail as they have been, evidenced by their need or desire to consolidate. Two days ago Chesapeake announced another round of layoffs. Inspiring another generation to stay as far away from oil & gas as possible. You can't raise a family or pay a mortgage on the fickle prospects of officers and directors who are incapable of comprehending anything beyond boom / bust.

Given these circumstances, it would be prudent to have an alternative organizational method in hand. People, Ideas & Objects’ Preliminary Specification offers a viable insurance policy against the industry's current trajectory.

Conclusion on the Issues

People, Ideas & Objects' concern is that none of the issues and opportunities identified and addressed in the Preliminary Specification have been acted upon by the industry. Efforts to enhance profitability and introduce innovation have been resisted by officers and directors since its publication in August 2012. Will consolidation fix this? We are concerned that the industry's productive capacity is beginning to decline.

We have seen significant deterioration in all aspects of the greater oil & gas economic infrastructure. The service industry has been seriously damaged and has little faith, trust or goodwill in the producer firms. Its capacities operate at around 30% of prior levels and continue to diminish. An active rebuilding is necessary. Where does the capital come from to undertake that rebuilding? In the past investments were made in good faith and they saw producers abuse accounts payable in order to finance their capital expenditures for another year. "No one else would give us any money." Not paying their suppliers for 18 months is not what a primary industry does. During covid producers sat and watched as the suppliers sold off horsepower to other industries and cut up equipment for scrap metal to survive. And now consolidation is adding additional difficulties in the form of fewer producers / dictators telling them what the service industries prices will be. Which brings them even more impediments to not invest. In a case of “fool me once shame on you, fool me twice shame on me” the service industry won’t get fooled again. The service industry believes if producers had some skin in the game, by way of philanthropic contributions, then they’ll have an understanding of their behavior's inappropriateness.

The Preliminary Specification offers an organizational performance framework with a vision for the next 25 years, aiming to rebuild the industry on a culture of preservation, performance and profitability. We fear that without change, the oil and gas industry will continue on its failed trajectory, exacerbated by consolidation. This would lead to greater distraction, lack of focus, and incapability in what is called the leadership today. The jeopardy this places society in is particularly dire, considering the economic and political consequences of allowing this industry to continue its degradation over the past decade. Producer firms have picked their solution in the form of consolidation. Having an alternative organizational and operating method as an insurance policy would be wise counsel. People, Ideas & Objects offer the Preliminary Specification.