We have concluded our campaign aimed at bringing to light the adverse consequences inflicted upon the oil & gas sector due to the Willful Misconduct of its officers and directors. We extend our gratitude for their cooperation, which has contributed to a significant shift in the natural gas price structure from 24.82 times the oil price on October 11, 2023, to a record high of 49.41 times at last Friday’s close.

Initially, our assertions regarding the industry's damage and destruction, alongside the critical issue of profitability, were met with skepticism. Many producers dismissed the importance of profits, emphasizing cash flow instead. However, investor intervention helped validate our concerns, underscoring the reality that profitability is indeed crucial. Our value proposition, estimating impacts between $25.7 to $45.7 trillion over the next 25 years, has ultimately underscored the necessity for industry leaders to heed the insights offered by People, Ideas & Objects.

In the aftermath of our campaign, we no longer face challenges in highlighting the issues our Preliminary Specification addresses, nor in garnering consensus regarding our value proposition. The credibility of officers and directors who previously dismissed or were oblivious to these flawed business practices has diminished. Their past reluctance to acknowledge or address these issues reveals a level of responsibility they cannot afford to ignore again. We believe there is an urgent need for these leaders to tackle these challenges head-on. To them, People, Ideas & Objects offers its best wishes for swift and effective resolution.

Introduction

People, Ideas & Objects is revitalizing the oil & gas industry by reintroducing a modified Profitable Production Rights Licensing method. This approach not only funds the development of the Preliminary Specification and nurtures our user community but also grants licensees the dual opportunity to engage in the North American oil & gas sector and its ERP software markets. In today's era, every business is becoming a software business, making participation in our ecosystem essential. I’ll restate here why participation in People, Ideas & Objects et al is valuable in the 21st century. It’s no longer enough to just own the oil & gas asset, it’s also necessary to have access to the ERP software and services of People, Ideas & Objects et al’s Cloud Administration & Accounting for Oil & Gas that makes the oil & gas assets profitable.

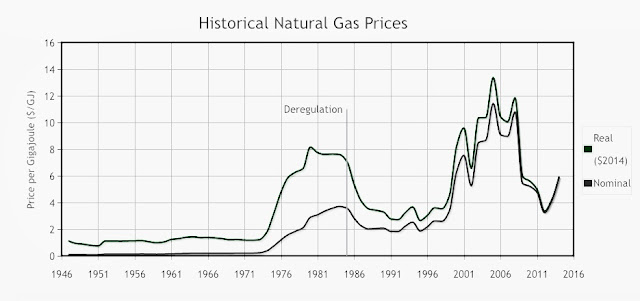

The transition of producer officers and directors towards clean energy and consolidation, coupled with their historical dismissal of shale's commercial viability, highlights a disregard for the oil & gas sector they once managed. This has led to a culture resistant to change, lacking in accountability and transparency, and neglectful of real profitability. Our 2023 / 2024 focus on the LNG issue has illuminated over $4 trillion in lost revenue since July 2007, a testament to the officers and directors willful misconduct.

The North American producer is portrayed as a failing organization, risking societal jeopardy with its inability to sustain shale production. The industry's operational, financial, and political challenges call for innovation and entrepreneurship—qualities the status quo lacks. As Edmund Burke suggests, technology represents a dynamic counterforce to stagnation and tyranny, offering a path towards innovation and change.

Despite the transformative potential of shale technologies since the 2008 financial crisis, the industry has failed to capitalize on this value. The status quo has led to distorted business practices and value destruction, underscoring the necessity for a new approach. People, Ideas & Objects stands as the sole alternative to outdated methods, offering a solution that ensures dynamic, innovative, accountable and profitable North American energy independence.

Our Profitable Production Rights Licensing provides the keys to accessing a new model of oil & gas organization—one that prioritizes dynamic, innovative, accountable and profitable oil & gas production, everywhere and always. As the industry faces its future, the choice between embracing this new path or clinging to the status quo will determine its trajectory. People, Ideas & Objects invites everyone to join us in building a future where oil & gas remains a cornerstone of North America's economic prosperity.

Licensing

Profitable Production Rights License

In terms of implementation, our objective is to encode each Profitable Production Rights License onto a dedicated blockchain, specifically secured through Oracle Cloud Infrastructure and the Oracle Autonomous Database. This capability is made possible by the recent introduction of the Oracle Blockchain Table. Within the context of the Preliminary Specification, this Oracle database will oversee the administration of Profitable Production Rights Licenses, effectively managing the contracts of rights holders. Consequently, this enables contracted licensees to access People, Ideas & Objects software and services, while also overseeing and managing their revenue and expenses.

Should any assignments, sub-leases, or transfers of the Profitable Production Rights License occur, these actions will not alter or remove the original purchaser's transaction in the database. Instead, they will generate an additional block on the chain or a new row within the Oracle Blockchain database instance. Profitable Production Rights Licenses are organized via their serial numbers to collate all related transactions, assignments, current ownership details, and the licensing of production rights to the respective producing Joint Operating Committee.

The licensee of the Profitable Production Right will maintain ownership and control over the encryption key necessary to access the record database. This database archives the production contracts executed with producers, who are invoiced based on the terms of the Profitable Production Rights Licensees' contracts. The licensing structure grants exclusive access rights, positioning it as a unique solution for organizing North American oil & gas exploration, production, administration, and accounting in a profitable manner.

Oracle's Blockchain Tables are specifically designed as append-only tables to support centralized blockchain applications. Within this framework, peers are identified as database users who rely on the database's integrity to preserve a tamper-resistant ledger. This ledger, implemented via a blockchain table, is both defined and managed by the application, allowing existing applications to safeguard against fraud without the need for a new infrastructure or programming paradigm. Although the transaction throughput for a blockchain table is lower than that of a standard table, its performance is notably superior to that of a decentralized blockchain system.

It is essential to acknowledge that Oracle's Blockchain Database does not represent a pure blockchain implementation, as it does not distribute its blockchain across servers for validation in the case of suspicious transactions. Instead, its design prioritizes higher transactional performance, a critical requirement for our applications. Managed by the Oracle Autonomous Database, it serves as a crucial component of our Cloud Administration & Accounting for the Oil & Gas Software & Service, ensuring data immutability—a fundamental blockchain feature. This system guarantees that Profitable Production Rights Licensees have secure rights, necessitating that North American oil & gas producers obtain sufficient licenses to access our Cloud Administration & Accounting Software & Services for the entirety of their production profile. People, Ideas & Objects is confident that this solution will provide an unmatched competitive advantage in profitably organizing producers.

Flexible Profitable Production Rights License

Oil & gas production inherently comes with its unpredictability. This is particularly true for fields experiencing decline, with shale regions showing notable variability. The global market demand has witnessed significant fluctuations, as evidenced by a 25% decrease in worldwide consumption during the COVID pandemic. Although such a steep decline might be rare, it establishes a critical baseline for analysis. This situation is further complicated by the decentralized production models and the price maker strategy introduced by the Preliminary Specification, potentially leading to greater and less predictable variations in a producer's production volumes.

Addressing these challenges necessitates a robust mechanism to manage the financial implications of production variability, especially considering the fixed overhead costs associated with Profitable Production Rights Licenses—predominantly those related to Oracle software licenses for Cloud Administration & Accounting for Oil & Gas software and services.

To mitigate these challenges, People, Ideas & Objects have introduced two distinct categories of Profitable Production Rights. The first category has already been described as the Profitable Production Rights. The second, the Flexible Profitable Production Rights License, is designed to account for up to 25% of the total production profile of the continent or the subscriber base of People, Ideas & Objects, whichever is lower. This allocation is intended to buffer against up to 25% of production variability across all operations. Each producing property is automatically allocated 25% of the Flexible Profitable Production Rights License to compensate for any potential production decline, thereby indemnifying Profitable Production Rights License owners against the financial risks posed by variable production volumes of a Joint Operating Committee production.

In scenarios of extreme production declines, as observed in the past decade, or when production is halted due to unprofitability—a situation expected to represent a small fraction of North America's total output—the Flexible Profitable Production Rights License comes into play. It covers the revenue loss for any shut-in production, assuming the property is being reworked to resume production, aligning with the core objectives of the Preliminary Specification. Should production become indefinitely suspended or abandoned, Profitable Production Rights Licensees are freed to seek new production opportunities. In such cases, revenue impacts would be borne by Flexible Profitable Production Rights Licensees, not the standard Profitable Production Rights Licensees.

The pricing strategy for the Flexible Profitable Production Rights License does not undervalue it compared to the standard Profitable Production Rights License. By People, Ideas & Objects acquiring all Flexible Profitable Production Rights Licenses this will redistribute the margins generated through People, Ideas & Objects to those shut-in areas. Therefore allocating 25% of the overall production profile in consideration for 100% of the Flexible Profitable Production Rights Licenses. Thereby purchasing the Flexible Profitable Production Rights in exchange for 36% of the budgeted earnings of People, Ideas & Objects. Holding all Flexible Profitable Production Rights Licenses is expected to strengthen our negotiating position when leasing these licenses to producer firms that require coverage for a quarter of their total production. Negotiations for Flexible Profitable Production Rights will begin once all Profitable Production Rights have been fully allocated to each Joint Operating Committee.

Therefore to summarize the configuration of Profitable and Flexible Profitable Production Rights.

The strategy outlined for the Flexible Profitable Production Rights License within the context of People, Ideas & Objects involves a nuanced approach to pricing and redistribution of value within the oil & gas sector, specifically targeting areas of production that are currently shut-in or underutilized. This approach does not undervalue the Flexible Profitable Production Rights License in comparison to the standard Profitable Production Rights License. Instead, it aims to leverage these flexible rights to enhance the overall production profile and financial health of the involved entities, particularly Profitable Production Rights Licensees through strategic negotiations and allocations.

1. Acquisition of All Flexible Profitable Production Rights Licenses by People, Ideas & Objects: By acquiring all Flexible Profitable Production Rights Licenses, People, Ideas & Objects positions itself as a central figure in the redistribution of margins to shut-in areas. This action underlines the intent to revitalize these areas by ensuring that they can contribute to and benefit from the broader production and profit mechanisms within the industry.

2. Redistribution Mechanism: Allocating 25% of the overall production profile in exchange for 100% of the Flexible Profitable Production Rights Licenses signifies a strategic redistribution of resources and opportunities. It effectively means that a quarter of the total production capacity is considered in the valuation and acquisition of these flexible rights, aiming to balance the scales between different production potentials and needs within the industry.

3. Financial Arrangements: The decision to exchange these rights for 36% of the budgeted earnings of People, Ideas & Objects highlights a significant investment in the potential of these shut-in areas. It reflects a confidence that the activation and utilization of these areas will not only be profitable but also contribute substantially to the overall earnings and operational success of People, Ideas & Objects.

4. Strengthening Negotiation Positions: Holding all Flexible Profitable Production Rights Licenses enhances People, Ideas & Objects ability to negotiate with producer firms that need to cover a significant portion of their production. This strategic position allows People, Ideas & Objects to dictate terms that are favorable and ensure that the licensing of these rights contributes positively to its objectives and the wider industry's health.

5. Allocation and Negotiation Process: The strategy indicates a phased approach, beginning with the full allocation of Profitable Production Rights to each Joint Operating Committee before initiating negotiations for Flexible Profitable Production Rights. This sequence ensures that the foundational elements of production rights and responsibilities are established, allowing for a more focused and effective negotiation on the flexible aspects.

What do Flexible and Profitable Production Rights Licensees earn?

The narrative provided outlines an innovative approach introduced by People, Ideas & Objects aimed at transforming the operational and financial frameworks within the oil & gas industry. This transformation pivots around the concept of Profitable Production Rights Licenses, which serve as the cornerstone of People, Ideas & Objects strategy to overhaul how the industry functions, particularly in addressing the inefficiencies and value destruction perpetuated by current management practices.

This strategy is the exclusive access granted to licensees of Flexible and Profitable Production Rights to the Cloud Administration & Accounting for Oil & Gas Software & Services. This exclusivity is pivotal, ensuring that the revolutionary services developed under the Preliminary Specification are reserved for those holding the appropriate licenses. It's a model that not only underscores the value of these licenses but also sets a clear boundary for access to innovative operational capabilities. Each license is designed to enable the profitable processing of one barrel of oil equivalent (BOE) per day, marking a significant step towards more efficient and profitable operations.

An interesting aspect of this strategy is the anticipation of a development phase, a period characterized by the absence of financial transactions, both in terms of revenues and expenses, for the licensees. Despite this, licensees are encouraged to engage with producers early on to secure production rights, laying the groundwork for operations ahead of the commercial launch of Cloud Administration & Accounting for Oil & Gas Software & Services. This proactive approach is indicative of the strategic foresight embedded in People, Ideas & Objects model.

The revenue model proposed is another key element, with Profitable Production Rights Licensees generating income by levying fees on producers for the processing of their BOE through the platform. The flexibility granted to rights holders in structuring these fees allows for diverse and potentially innovative business models to emerge, tailored to the specific dynamics of the engagements between licensees and producers.

People, Ideas & Objects critique of current industry practices forms a critical backdrop to its strategy. The critique is sharp and comprehensive, pointing to a systemic failure to create value, manage capital structures effectively, and compete for capital since the initial oil price collapse of 1986. Through this lens, People, Ideas & Objects highlights the vast potential for transformation in the industry, underscored by the identification of a $4 trillion revenue loss in the natural gas sector from July 2007 to the end of 2023—a stark reminder of the opportunities missed under current operational paradigms. And a source of value in the Profitable Production Rights Holders offering to producer firms.

In response to these challenges, People, Ideas & Objects presents its value proposition as a beacon of change. By leveraging the Preliminary Specification, People, Ideas & Objects envisions an industry that is not only more dynamic, innovative, and accountable but also significantly more profitable. This vision extends across the full spectrum of oil & gas operations, from exploration and production to administration and accounting, offering a comprehensive blueprint for transforming all producers from the startup to integrated multinationals.

In essence, People, Ideas & Objects strategy represents a bold step forward in reimagining the oil & gas industry. By placing Profitable Production Rights Licenses at the core of its approach, People, Ideas & Objects aims to catalyze a shift towards preservation, performance and profitable operations. This strategy challenges the status quo, proposing a future where the industry not only recovers from its historical inefficiencies but also positions itself as a competitive and financially robust sector, capable of attracting and managing capital with unprecedented efficacy.

What do Flexible and Profitable Production Rights Licenses earn?

The innovative approach introduced by People, Ideas & Objects through the Profitable Production Right License represents a significant shift in the oil & gas industry's operational and financial paradigms. The essence of this shift lies in leveraging advanced technological solutions and strategic pricing models to enhance profitability and operational efficiency. This model meticulously balances the integration of technological advancements with pragmatic financial strategies, aiming to redefine the industry's standards for profit generation and resource management.

The core of the revenue generation mechanism under the Profitable Production Right License is a sophisticated negotiation process. This process aims to establish a share of the present value of the differential, which effectively compares the value proposition offered by People, Ideas & Objects and its associated technological and service advancements against the industry's status quo. The outcome of these negotiations, which will be uniquely tailored to each agreement between the Profitable Production Right Licensee and the producer firm, determines the revenue potentials. Such contracts are managed using the Oracle Blockchain database, ensuring transparency and efficiency in handling each specific barrel of oil equivalent (BOE).

A proposed revenue model suggests linking the licensees' earnings to a percentage of the oil & gas commodity price, with a discussion range between 5% and 10%. This range is designed to capture a significant portion of the pretax profitability of commercial operations, ensuring that producer operations remain profitable under the Preliminary Specification. The rationale is to establish commodity prices that are not only marginal but are elevated to a level that secures profitability. This approach addresses a long-standing indifference from current producers towards optimizing profitability, thus presenting a cost that future producers would consider essential for determining their profitability.

The pricing structure of the Profitable Production Right License, set at $1,000 U.S. per BOE, is reflective of the current North American production profile and accounts for the inclusivity of heavy oil production within the People, Ideas & Objects budget. The model acknowledges the unique operational dynamics of heavy oil producers, including their existing ERP systems, while still positioning them as direct beneficiaries of the price maker strategy advocated by People, Ideas & Objects.

Addressing the operational costs associated with the Preliminary Specification, the long-term maintenance of software development and community support is deemed non-material relative to the gross revenues of producers. An analysis comparing the development costs of the Preliminary Specification against the gross revenues of producers in 2021 illustrates that the operational and incremental software development costs post-commercial release are sustainable, amounting to a modest percentage of a single year's oil & gas revenues.

The financial strategy extends to encompassing the overhead costs within a manageable framework for both Flexible and Profitable Production Rights License owners, translating into an all-in cost that reflects these long-term support and development costs. This model ensures that the Profitable Production Rights Licenses do not adversely impact the service providers' fee structures or billing practices, yet indirectly influences the producers' access to service providers through the softwares access rights.

The foundational principle of the Profitable Production Right License is its role as a contract granting producers access to a suite of organizational capabilities aimed at securing profitable production. This right, inherently reconfigurable, detaches the risks typically associated with oil & gas property ownership, providing a transferable, assignable, and leasable avenue for operational flexibility.

Today’s producers' tactical management approach includes everything that comes into their minds. In the past few years we’ve seen $25 million in executive bonuses paid by Chesapeake the week prior to its bankruptcy declaration. It appears that bankruptcy is the means to deal with shareholders who have become too dissatisfied with management performance and is how producers can reshuffle the deck as it were. Profitable Production Rights Licenses circumvent these actions by having a clause that terminates the Profitable Production Rights License upon bankruptcy. Therefore freeing up the rights and maintaining value in the hands of the rights owner. Endorsing the purpose of Profitable Production Rights by separating ownership of oil & gas production from the right to process that production. This is done through organizations represented by Cloud Administration & Accounting for Oil & Gas. The Licensees could then engage bankruptcy trustees to reinstate the Profitable Production Rights License. This would be on terms that maintain independent ownership of the Profitable Production Rights License separate and distinct from the means of production.

Who and why would anyone be interested in purchasing these Profitable Production Rights Licenses?

Answering the who and why anyone would be interested in acquiring Profitable Production Rights outlines a comprehensive strategy aimed at revolutionizing the oil & gas industry. Through the development of People, Ideas & Objects Preliminary Specification, and building of the Cloud Administration & Accounting for Oil & Gas software and services. This approach is designed to address the industry's long standing challenges with preservation, performance and profitability. Marking a decisive shift from traditional practices that have proven ineffective and unpopular among investors and stakeholders. Here’s a breakdown of the key elements and their significance:

Strategy for Industry Transformation

Introduction of Profitable Production Rights License: A core component of the strategy is to incentivize various stakeholders within the industry to adopt new practices that ensure profitability and sustainability. This involves shifting from traditional methods of operation to more innovative and accountable approaches, facilitated by the Profitable Production Rights License. This license serves not only as a revenue generation tool for People, Ideas & Objects but also as a catalyst for industry-wide change.

Target Audiences:

Investors: Highlighting the disillusionment of investors with past industry practices, the strategy aims to re-engage them by offering a stake in a transformed, dynamic, and profitable industry.

Oil & Gas Employees: Acknowledging the risks faced by individuals in supporting industry transformation, the strategy emphasizes confidentiality and the promise of a safer, more rewarding future.

Service Industry Representatives: By addressing the boom/bust cycle and advocating for a more stable and trustworthy relationship between producers and the service industry, the strategy aims to rebuild trust and ensure mutual profitability.

Producers (North American and Worldwide): Encouraging direct investment in Profitable Production Rights Licenses or engagement through lease agreements, this approach seeks to secure production rights and promote a performance-based culture across the global industry.

Our user community and their service provider organizations: Their participation in these software developments proves their motivation for profitability everywhere and always. A Profitable Production Rights License would provide them with an incremental value-add from what they seek to produce for the industry. Securing additional motivation to provide the most profitable means of oil & gas operations, everywhere and always. Our user community and service provider organizations are derived from the general oil & gas community. Having direct participation in the production process is attractive to these people.

Key Benefits and Outcomes

Disintermediation through Information Technology: Leveraging IT to streamline operations, reduce inefficiencies, and foster a more direct connection between production and profit.

Organizational Constructs to support a Cultural Shift: Proposing a reimagined structure for the industry that emphasizes dynamic, innovative, accountable, and profitable producers. Advocating for a wholesale cultural change within the industry to embrace new ways of working that prioritize profitability and sustainability.

Collaborative Effort: Recognizing the need for a collective industry effort to overcome the challenges and risks associated with transitioning to new operational models.

Conclusion

The strategy outlined is ambitious and seeks to address the multifaceted challenges facing the oil & gas industry by fundamentally rethinking how it operates. By focusing on innovation, accountability, and sustainability, and by engaging a broad spectrum of stakeholders through the Profitable Production Rights License, the approach aims to transform the industry into a more profitable, sustainable, and innovative sector. This transformation is not only necessary for the industry's survival but also for its ability to compete and thrive in a global market that increasingly values these attributes.