Three modules of the Preliminary Specification are “market” modules, including the Resource, Petroleum Lease, and Financial Marketplace modules. Each establishes a marketplace where producers can engage in the markets they need.The marketplace modules mimic the three markets producers participate in. They are designed to deal with the day-to-day activities of each producer, service industry member and others. Supporting them with the contractual, transaction processing and other capabilities of Oracle Cloud ERP and People, Ideas & Objects Preliminary Specification. We also support our user community and their service providers in our Cloud Administration & Accounting for Oil & Gas. Enabling producers to apply their competitive advantages and strategies in the greater oil & gas economy.

North America has advanced its overall quality of life through markets and price discovery. The Preliminary Specification will act as a part of the structures that define and support the oil & gas industry. Our decentralized production model price maker strategy relies on the principle of oil & gas commodities being priced based on the price maker principle. Producers need to produce only profitable production, after full consideration of all their actual costs on a timely and accurate basis. This is how they’ll operate with Cloud Administration & Accounting for Oil & Gas. Using all of the information contained within the commodities market price (production, inventory, consumption, reserves) to determine profitability and ultimately what will and will not be produced. It is these same mechanisms that are involved in every transaction of a free market.

From the Preliminary Specifications Resource Marketplace module we quote from a paper written by Professors Richard N. Langlois and Nicholas J. Foss entitled “Capabilities and Governance: the Rebirth of Production in the Theory of Economic Organization.” they note.

The organizational question is whether new capabilities are best acquired through the market, through internal learning, or through some hybrid organizational form. And the answer will depend on (A) the already existing structure of capabilities and (B) the nature of the economic change involved. p. 20.

And

If by contrast, the old configuration of capabilities lies within large vertically integrated organizations, creative destruction may well take the form of markets superseding firms. History offers many examples of both. p. 20.

And

Either way it boils down to the same common-sense recognition, namely that individuals - and organizations - are necessarily limited in what they know how to do well. Indeed, the main interest of capabilities view is to understand what is distinctive about firms as unitary, historical organizations of cooperating individuals. p. 13.

In terms of the Resource Marketplace module we first need to discuss two components of how operations are conducted in oil & gas. Field service industry providers extend producers' capabilities and capacities into their regions of interest. If producers owned and operated their field infrastructure it would otherwise be an impossible impediment and constraint towards progress. The second component is the history of abuse and disrespect producers have displayed and presented to the service industry over forty years. And particularly since 2015 when producers recognized their financial difficulties were amplifying.

The status quo long ago accepted the assumption that oil & gas is a boom / bust industry. All other industries sought to work these issues out of their businesses and industries many years ago. It is this continuing acceptance by producers that has left us with a legacy of maybe six good years out of the past thirty six. Officers and directors don’t understand this argument as they’ve experienced thirty six years of superior executive compensation. Producers assumed the service industry would adjust to the boom / bust trend in lock step with them. There is an implied assumption that the service industry, like the oil & gas industry itself, enjoys revenues as a primary industry. Therefore, it continues business as usual during bust cycles. The diversity of the service industry offerings, and their coverage across the various regions of their operations throughout North America spread them thin operationally. As secondary industry participants they are not as resilient as producers believe. Scaling back from 1,900 active drilling rigs during 2015 to 400, forcing 50% price reductions on the drilling operator or they would use another vendor, the producers induced a collapse of their revenue streams into the low and below teens in terms of percentages of prior levels, which has been devastating on the financial health and viability of the entire service industry.

Now in 2024 the repercussions of this downturn have decimated much of the service industries capacities and capabilities that were once available to producers. The largest service industry providers have left the continent due to this abusive treatment. Therefore for producers to work out the boom / bust cycle through our price maker strategy will contribute to rectifying this issue in the long run. Through profitability everywhere and always, the oil and gas industry will build a stable infrastructure. Providing a stable environment, or a constant level of demand for which the service industry would be able to budget, plan and prosper.

After this and similar treatment over the past four decades investors in the service industry are unwilling to participate in the rebuilding of their much needed field operations. They invested in good faith and were abused by the producer firms. They’ve witnessed the equipment they invested in being cut up for scrap metal to pay the light bill and taxes on the shop or horsepower sold off to other industries. This was due to the producers determining they could get away with leveraging additional field activity by not paying their bills for 18 months after the jobs were completed. Producers should have alerted the service industry representatives to these plans beforehand. The dilemma today is who’s willing to provide the financial resources for the service industry to recapitalize itself. The funds that would enable it to reestablish the capacities and capabilities necessary for a self-sufficient and profitable oil & gas industry? The service industry believes that producers broke it, they can fix it. Maybe when they have some skin in the game they won't be so abusive.

This is what’s known and understood in the market today. It's not news. Producers expect the service industry to resume normal operations, yet fail to consider the consequences of their prior actions. A similar example is the history of oil & gas ERP providers over the past thirty years. I can report there’s still no consideration of a second chance these first tier ERP providers will ride to the rescue of the producer firms. Why? They feel the industry is too complex, too costly and there are not enough producers to negotiate sales prices fairly. SAP is a custom implementation for each sale. The last two ERP providers left in 2000 and 2005, as documented on page 17 of our White Paper. This was due to producer officers and directors' inability to pay for software development in advance. The only method by which these vendors would approach the industry.

Producers have had ten years to invest in the Preliminary Specification to make their organizations profitable and accountable. They also had the opportunity to avoid this inevitable, predictable and fatal outcome but didn’t do so. Not a penny has been spent on People, Ideas & Objects at any point. The need for skin in the game was the apt approach when so many oil & gas ERP investors and vendors were betrayed three decades ago. This has now been done to the service industry. People, Ideas & Objects are instilling market principles in the producer firms, however, this does not imply that those who support them have the inherent trust in producers as a result of their prior actions to rely on market mechanisms at this time. Industry culture will need to have been proven to be changed. We’ve heard the promises before.

Producers sit on primary industry revenues. They will show a thumbs down to this idea as if People, Ideas & Objects is the only vendor they’ll be faced with who has this ludicrous prepayment idea. Officers and directors' actions have consequences that are wholly detrimental to everyone else in the industry. Officers and directors will argue this does not remind them of what markets and price discovery should look like. Correct, it's what’s necessary after their destruction of markets.

These facts on the ground are what officers and directors refuse to consider or admit. Until they do the industry will be beset with problems of the scale and magnitude of trillions of dollars. These issues need to be dealt with and I am unaware of another solution. The need to rebuild the industry brick by brick and stick by stick must be financed by the only means now available. The primary industry revenues of the dynamic, innovative, accountable and profitable oil & gas industry. It is facilitated through the Preliminary Specifications Resource Marketplace module and the price-maker strategy in the decentralized production model. Granted there will be those within the service industry that will continue to scrounge for the pennies falling from the officers and directors' pockets. However, that does not create the dynamic, innovative, accountable, profitable and energy independent oil & gas industry that we need.

The Financial and Petroleum Lease Marketplace will also implement market organizational structures in the Preliminary Specification. This will provide the organized interface necessary to access and interact with these markets. Modules in which the full transactional power of the Preliminary Specifications ERP system supports these markets. We’ll also discuss the Marketplace Interface we're building. I believe COVID provides the opportunity to adjust one's opinion to this feature. I have suffered the slings and arrows, the ridicule for it in the past. There is little that disagrees with what I haven't heard. In my opinion it is revolutionary and needs to be seen in the context of the changes that occurred in 2020 - 2022 covid era. At a minimum it adds an element of serendipity to working from home. One point I may not have been clear about is that the Marketplace Interface is a virtual representation. Users will be able to access it through any screen on any of their devices. The person does not wear a headset.

The Petroleum Lease Marketplace module is exactly what you could imagine. An opportunity to post, bid, purchase, and sell mineral rights and producing properties in the marketplace that exists and is replicated virtually within the Petroleum Lease Marketplace module. Everything from the opportunity to participate in a joint venture to establishing surface rights payments is fully supported by the ERP system of the Preliminary Specification. Our product sits on top of Oracle ERP Cloud which includes their tier 1, Oracle Fusion Applications which Gartner rates as the highest quality offering. Oil & gas markets include Federal, State, Provincial, Freehold and offshore leases. An opportunity for industry to consolidate on a dynamic platform which uses proven tier 1 technologies with the constant support of service providers. This platform maintains transaction administration and accounting in a standard and objective manner. (Note: People, Ideas & Objects maintain the policy, and it is written into our user community and service provider licenses.)

We will keep arm’s length distance from all royalty administrations. We operate in the long-term interests of the oil & gas industry. To ensure that they are provided with the most profitable means of oil & gas operations. There will be no compromise on this anywhere within this community.) This will be enhanced with the constant iterative design and development being undertaken by the People, Ideas & Objects user community and developers on a permanent basis. Whereas if a jurisdiction reviewed and changed their royalty rates at some point, in terms of either the rate or method calculated, producers would not need to concern themselves with the administrative or accounting aspects of those changes. The user community, developers and service providers would handle them and ensure that the software and services are updated on time. Producers would only need to deal with any issues regarding revised royalty costs.

Producer firms do not have competitive advantages in administration and accounting. Thankfully that is one of the statements we have no pushback on. However, these areas shouldn't be slapped together in a haphazard manner. There’s no reason why the industry doesn't have access to state of the art ERP systems within their firms. That producers haven’t, has led to many questioning not only the integrity of accounting but also the systems used by the industry. This questioning should never have been necessary and implementation of Tier 1 ERP systems is now an explicit demand of the investment community. Oracle Cloud ERP is the premier Tier 1 ERP system on the market.

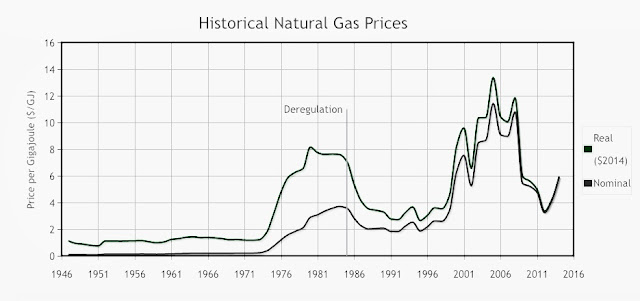

And why is it that the issue of overproduction, or as we define it as unprofitable production, can be documented to have existed in the North American marketplace as far back as July 26, 1986? The solution we propose to the overproduction issue, in addition to aligning all seven Organizational Constructs, has been available since August 2012. In terms of markets, it is estimated that there is double the amount of oil needed by 2050. This capacity overhang forces North American high cost producers to assume the swing producer role and produce only profitable production. During the next 27 years, Saudi Arabia will be able to produce profitably at any price with its production costs of $3.00 and probable $0.00 in capital costs. They could use the money, and the markets in 2050 are too far away and unpredictable for them to sit back and wait for.

The third marketplace module is the Financial Marketplace module. With the Preliminary Specification, the Joint Operating Committee becomes the key Organizational Construct of a dynamic, innovative, accountable and profitable producer. In the Joint Operating Committee section we noted that the movement of knowledge, which includes the detailed actual, factual accounting information for that specific property, to where the decision rights are held, which is the Joint Operating Committee, enhances accountability.

It's here that the Financial Marketplace enhances accountability through the board of directors' interaction with their current and prospective shareholders and bankers. A review of the Financial Marketplace module specification would be the most comprehensive source of information to capture an overall understanding of the module. With the standard and objective nature of the accounting conducted throughout the Preliminary Specification and the service providers. Would that satisfy some of the issues investors and bankers have raised regarding their investments and loans in the industry? Where everything being produced is profitable and producers seek to maximize profits by shutting-in unprofitable production? Would People, Ideas & Objects, our user community and service providers help producers satisfy their shareholders and bankers to the point where they’d invest in the industry again?