How Producer Bureaucrats Overstate Cash Flow, Part II

Generating profitability everywhere and always will be the producers most effective means of ensuring their cash flow is covering all of their costs and providing the cash resources necessary to operate their business. The reorganization of the industries administrative and accounting resources into the service providers defined in the Preliminary Specification enable this transition to take place. Changing the producers fixed costs of administration and accounting into an industry based variable cost of administrative and accounting capability. Variable based on production within each Joint Operating Committee. Making all of the producers costs variable and allowing them to shut-in any unprofitable production without incurring a loss. These “null operations” will then be the focus of the producer's innovations in order to return them to profitable production. Null operations that will no longer dilute the profits of the producers profitable operations. Saving the reserves for when they can be produced profitably and keeping the losses that would otherwise have been incurred from increasing the costs of producing those reserves in the future. This also removes the marginal production from the commodity markets allowing them to find their marginal price. Our decentralized production models price maker strategy, which is based upon the Preliminary Specifications actual, factual and industry standards based accounting determination of profitability, is the only fair and reasonable method of production allocation. These are key features of the Preliminary Specification and are what are necessary to deal with the current industry difficulties.

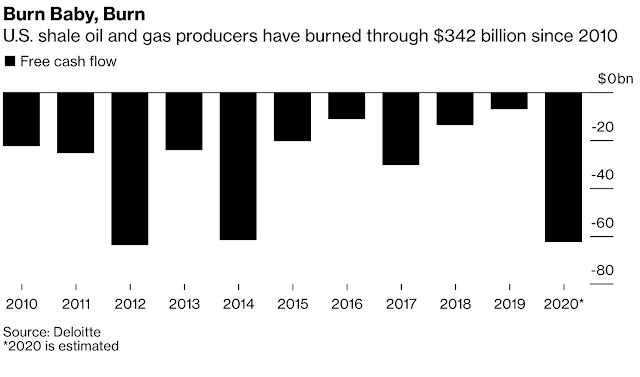

We are at the beginning of the third quarter 2020 financial reporting season. It will be very interesting to see the impact that events have had on the producer firms. The one thing that we can note consistently throughout North America is the layoffs happening in the greater oil and gas economy. Which I guess makes sense since we’re at what are believed to be very low levels of drilling activities. It may be that our drilling activity is just slightly better than 1898. Reflecting just how bad it is in the service industry. What we know is that producers have never been the ones to produce free cash flow. That’s cash flow less their capital expenditures. Where are those willing investors these days? It is therefore reasonable to assume that reduced capital expenditures would lead to strong free cash flow in the third quarter of 2020. The question that I have then is, why so many layoffs?

Yesterday we discussed the motivation that producer bureaucrats would have in misrepresenting their cash flow numbers. When producers are evaluated at six times cash flow they’re able to quickly increase the value of their options and stock holdings through this bit of accounting wizardry. In this series that is focusing on cash flow. We’ll talk about the specifics of that process and how it has evolved over the past four decades. In subsequent posts will go into the details of the individual accounts that are affected, those being overhead, interest and the excessive capitalization of field activities. As we’ve discussed the current process is for producer bureaucrats to have these costs avoid hitting the income statement in a timely manner and place those costs on to that big, bad, beautiful balance sheet account of property, plant and equipment. This has a direct impact on cash flow in the following ways. First the earnings are higher than they actually are due to the deferment of large portions of overhead and interest and moving the cutoff between operations and capital so that capital receives more of the share of these costs of the organization. The question then becomes are these deferrals material enough to severely overstate the earnings beyond the change that occurs in depletion? I am suggesting that it is, and the material nature of these adjustments need to be considered in order to better understand how cash flow is over reported through this mechanism.

Back to the question at hand, will cashflow be enhanced in the third quarter reports or will something else be consuming cash? Owning a growing small business is one of the most difficult issues to manage in business. Sales are increasing which would indicate that accounts receivable are growing and expanding. It’s the owners responsibility to finance those receivables some way and somehow. They’ll have to pay for the product they’re selling, whether that is payroll or products, and wait 60, 90, or 120 days to be paid for these sales. It feels like they’ll never catch up when they’re in that situation. We’ve discussed how the producer bureaucrats extended the payments of the service industries accounts payable beyond 180 days in order to continue with their capital expenditure programs. This was their last desperate act to have their capital programs continue. A despicable and abusive act but that was what they did. This was also part of the reason that working capital for the producers declined so precipitously in the past year. No investors, minimal working capital and spending on short term credit caused all the working capital to be extinguished and moved into negative territory. Now those chickens have come home to roost, accounts payable may have been paid down in the third quarter at these producer firms. And as a result, a similar situation is occurring to the producers that happens when a small firm is growing and they’re faced with having to finance their receivables. Producers are having to pay for their prior sins. Cash maybe only headed one way, and that is out.

Cash flow is also diminished as a result of the producers business model that doesn’t provide for what I would call a “float.” I call it a float as that is the best way to describe it. It is the cash on hand that the business uses each month to pay the bills, payroll and keep the operation running. Usually a business has the float being replenished each month by the proceeds of the sales of their products, and as such the next month's float will soon be replenished for next month's expenses and so on. In oil and gas there is nothing coming back from the sales of oil and gas that is an adequate amount of cash to cover off the current expenses. People, Ideas & Objects claim that the energy consumer is and has only paid for the operating costs and the investors have been on the hook for the capital costs so they could sit on the big, bad, balance sheets, in what we can all agree is a capital intensive industry. What has happened prior to the investor strike is the capital budgets were set, usually in September and then the bureaucrats went to the markets to raise these funds. It is these investor funds that were used to keep the operation liquid enough throughout the year when in September the bureaucrats would just rinse and repeat. Moving all of their spending onto property, plant and equipment. Except there are no more investors or banks to replenish the capital budgets and the producers never generated adequate amounts of funds from their operations to support their wild spending plans. They also spend enormous amounts on their lavish executive compensation. As time passed, the investors left, and any cash that has been scrounged up was used to keep the lights on. Therefore it’s certainly not that the producer bureaucrats are seeking to increase the performance of their organizations by reducing their staff count. They’re only trying to make sure that whatever cash on hand covers the next payroll, that is this week's payroll.

It should be questioned and asked why the producers are laying off personnel at this time or anytime for that matter. In 2019 our sample of producers who represent approximately ⅓ of the productive capacity of North American oil and gas production. Incurred 2.91% of their revenues in overhead! If overhead is so low why are they cutting 10, 15 and 20% of their staff? At best they are only going to produce a 0.582% decrease in their total costs. Unless of course the representation that 2.91% somehow distorts what it is the producers are actually paying? It has been People, Ideas & Objects contention that overhead is capitalized to the tune of 85% on average. I’ve invited bureaucrats to prove me wrong, and there is no one as of yet willing to provide me with the facts and figures to prove to me otherwise. Until then I’ll stick with 85% as it is the closest to the truth based on my experience. At 85% the overhead for the producers would actually be 19.4% of total revenues or $45.6 billion in total overhead for all of 2019 instead of the reported $6.8 billion for our sample of producers. This makes more sense and will be discussed in detail in tomorrow's post. Overhead therefore in itself is a material misstatement of the scope and scale of the operation in terms of the capitalization policies. I am approaching the recording of capital assets from the point of view of minimizing the amount recorded in order to a) increase the producers monthly cash float. b) have the prior invested capital recorded in property, plant and equipment returned quickly and in a manner that is competitive across all industries. c) establish for the producers an independence in terms of their capital structure by depending on “real” cash flow and not outside financing. Oil and gas is a capital intensive industry. Which implies to me that the commodity prices should reflect that the majority of its costs are capital. Currently they are not, and have not been for many decades. “Building balance sheets” is the aberration and cultural distortion that shows this has been the case for a significant period of time, and it isn’t doing anything for anyone at this time.

The sum total of these changes to overhead, interest and drawing a different line between operations and capital is that the severity of overreported cash flow for our sample of producers has the potential to exceed $131 billion just for the fiscal year 2019. This would translate into a market capitalization adjustment for 2019 of $789 billion for our sample of producers representing ⅓ of Canada’s and the U.S. productive deliverability. The issue unfortunately today is that these producers' market capitalization at the end of 2019 was $362.5 billion and their market capitalizations as of today total only $168.8 billion. Who would have thought that they’d lose almost $200 billion in market capitalization in 2020?

This is the reason that the Preliminary Specification is necessary in the industry. Recording the appropriate amount of capital based on a competitive offering on the North American equity markets is where the thinking of the producers has to be. “Building balance sheets” in reality has been a blatant and tragic misrepresentation of the performance of these producers and was used to grossly distort the scale of executive compensation. Our decentralized production models price maker strategy is the only method in which they’re going to be able to compete in those equity markets. Recognizing the appropriate amount of capital within each barrel of oil equivalent now in their current financial condition would only show the tragedy that has gone on here. (Reflecting massive losses due to very low prices.) An organizational reconfiguration and effort to deal with this past is the only way that they’re going to get through this and be able to compete in future capital markets. What they’re doing today is clearly not working and hasn’t for four decades.

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. And don’t forget to join our network on Twitter @piobiz, anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.