Our Ground Floor Vision

People, Ideas & Objects have painted a vision of how and what the Preliminary Specification, our user community and their service providers would structure the dynamic, innovative, accountable and profitable oil and gas producers to be. Recently in Organizational Constructs we noted how the Preliminary Specification uses five major structures to define and support the industry. These include the Joint Operating Committee, markets, Intellectual Property, specialization and the division of labor and the Information Technologies that are available today, such as the Internet. Expanding on these constructs to include the reorganization of the Intellectual Property of the earth science and engineering capacities and capabilities that are undocumented in the industry today. Offering a comprehensive organizational form which provides an ERP system to support exploration, production, administration and accounting. Setting out the gold rush opportunity for the industries engineers and geologists to document, publish and earn the copyright and therefore establish a foundation for their new applied sciences firm based on that Intellectual Property. In the process breaking down the foundation of the existing producers capacities and capabilities and setting up new ways in which the engineers and geologists will operate in the industry we’re rebuilding. Supported directly through the Preliminary Specifications Work Order system that captures their time and billing needs to manage the commercial aspects of their products and services.

But there is so much more to what we’re doing, and what everyone involved in oil and gas could be doing. The primary industry of oil and gas directly affects many other businesses and industries that are critically important to the success of a profitable, energy independent North America. That is to ask the question, what business, or how are you employed today? Does it affect our objective of ensuring that all production in North America is produced profitably and always? And profitably from the point of view of recognizing all of the costs of exploration and production in a timely and accurate manner? That competes in the North American capital markets on a competitive basis? Then you will be interested in better understanding the overall vision of rebuilding the oil and gas industry based on your involvement in the markets that are forming, and need to form, to make these objectives real for the remainder of the time that we’re dependent on oil and gas. Those wishing to save the planet will have their own plans as they move on to their clean energy startups. Ground floor opportunities for everyone in energy! Just as The Constitution assures us that all men and women are created equal. This ground floor opportunity offers the same equal treatment today. However, unlike the Biden regime it does not suggest that equality of outcome is even possible anywhere or at any time in this or any galaxy that we’re aware of.

The role of capital in a startup operation is massively diminished in the 21st century. Particularly when the acquisition of Intellectual Property is the foundation of a firm. Add to this the soon to be standard working from home method of operation cuts the overhead of what you're doing. The other aspect of all of this is you don’t have to technically do anything in the short term. That is your new venture can exist almost exclusively in your mind and SSD. The time spent in planning, thinking, or what I’ve listed as the competitive advantages of the service providers would also be applicable here. They include quality, specialization and the division of labour, automation via software, innovation, leadership, application of Artificial Intelligence, which all use the uniquely human attributes of issue identification and resolution, creativity, collaboration, research, ideas, design, negotiating, compromising, financing, reasoning and judgement to just start the list. These form the long term competitive advantage of these businesses built upon the foundation of the Intellectual Property being developed.

I’ve mentioned this opportunity to some people and in some cases found an interesting response that I would caution people from taking. That is they think the opportunity is too advanced for them at this time. Or too advanced for them. Maybe they’re just being kind to me and not telling me what they really think! People shouldn’t be thinking this way. Everybody has a role and a place to fit in, somewhere. Don’t preclude yourselves from this opportunity without some serious thought and consideration first. Set aside your concerns of where you are today, and think more of where you'd like to be in a decade and three decades from now. The only thing that haunts you in old age are your regrets. (And it’s not that I’m completely there yet.) Don’t let the opportunities you didn’t fully explore become one of your regrets.

To rebuild the foundation of the oil and gas industry on profitability is the only way that the primary, secondary and tertiary industries can develop and prosper. What has happened here in the past is, and should be seen as unacceptable, is nothing short of a dictatorship run by bureaucrats for their own self serving purposes. Which is the inherent motivation of all people to do well for themselves. And that is what this opportunity provides, the opportunity to build a substantial business operation. Yet, as a result of their failure, we see now the need for a profitable oil and gas industry is necessary to make everything else real. And if everyone is not focused and pointing in the same direction at that goal and objective of profitable energy independence, we’re wasting our time, our resources and other people’s money. It’s time someone did something and that demands action from every corner of these industries and people involved. And that is us.

A few quick tips to make the process easier and safer for you. Don’t be afraid to publish your IP as soon as you can generate it. I use Google’s blogger platform for a number of reasons. At the beginning denial-of-service attacks were common and could cause time and effort to be consumed on petty server related maintenance. I’ve done none of that for any reason for the past sixteen years. It’s free and has the ability for you to earn advertising though you won’t have a strong audience in the engineering or geological related discussion of oil and gas. This is not a large market. Don’t concern yourself with bureaucrats finding out what you're doing. They're not looking and are busy with other things. If they do find you the worst they can do is blacklist your site on their file wall which is shared across the industry. Just don’t post your picture right away. In other words don’t quit your day job. Writing is the process of generating the IP and the process never ends. You’ll always be building on the base of what you've done.

The need to spend money doesn’t exist. That is unless it’s absolutely necessary. If the pennies can’t scream any louder, don’t spend anything. Remember we can stop the log from rolling down hill at great cost. And begin rolling it back up with great effort and cost. Only to have what we had that’s caused this damage. There are better ways to do things today. Let's use those methods instead. You can start today.

I’m now going to head off the range, even further, for a few minutes to get a point across that might be a bit of a stretch for some people. However I’m willing to risk it in terms of relating where we might be in the greater scheme of things. Whatever you may think of the argument make sure you come back. The first paragraph is a quote from Winston Churchill, and they are followed by quotes of Professor Larry Arnn in his book “Churchill’s Trial, Winston Churchill and the Salvation of Free Government.”

Mankind has never been in this position before. Without having improved appreciably in virtue or enjoying wiser guidance, it has got into its hands for the first time the tools by which it can unfailingly accomplish its own extermination. That is the point in human destinies to which all the glories and toils of men have at last led them. They would do well to pause and ponder upon their new responsibilities. Death stands at attention, obedient, expectant, ready to serve, ready to shear away the peoples en masse; ready, if called on, to pulverize, without hope of repair, what is left of civilization. He awaits only the word of command. He awaits it from a frail, bewildered being, long his victim, now—for one occasion only—his Master.

Churchill raised the hope that science itself will lead to the amelioration of these dangers but was quick to discard this hope: “The hideousness of the Explosive era will continue; and to it will surely be added the gruesome complications of Poison and of Pestilence scientifically applied.” Mankind is progressing toward destruction. Only an improvement in certain virtues of man—especially the virtue of wisdom or of “wiser guidance”— stands in the way of his elimination.

Nuclear weapons were the subject of his last major speech in the House of Commons, which he gave on March 1, 1955, shortly after the announcement of the hydrogen bomb by the United States. The hydrogen bomb was much more powerful than the atomic weapons used against Japan, and Churchill thought the change in power important, a difference in degree that amounted to a difference in kind. It revolutionized “the entire foundation of human affairs” and placed mankind “in a situation both measureless and laden with doom.” He continued: “Major war of the future will differ, therefore, from anything we have known in the past in this one significant respect, that each side, at the outset, will suffer what it dreads the most, the loss of everything that it has ever known of.”

Here then is the new situation: men can now build societies in which large populations can enjoy security, comfort, freedom, and plenty. The tools that enable them to build such societies, unknown in the ancient world, can also be used to destroy those societies. This changes the relationship between construction and destruction, between building and tearing down, between saving for the future and living for the present. It is in principle a demoralizing fact if by morals we mean the virtues that lead to peace, harmony, and plenty in a modern society.

The analogy I want to draw here is; as our tools and organizational methods become more effective, the extent of our reach becomes more consequential. The fact is there are many calculations as to the number of man hours of equivalent labor contained in each barrel of oil. For the purposes of this calculation I’ll use 10,000 man hours or 1,250 man days of labor equivalent per barrel. With approximately 130 million boe / day consumed, just today’s consumption is the equivalent man days effort of a population of 162.5 billion people, or 722.2 million man years that we gain each day through the consumption of that energy. Dare I ask what are our moral and ethical virtues have allowed these bureaucrats to destroy what is so obviously now a mortal dependence? And, if oil and gas is as valuable as represented here, why have we taken it from future generations unnecessarily and unfairly by not at least producing it profitably? Profitable from the perspective of an accurate accounting of the costs of exploration and production. We owe them at least the assurance we didn’t waste any, and that we pass a viable industry on to them so they can manage theirs. There is a history recorded on this blog that began in December 2005 that details the deficiencies of these bureaucrats' administration and what their motivation was. Have they now earned the right to continue in that role, to divert oil and gas revenues for the continuation of their own personal benefit, and “pursue” their objective of “saving the planet” with clean energy after exposing us to such dire consequences?

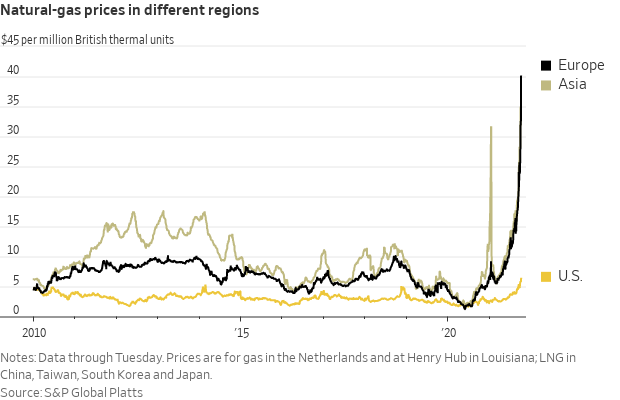

I see the same behaviors and attitudes that have been ever present with these bureaucrats. In a Reuters article entitled “Canada boosts U.S. natgas exports, drills more as global prices surge” we hear the whining and sniffling of producer CEO’s telling us what we’ve known for some time.

However, a shortage of skilled crews to operate drilling rigs in Canada could limit how much gas output climbs, and some producers remain cautious that increased supply may rein in prices.

"How do we do more even if we wanted to do more? We're at a limit on the people that we have," said Darren Gee, Chief Executive of Peyto Exploration and Development Corp.

Taking a responsible approach to oil and gas. A responsible approach could be defined however they would want to. This chronic excuse, blaming and viable scapegoating has to stop at some point and there’s only one way that I can think that’s going to happen. Start rebuilding the industry on the basis of this overall vision that People, Ideas & Objects have presented here and build the Preliminary Specification. That way these officers and directors self absorbed navel gazing can be replaced by people who are focused on the one critical aspect of what’s required of everyone. Profitability in the primary industry of oil and gas to ensure that value is being built everywhere and always, for everyone.

Please note there is a different procedure for our user communities involvement than what is defined here. I’ll address those differences in Monday’s post and support why those differences exist.

On the other hand we have no shortage of work to do. Much needs to be done in the next few years. The Preliminary Specification needs to be built. The engineering and geological explicit knowledge needs to be captured as Intellectual Property and developed. New oil and gas firms need to be formed, capitalized and organized. Assets need to be transferred to these new producers in innovative, strategic and tactical ways. In this process we’ll all be helping the current producers to travel faster down their chosen journey to clean energy by disposing of dirty oil. This transition to the Preliminary Specification is something that must be done to deal with the financial difficulties the industry is plagued with from the current administration. This also needs to be done as preparation for the future. And to learn from the experience of this transition as we’ll be faced repeatedly with situations that share this same scope and scale of change in the near future of this business. We’ll therefore be somewhat prepared and experienced in challenges of this nature. Please review our Production Rights to see how everyone can participate in making this new oil and gas industry happen. An industry where it will be less important who you know, but what you know and what you're capable of delivering, what the value proposition is that you’re offering?

Those interested in joining our user community are People, Ideas & Objects priority and focus. The Preliminary Specification, our user community and their service provider organizations provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence, everywhere and always. In addition, our software organizes the Intellectual Property of the exploration and production processes owned by the engineers and geologists. Enabling them to monetize their IP for a new oil & gas industry to begin with a means to be dynamic, innovative and performance oriented. Providing a new investment opportunity for those who see a bright future in the industry. A place where their administrative, accounting, exploration and production can be handled for the 21st century. People, Ideas & Objects have joined GETTR and can be reached there. Anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.