We've been discussing the insurance policy that People, Ideas & Objects offer to those responsible in the industry—a contingency plan to establish an alternative means of organization and operation in case the current administration fails further. This failure has been ongoing for at least a decade. Progress is not linear, and unfortunately, neither is failure. While we stand on the shoulders of giants, we've neglected to advance further, leaving issues unresolved for too long. Future opportunities are now beyond our reach, necessitating a rebuilding of infrastructure capacities and capabilities as a priority.

People, Ideas & Objects have campaigned to persuade industry officers and directors to adopt the Preliminary Specification, aiming to reconfigure the oil & gas industry around a culture of preservation, performance, and profitability. However, producer officers and directors denied any need for such changes and proceeded with their own consolidation plans. We wish them well, understanding that they likely feel the same about People, Ideas & Objects. If nothing else, our Campaign Report Part I identified the issues, highlighted the inadequate approaches taken to resolve them, and exposed the fundamental lack of business understanding that caused these problems in the first place. This has been quite revealing regarding the quality of the current leadership in the oil & gas industry.

The Other Insurance

Our campaign has now firmly placed officers and directors on record regarding the industry's issues, their severity, the resolution we offer, and the time frame within which these problems must be addressed. The potential loss of revenues and assets, amounting to $40 billion per month or more, should be a significant motivator for them to act. Failure to act promptly exposes them to personal jeopardy, as their mismanagement could lead to shareholder litigation, putting their personal assets at risk to cover the shortfall investors should have realized. Regardless of whether officers and directors were previously aware of this risk, they are now legally held to the standard of awareness and should be fully aware of the situation following our campaign.

Consolidation, like most industry initiatives this century, is already showing signs of failure. One major issue that People, Ideas & Objects have highlighted is the extinguishing of motivation and initiative due to the current leadership. From producer investors to the service industry, nothing will happen while the current leadership continues. The failures of consolidation are evident in layoffs at Chesapeake, where people now recognize that the boom/bust cycle offers no stability for a future career. Nitro, a startup in the service industry, declared bankruptcy because it relied heavily on revenue from one producer that was consolidated and no longer available. Knowing of the prior treatment the service industry received from an unconsolidated industry, who will venture into a consolidated industry where each producer wields more power over the future of each field organization's prospects. This will further stunt the future industry development in terms of technical advancements and innovation.

Producers’ assertion that consolidation will solve the issues they created is invalid in the long run. The shift to declare shale uncommercial and move to clean energy lasted almost two years before they realized oil & gas revenues were essential. If they truly believed in clean energy, they should have quit their positions, started a new venture, and taken the necessary risks. Consolidation is reminiscent of the old Soviet Union, where motivation was driven by fear and intimidation. However, today's officers and directors lack the military or other means to instill the necessary fear to drive a productive oil & gas industry. Their alleged collusion has been discovered, tarnishing the industry's reputation for another generation.

Efforts to mitigate the damages caused by consolidation will fail, as everyone intuitively understands. Attempts to convince their Officers and Directors Liabilities Insurance providers will also fail, as these providers have no reason to cover them when they are likely to be found liable of willful misconduct. This liability is a result of their inactions, despite shareholder concerns since 2015. They never entertained People, Ideas & Objects as a solution, available since August 2012. This indicates they will ride the situation to its lowest point, extracting what they can before the collapse becomes too obvious.

And

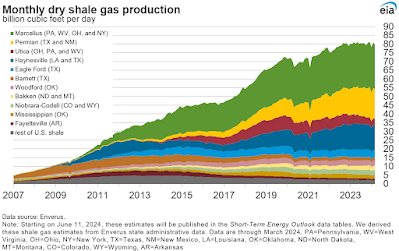

These two graphs from the May 23, 2024, EIA Natural Gas Weekly Report raise the question of how correlated they are. We are definitely behind the curve in terms of the industry's deliverability, capacities and capabilities. Is the flattening of shale production suggesting producers are finally learning that shutting in production when prices are desperately low is the right action? I can assure you that any production that may have been recently shut-in was purely routine maintenance and has returned. Natural gas prices are not profitable in any sense of the term. Unprofitable production is the same as overproduction. Sustained oil & gas overproduction has gutted all the value from the industry, and it’s now incapable of maintaining its productive capacity.

Artificial Intelligence

The value of Artificial Intelligence (AI) is continually evolving. AI excels in performing specific tasks and assisting people with their work, and its potential will keep expanding. However, the oil and gas industry requires more than just personal task management and productivity enhancements typically associated with AI. In terms of productivity and scientific advancements, AI could become as revolutionary as the Internet. These are indeed transformative times.

People, Ideas & Objects hold distinct competitive advantages in Intellectual Property (IP), research, and our user community. We are discovering that AI significantly enhances the value of our IP. We've documented that IP will be crucial for individuals to remain employed in the near future. While skills and education are essential, they often fall under the category of tacit knowledge. IP of explicit knowledge, on the other hand, can be directly owned, licensed (as our user community members do), or through working for those who own or are licensed in some form of IP. Any of these three methods enable the leverage of IP through AI, making AI the ultimate "killer app."

Another perspective we hold is that AI is now the "app killer." Since the release of ChatGPT 4.0 last year, the number of apps I use has diminished significantly. When tasks can be accomplished more easily and effectively than the best app could previously manage, the need for those apps diminishes. Moreover, why subscribe to an app when AI does it better? With the release of ChatGPT 4.o, I've pleasantly retired Siri to history.

At this point, People, Ideas & Objects can assert that the most valuable asset is the underlying Intellectual Property (IP) of a solution. Unlike other assets, IP cannot be easily replaced by Artificial Intelligence providing a superior alternative. Software will continue to drive progress in every industry, whether dealing with tangible or intangible products. For People, Ideas & Objects, it's not the oil & gas asset itself that holds value today; it's the software that makes these assets profitable. Without robust IP to protect our applications from AI encroachment, we risk becoming obsolete, much like Siri has become.

People, Ideas & Objects focus on addressing business issues in oil and gas. We utilize Information Technology to resolve these issues by automating business processes and reorganizing both producer firms and the industry itself. While our efforts extend beyond AI, AI will have a significant impact within our Preliminary Specification, especially through our Artificial Intelligence module. This module consolidates the industry's AI efforts into developing business algorithms and creating a generic AI base across the industry. Producers can then leverage this AI base to advance their applications for their Joint Operating Committees or producer data within the Preliminary Specification. By using Professor Paul Romer's concept of non-rival goods, we can defer the heavy costs of each producer developing the AI infrastructure, competing for scarce resources, and failing to collaborate on a broad enough scale to maintain appropriate focus.

Currently, the business data within the industry is inconsistent and aggregated with workarounds like overhead allowances that estimate what might be correct. Comprehensive analysis and systems engineering are necessary to establish the industry's needs and build processes based on actual data elements. This foundational step is essential for the industry to make the data usable in the future. Our user community's role is to analyze, input, and maintain these requirements, providing producers with the tools they need. This establishes a permanent software development capability, starting with properly organizing and managing enterprise data. When data is conflicted, unstructured, and unreachable due to being recorded in multiple locations, AI will never help the producer organization derive any value from it.

Managing resources and processes to focus organizations on profitability and value is crucial. This involves stripping the producer firm down to its key competitive advantages—land & asset base, and earth science & engineering capacities and capabilities. Administrative and accounting resources are removed from the producer firms and reorganized into our user community-owned and operated service providers, who hyper-specialize in one process and apply it across the industry. Using hyper-specialization, division of labor, and automation in a shared infrastructure brings enhanced productivity, speed, standardized and objective accounting, turns all producer costs variable (including overhead costs), and focuses these on producer profitability. Only through a fundamental reorganization of the industry and producer firms can the current business issues be effectively addressed.

Conclusion to these Consequences

We often hear producers emphasize their reserves and their ambition to expand and "grow" them through consolidation. This reflects a myopic focus on reserves as the industry's holy grail. By now, it may seem redundant to state that these reserves are useless in their hands. If producers cannot extract them profitably—in the true sense of profitability—then those reserves are better left untouched. Extracting them at a financial loss is a misguided venture. For decades, these producers have persisted in their flawed methods, causing immeasurable losses and damage to the industry.

Their Officers and Directors Liability Insurance risks are substantial. They have not taken necessary steps to mitigate obvious issues, and the industry's landscape increasingly reflects the desolate nature of current administration by officers and directors. It appears they are willing to take this risk, and their chosen method of consolidation is beginning to show its fallout.

In contrast, while we do not solely rely on Information Technology to provide value, People, Ideas & Objects focus on business and organizational issues that can generate real value for producers and the industry. The IT infrastructure, possibly mirrored in the AI infrastructure, is mature. As the rest of the world accelerates in performance and quality, the oil and gas industry clings to its outdated practices. They insist on giving failed methods one more try, despite over four decades of evidence showing they do not work. People, Ideas & Objects provide for the most profitable means of oil & gas operations, everywhere and always. What does their lack of concern for profitability reflect?