These Are Not the Earnings We're Looking For, Part LV

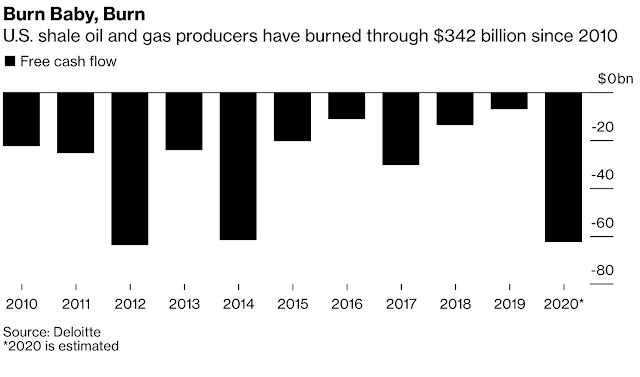

Earnings, or whatever you want to call what it is that producers do, are very disheartening in the third quarter of 2020. The deterioration of the financial base of the industry is something that I’ve documented here since before the general exit of the investors in 2015. An interesting commentary of how this happens is the series I ran in early 2017 entitled “My Argument.” There is also the White Paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” These detail the decline of the industry on its current trajectory and define its ultimate ending in the reduction of its capabilities and capacities in terms of what the service industry will be able to provide, and ultimately North America’s downward trajectory in terms of its production profile. Now in November 2020 the answer to the kids, is yes most definitely we are here. I’ll concede there’s been an acceleration in the industry's downward trajectory as a result of the virus. I’ve always stated that the ability of the industry to weather another storm would be difficult based on the financial destruction that has and was occurring. The virus is maybe the best example of what can happen when an industry is unprepared for further difficulties however, these oil and gas producers were wholly unprepared for even a mosquito bite. We are in serious jeopardy at this point.

The state of affairs is untenable. We can coast the downslope for quite some time and enjoy the efforts of those that came before us. We’ve done that now and the previously established value has been extinguished. There is nothing left anywhere in the North American oil and gas industry as it stands today. It needs to be rebuilt brick by brick, and stick by stick once again for the demanding future oil and gas faces. The third quarter reports show that it is not these organizations that are going to be the ones that drive the bus. They have no concept of what it is that’s destroying them, so they feign to the media and themselves. They have no desire to address what it is they’ll do to remedy the difficulties. They’ve done nothing for well over a decade now and these facts are highlighted in the commentary from here and here.

This is going to be a quarter-by-quarter, year-by-year slog and I’m sure we will prevail,” (BP) Chief Financial Officer Murray Auchincloss said in an interview with Bloomberg.

Exxon’s Swiger (CFO) is convinced that prices will recover. Things are so bad that prices across oil, refining and chemicals are “at or significantly below bottom of the cycle conditions,” he said. Whether Big Oil investors are willing to wait for that forecast to come true remains to be seen.

We also have evidence in this World Oil article that the producers have not discovered the solution to what ails them at this time. People, Ideas & Objects have been writing about our solution to their difficulties for many years now. It never dawned on me that the Internet hadn’t been installed in oil and gas yet. Here's another quote from that World Oil article.

“Making energy relevant and investable again is the million dollar question,” said Jennifer Rowland, a St. Louis-based analyst at Edward Jones. “They’re still trying to figure that out.”

The primary issue that I have with the last quote is that making energy relevant and investable again should be the “Trillion” dollar issue. For producer bureaucrats it is as always, they’ll muddle through and do nothing. With the caveat that maybe their “investors are willing to wait for that forecast to come true.” Just as People, Ideas & Objects are concerned about the capacity of the industry to deal with difficulties in its current situation. With the virus raging there is no guarantee that there won’t be any further surprises down the road. The unpreparedness of these producers combined with their lack of financial capabilities and head in the sand routine will cripple its opportunity in terms of North American energy independence. We documented before how the energy sector as represented in the S&P 500 has dropped from 11 to 2%. Noting in today’s market that represents a $2.07 trillion dollar decline. Those are the real losses that have occurred in the financial industry to the producers investors directly. Separately the value proposition of People, Ideas & Objects is in the range of $25.7 and $45.7 trillion over the next 25 years. These values represent the difference between the current bureaucratic business model vs what the Preliminary Specifications decentralized production models price maker strategy provides. A differential generated through the ability to ensure each property is profitable everywhere and always. This value would be distributed in terms of the producers funding for future capital expenditures, dividends and retirement of bank debt. But even more than that it would provide the financial resources for a robust and well managed industry that supports a healthy and robust secondary and tertiary industries the producers rely upon to function. It would also provide career security to those people who have, and most importantly who will need to commit to the industry in the future. Therefore that $2 trillion in losses from the S&P is incremental to People, Ideas & Objects value proposition.

All of these losses are most likely replicated in the people who no longer desire to work in oil and gas or the service industry and the general economy overall. Creating additional serious long term issues that remain unaddressed by the producers. But more than the losses that we can easily document today, the Preliminary Specification was published in December 2013 and since that time it has been a steady and tragic decline in the value everywhere for anyone associated with oil and gas. We’ve also lost the capability to prepare for the future. We don’t have the resources or infrastructure to build upon what needs to be available for that very difficult future. This is part of the tragic loss that has been incurred by the deviant and irresponsible nature of the producer bureaucrats that have been the cause of all of this. It is they who did nothing in the face of such difficulties. And yet, as we see in those two quotes above, both BP and Exxon suggest that essentially “muddling along” and “doing nothing” are the only routes they’ll pursue. These are pre-retirement statements in my opinion. These forced retirements have to be instituted immediately by those that are capable of doing so and we need, in my opinion, to move forward with the development and implementation of the Preliminary Specification. These third quarter reports show that the downward trajectory has accelerated much faster and further. We are now on the verge of a panic in terms of the “actions” that will be taken to remedy the problems that are seen as the culprits. And as in any panic nothing good is ever decided and no constructive organization or sense can be made until things are worn down to the base.

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. And don’t forget to join our network on Parler @piobiz, anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.