How Producer Bureaucrats Overstate Cash Flow, Part V

The bigger they are, the harder they fall is the saying. It’s difficult times like these in oil and gas that having the agility of a hummingbird will ensure you have the capacity to meet the threats and realize the opportunities that a producer may face. Much as the resilience and persistence of a startup organization would have. Turning bureaucracies into a larger form of the beast that has brought it to its knees will? I think we’ll find out in very short order. When the world is employing technology to accelerate their organizations to deal with the speed and pace of business. It’s good to know there are still rebels who can shirk that dynamic and show that there are different roads that can be taken. There are many examples in history that show these producer bureaucrats that their grasp of the past will be successful. The former Soviet Union was a basket case and now under Putin? Or how about the doubling down that we’ve seen in Iran? These are the kinds of rebels providing inspiration to our good friends the bureaucrats. Even closer to home we have the pertinent example of Maduro in Venezuela. When so many oil and gas bureaucrats think the same things regarding consolidation, how could they be wrong? And think of the benefits, a single point of contact for everyone for all things oil and gas. What was I thinking of bringing ERP systems based on the Joint Operating Committee to make North American producers dynamic, innovative, accountable and profitable?

We’ve now discussed the allegedly immaterial and irrelevant costs of overhead and interest in the oil and gas industry. Cenovus, post Husky consumption, plans on 25% of their staff being cut, the financial relief from just the staff salaries that are cut will total 100% of what Cenovus reported as G&A for 2019. Yes, overhead is irrelevant in oil and gas and we must always believe that! So the bureaucrats say. Here’s a question I have about these cuts and overhead in general. What is it that these people who are deemed “overhead” do? Do they just sit on their hands all day? Or are they active and productive, in the course of which incurring significant, additional overhead costs in their wake. When you cut the staff, are the activities stopped, or do others just pick up the generation of these other overhead costs? If so, what have you cut?

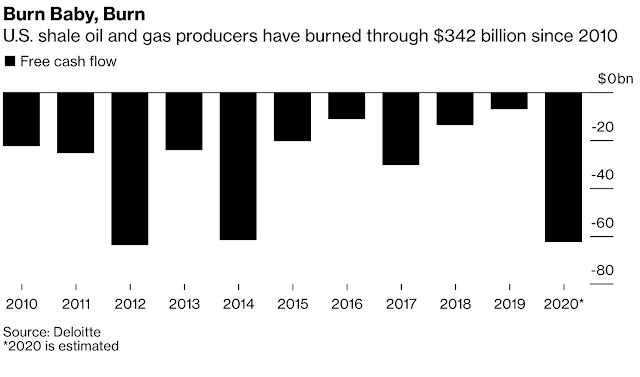

We move on now to discuss the third category of over capitalization that is used to “build balance sheets,” overstate earnings, attract overinvestment and hence create chronic overproduction. This third item is the line between what is deemed to be capital and what is operations. There is no disagreement that oil and gas is a capital intensive industry. This should apply, in our opinion, to the commodity sales price as well. That commodity prices should reflect the significant capital costs that are involved and included in exploration and production. Producers are facing an acceleration of their costs of exploration and production over the next 25 years. Facilities and infrastructure will need to be either built or extensively refurbished in order to remain in service through this period. The costs of oil and gas contained within each barrel of oil is on an ever increasing trajectory. The effort involved for the exploration and production of each incremental barrel of oil equivalent is higher than the prior barrel was, as it always has been. The logistical, political, environmental and business related complexities and difficulties are accelerating and will continue to do so. Recent history has shown that the industry is uncompetitive in the market for investment capital. Cash can no longer be “put in the ground” for the bureaucratic sport of it. The retrieval of that previously invested cash has to be the primary concern of the producer. This would enable producers to internally generate the funds for their own capital expenditures, pay off their debts and issue dividends which will be a requirement for at least the next decade in order to reestablish themselves with the reputation of profitable, value generating organizations. Until then the only source of cash will be claiming that “cash you have to put in the ground” as producers have been telling their investors these past decades.

“Shale is a rapidly depleting asset” is the opinion of Wall Street investors. And investors are efficient communicators of the difficulties being faced. There are very high costs associated with shale drilling and completion. All subject to those accelerated decline rates. Extensive reworks and recompletions are necessary in as little as one to one and a half years. Additional laterals may be drilled and completed to expose new reserves to the well bore and enhance the deliverability of the remaining, existing production. These extensive and costly incremental costs are currently tossed on top of the initial drilling and completion costs and depleted over the remaining life of the proven reserves initially revealed and any enhancements exposed through the rework. Which may extend the life of the reserves into the next century. This is contrary to People, Ideas & Objects proposed practice of sourcing and returning previously invested cash for reuse by the producer. It is also contrary to the competitive nature of global capital markets. It is a luxury that no one is afforded and certainly no one is entitled to. An endless supply of financial resources provided by the investors, as a result of questionable accounting, was never acceptable. At the same time the consumer has become accustomed to an energy cost structure which is inadequate, leading them to believe it is cheap and plentiful, leading them to lose all sense of the value the commodities bring to their lives. These attitudes will lead to further political difficulties in the very near future when producers will ultimately have to address the more appropriate costing of their sales. To address these issues producer bureaucrats have stuck their consolidated heads in the sand. It is our opinion that the initial drilling and completion costs of shale should be impaired when additional, extensive work is done downhole. The initial well’s drilling and completion value has somewhat expired. Or, the recompletions and other extensive work needs to be expensed. Having this both ways seems contradictory and is inconsistent with the principle of generating cash, earnings and measuring performance. Which is the last hope for the North American oil and gas producer. The destruction that has been allowed to occur will reveal itself in almost every aspect of the business throughout the next decade. It’s called a reputation, consolidation doesn’t address the bureaucrats diminished reputation.

These solutions of course assume the Preliminary Specification is available to provide the decentralized production models price maker strategy. Where the ability to shut-in unprofitable production is available and hence the commodity markets will have found the marginal costs of oil and gas on a global basis.

This is all accounting, as I’ve been accused of many times. “Accounting will never make a basin profitable or unprofitable.” Yes it is accounting and business doesn’t enter the logic of the producer bureaucrat. How the industry has approached the recording and recognition of their capital costs over the last four decades has been the chief cause of its decline in financial performance. The landscape today is in shambles and the bureaucrats don’t seem to care other than to pick up on the latest industry trend so that they too look good. Now that they have consolidation as their new calling they’ll be able to resume sitting on the couch while things develop, either good or bad, and leave any issues otherwise unaddressed. Until the next crisis arrives, just like the last crisis, which is the same crisis, at which time they’ll think of something new to make it sound good and buy more time. Except no one is listening, and the investors certainly aren’t biting on the creative nature of their “consolidation” plans. This is just more of the cyclical downturn that we’ve been on for decades.

I do wish I could write about something positive, I do lose a number of readers because they say I’m too negative. It’s not that I’m negative it’s the industry is in shambles. A situation that I am providing a solution to. I don’t know if anyone else is buying what the bureaucrats are selling anymore, in the past, here in Canada, these themes or is it memes were picked up by John Q. Public and parroted with little to no thought behind them. With more layoffs now baked in the cake due to consolidations, will John Q. Public understand that the trend is not their friend?

The misguided nature of personal executive compensation has no basis in terms of the business performance. This has been noted in the Wall Street Journal recently and elsewhere. Yet nothing happens, this entitled group continues on with whatever flavor of the day with no consideration other than “what’s in it for me” and we all know that the moment that things become untenable it will be they who will leave en masse in order to ensure that no one will remember anyone of these individuals names. Third quarter financial reports for our sample of producers began yesterday and will continue for the next few weeks. I’ll be returning with our quarterly review on November 12, 2020 to report on the rolling tragedy.

In Part II of this series we noted that the adjustments our sample of producers made for overhead, interest and capital vs. operations totaled around $130 billion. Reflecting an overstatement for their market capitalization of $780 billion for about one third of North America's production profile. The motivation to do this, and to do so systemically and consistently throughout the industry by all producers for all this time, with the obvious and highly detrimental consequences being played out today, shows that the motivation I’m alleging is accurate. We noted the Bloomberg quote on Tuesday that had the “Energy” sub-industry value in the S&P 500 fall from 11% to 2%. The value of that loss can be quantified based on the market capitalization of the S&P, which is currently $23 trillion. Therefore the difference between 11% and 2% in terms of quantifiable loss these bureaucrats are responsible for would total $2.070 trillion. Chump change to these bureaucrats, we know, but losses realized by all others concerned with the industry.

There’s a theory in accounting known as the Efficient Market Hypothesis. In a nutshell it suggests that all information is known in the financial markets and therefore is reflected in the price of the participants in that market. When I see that the energy index represents a $2.07 trillion loss. And at the same time, by my calculations, the amount of overstated cash flow of one third of North America's production profile is approximately $130 billion, representing a market capitalization of $780 billion. It is reasonable then to conclude that what I’m discussing in this post is already understood and acted upon by the investment community. Yet, as we see, nothing is being done, nothing is being admitted to and conversely these producer bureaucrats believe they have everyone convinced otherwise.

In Part III of this series we noted that the hypercritical issue that producers of all sizes are currently facing is the shortage of cash. The inability to replenish the cash float each month was never understood as an issue when the investors were deceived into loading the annual budget of the producer. Now with no investors for the better part of 5 years the drainage of monthly cash these organizations has cumulatively incurred as a result of their capitalization policies, the subsequent “leakage” or “slippage” that occurs, leaves producers with no cash to pay the bills next month. Consolidation is supposed to help this? It may in my opinion help, in that it will finally call an end to this tragic era of oil and gas history. Remove the cause of the problem, the bureaucrats, and commence the developments of the Preliminary Specification.

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. And don’t forget to join our network on Twitter @piobiz, anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.