Attention: Boards of Directors

I would encourage those members of any producer's Boards of Directors, both past and present, to ensure they read this blog post. Please note too that I am not a lawyer and am not dispensing any legal advice.

As background there is this World Oil article that was published yesterday detailing a possible investigation of the shale producers by the SEC. It has been People, Ideas & Objects contention that the source of their issue is one that all organizations in all industries need to confront. The valuation of their assets, understanding that over reported assets beget over reported profits which beget overinvestment which in turn beget overproduction or unprofitable production as we describe it. For further clarification talk to your CFO, or research Bernie Madoff.

Today we’ll be discussing what it is that we’ll be learning, understanding and appreciating about the bureaucratic mind, bureaucrats being our categorization of the officers and directors of the producers, that keeps oil and gas so fresh, dynamic and innovative. Commodity prices offer us the best opportunity to fully analyze what the North American producer bureaucrats behavior is and will be in the future regarding oil and natural gas prices. Their first priority is that the excessive executive compensation must be paid first and foremost. These people have destroyed the value of their holdings and stock options therefore the daily take is the only reason they’re still around. Now that Chesapeake has defined clearly the bankruptcy process, or wash cycle as we call it, and its effectiveness, expect 2021 to be a record year for such declarations, a year of renewal the bureaucrats will believe. We already see in 2021 the same behaviors that have been present in the marketplace since at least July 1986 when OPEC declared its first price war on North American producers. Welcome to the new oil and gas, same as the old, they hope you enjoy playing.

The game is played this way. You place your bet on the price of oil or natural gas, the producer's stock price reacts to that. That’s all you need to know. The effect of management, the role of management and the responsibility of management to “manage” the business is not expected or understood to be valid in this game of chance. Why manage when you can muddle? Management takes effort and that is not what’s done here. All the money that is used in the drilling, completion and equipping of new and spectacular shale wells will be flushed through the process of bankruptcy where the service industry, investors and bankers will ultimately pay for those costs because they too believe in the big science experiment, it's just they didn’t know that when they signed on. You’ll note too that since Chesapeake has a new, much smaller value of property, plant and equipment account on their balance sheet. Yet the same assets in the form of petroleum reserves that have been handed back to the same management through the process of the bankruptcy, they can begin to spend like drunken sailors once again and get back to the point where those “assets” are the same size of their reserves value. This makes Chesapeake uniquely cost competitive in the industry, better able to focus on “building their balance sheet,” which of course will precipitate the higher cost North American producers to immediately enter their own bankruptcy wash cycles. Once again I ask who is the bigger fool for supporting this financially?

In addition to this revised cost competitiveness, post bankrupt North American based producers will be able to increase their production of oil and gas and take market share from those who have not entered or fully completed their bankruptcy wash cycles. This will further aggravate the commodity prices and as a result you're missing the main point of the exercise here, it’s all about the science experiment. There are reserves out there that must be captured. Chronic overproduction and oversupply is the issue that some allege but that will be hard for People, Ideas & Objects to prove when new investors rush in to capture some of those “windfall” profits of Chesapeake and other bankruptees. Profits they’ll be able to “earn” on just “$20 a barrel oil prices!” It is key to remember at this point that Chesapeake once had a market capitalization of $27.5 billion, just 50% higher than the $18.5 billion they raised and a $331 million pre bankruptcy market capitalization. Banks lost $2 billion in the bankruptcy process, $2.2 billion in accounts payable was never paid, primarily to the service industry. And the last point, which I think is the most important point, they even reported losses based on their ludicrous and specious accounting methods of over $22 billion in their lifetime. I would point out that as of today this organization hasn’t changed, will not change and has no incentive to change if each decade plays out according to this script across the North American producer population. The only change that has been made is to the Board of Directors which, for the past board, may be a problem. Which actually makes it a problem for all Directors on all Boards of all producers that are pre, post or currently in their own wash cycles.

The need to augment my “Issue Mitigated, Nothing Litigated” blog post, which can be reviewed as it is the Featured Post on top of the left column. Corporate bankruptcy doesn’t eliminate the risk, culpability or guilt of the individual officers and directors of the producers when it was the corporation that was bankrupt as a result, in these cases, of their inactions. And they should note, of which I’m including the reconfigured Chesapeake, that the risks associated from overproduction and oversupply have been and are still present since at least July 1986, of which absolutely nothing but the declaration of muddle through was done, and the solution in the form of the Preliminary Specification has been present since December 2013. And dare I say the chronic abuse, ostracisation and difficulties People, Ideas & Objects experienced only proved that they were well aware of our solution. If they continue to choose to ignore their risk, culpability and guilt regarding the overproduction issue and our solution they should ensure their insurance policies are up to date. In other words nothing legally was changed or will change through the bankruptcy process in terms of these personal obligations or risks. Directors and Officers remain susceptible to being sued by any of these people who now don’t just have quantifiable losses, but losses that are real in the case of former Chesapeake shareholders, banks and service industry participants. Let the litigation begin is what I say.

Interestingly though is the possibility that through the bankruptcy process the insurance for officers and directors liability coverage can be seen as an asset by the court and subsequently seized. Leaving the former directors holding the bag as they are eliminated from the company the moment they declare bankruptcy, and not that they care but just like its past shareholders were. Hence past directors at that point have no power in the form of their former corporations backing them up to deal with any litigation other than their personal fortune. Officers that survive the bankruptcy process will just, I assume renew under the new corporations such as Chesapeake, deem there is value (cash) to be had and use that as a new and much more creative form of enhanced executive compensation. One of the conclusions of that “Issue Mitigated, Nothing Litigated” blog post. After decades of attempting to appeal to the morally correct action to take in the form of developing the Preliminary Specification. People, Ideas & Objects only found proverbial gold when we raised the personal risk of the officers and directors as a result of their above noted (in)actions. Bureaucrats only respond to incentives that provide enhanced compensation, which obviously doesn’t amount to much in terms of action, or risks that put their personal fortunes in jeopardy. Therefore this is the key to motivating an oil and gas bureaucrat. Existing directors in all producers may want to verify these points with their lawyer and / or insurance broker. I then think they need to make the decision to mitigate the issue by funding the Preliminary Specification and therefore uphold their fiduciary duty. Or just retire from their boards prior to the difficulties becoming acute, which I admit sounds awfully risky as your overall risk of being sued remains.

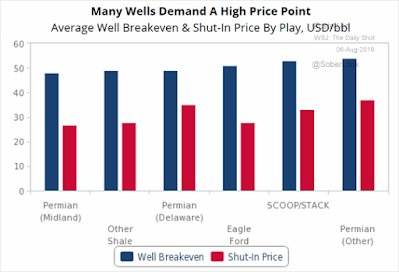

In contrast to this lunacy we have those who have been forced at many times since July 1986 to declare oil price wars on the North American producers. Whether this is rational behavior or not is best determined by beginning at the start of this post once again. It appears to me that OPEC+ are operating a business and not completely enthralled with the science experiment. Chronic overproduction, or as we’ve described it here, the chronic unprofitable production is the virus that cripples the price of oil and natural gas. It does not take much more than one incremental, unprofitable barrel in which to do so. North American producers produce 100% of their capacity 100% of their time and assume that the market is a magical and mythical place where all production is taken away to its rightful and honorable place. I had included the following WSJ graph from @soberlook in our White Paper “Profitable North American Energy Independence -- Through the Commercialization of Shale” and on this blog many times. Here is the description I placed in the White Paper.

What People, Ideas & Objects provide in our Preliminary Specification, if we could assume the accuracy of this graph's numbers, is the point at which the property would be shut-in would be at the breakeven point and below. The reason for this being the production discipline gained through knowing that producing any property unprofitably only dilutes the producers corporate profits. Producing below the breakeven point is the point where unprofitability begins. Producing below the breakeven point for one producer, in an industry who’s commodities are price makers, will have the effect where the price of the commodities will be dropped below the breakeven price for all producers. When all producers continue to produce below the breakeven price for four decades you have an exhaustion of the value from the industry on an annual and wholesale basis. Times were only “good” when investors were willing.

Production discipline is the key to the prosperity of the oil and gas industry, particularly in the era of abundance or shale era. They could attain that through the allocation of production quotas, government mandates or many other methods. The difficulty with those is that they’re arbitrary and no one is ever happy with their allocation. People, Ideas & Objects have chosen in the Preliminary Specification to use the most fair and equitable method of production allocation. That is if the property can be proven to be profitable, based on an industry standard, actual, factual accounting then the producer will produce the property. Doing so provides immense benefits to all concerned as profits become the determining factor of how the producer is performing. Corporate profits will always be the highest when the unprofitable properties are shut-in and are no longer permitted to dilute the profitable properties profits. The reserves of the shut-in properties will be saved for a time in which they’ll be produced profitably. And those reserves will no longer have to carry the additional costs of any incremental losses that would have occurred if they had continued to produce. But most importantly, the commodity market will have the marginal production removed from the market allowing it to find the marginal price. Producers will have a ready inventory of shut-in production in order to turn their innovative ideas toward. Profits are what an industry operates on. These are passed down to the secondary and tertiary industries as they are as much involved in the success of the industry as the producers are. With the economic downturn that has been precipitated by the oil and natural gas price collapse these past decades, does anyone doubt the need for real profitability throughout the production profile? This is the logic that People, Ideas & Objects have been selling for well over a decade. Highly unsuccessfully I might add. However as noted above we’ve now found the secret sauce of the bureaucrats motivation is appealing to the associated risks to their personal compensation and financial empires.

Certainly the virus has had a once in a lifetime impact on the markets. As a result producers have globally cooperated with each other to maintain prices that are palatable to them. OPEC+, initially at war with North American producers, began holding back over 9 mm boe / day and are still holding off 7.7 mm boe / day. They had scheduled to begin releasing an additional 500 thousand boe / day each month. However with the second installment of the virus, demand is fluctuating and OPEC+ have now agreed they will withhold the January and February increases totalling 1 mm boe /day. This caused the price of oil to rally markedly which is a characteristic of products that fall under the price maker definition. The prices of the North American producers shares were similarly affected. Spurring the increase in drilling and enthusiasm on how they could fill that 1mm boe / day that OPEC+ just removed. We know the “market is magic, mystical and marvelous.” And bureaucrats behavior and culture is fixed, unchangeable. Incapable of learning from past mistakes or adapting their understanding or appreciation of their great science experiment. We should remember that it is the North American producer that accuses OPEC+ of destroying the price of oil. Just as OPEC had done in natural gas over a decade ago! Wait a minute, is that right? A friendly reminder that the only source of capital for the science experiment was and is new investors, banks and the service industry, therefore more dilution of existing shareholders, and so on, exciting isn’t it? This is how the ultimate science experiment is achieved. Take my advice and hang onto your wallet when you're in the presence of these bureaucrats. The Preliminary Specification provides them with an abundant source of cash for their future capital expenditures. Their difficulty with us is they’ll have to work for it.

Finally with respect to that World Oil article and the potential SEC investigation of shale producers asset valuation. I've been arguing that this is an issue for more than a decade now. I've argued that although the SEC requirements were fulfilled by the producer bureaucrats it was done in bad faith. It has been done in bad faith for so many decades now that the culture of the oil and gas producers does not understand the point of the issue. Yes, the SEC allows the asset value to equal the reserves value if the producers performance should be so abysmal. The reserves limit however was never intended to be a target for all producers to seek each and every year. The business logic should have been: the most competitive producer would seek to have the lowest value of property, plant and equipment as possible. Instead the CEO's have been strutting about town with their "well built balance sheets" for decades now trying to prove they have the biggest and the best in the business. Foolish, unconscionable actions by people who knew better. The directors of these producers are now holding the proverbial "bag" and need to think to themselves how it is they can achieve what People, Ideas & Objects suggest is "issue mitigated, nothing litigated." Their fiduciary duty can only be achieved now by funding the Preliminary Specification.

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. And don’t forget to join our network on Parler or Gab @piobiz, anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.