"That Jarring Gong," Part VI

At this point, I want to expand on the implications and consequences for People, Ideas & Objects, the industry, and the broader oil & gas economy if we experience our fourth funding failure. Initially, when I began the “That Jarring Gong” series, I noted it would be our third development funding failure, incorrectly excluding our original 1996 initiative, which led to our market failure in early 1997.

Facing a fourth failure is daunting for anyone. Despite significant sunk costs, my actions today are not guided by past investments but by a continuous evaluation of our offering's deficiencies. Each funding failure prompts me to ask why it did not proceed and what improvements are needed.

I have been fortunate to foresee the current oil & gas issues, predict their impact on producers and the industry, and design our Preliminary Specification to resolve them. This foresight has enabled me to make recent attempts to initiate developments over the past seven years. If these efforts prove inadequate to provide a solution to the oil & gas marketplace, I am uncertain what standard would be acceptable.

My Issue

I struggle to see what more I can do to improve the Preliminary Specification as it stands today. While I am pleased with the current state of our work, I worry that further development by myself could erode its quality rather than enhance it. There is little more I can contribute in terms of vision. Our 2023 update primarily addressed Oracle initiatives in automation and Generative Artificial Intelligence. The scope and scale of our project now require input from many people who understand each aspect of the industry in far greater detail than I or any one person ever could. This is the source of quality in user-based ERP systems.

Developers know how to write software, but expecting them to build an accounting and administrative system for the oil & gas industry without guidance is unrealistic. They need to be guided by the users who will work with these systems, sitting side by side in development. This is the point we have reached today.

Failing to seize this opportunity could be a defining moment for the industry. If we don’t act now, it may lead to a collective resignation: "If 34 years wasn’t enough for the Preliminary Specification, I’m not the person to try next." This sentiment was echoed in the service industry for decades, leading to prolonged inaction. The issues we seek to resolve are systemic and cultural, deeply embedded within the industry. The scope and scale of the damage and destruction to date are tragic, with two key aspects often overlooked:

- The elapsed time during which intervention should have occurred.

- The detrimental and now irreversible causes of the decline.

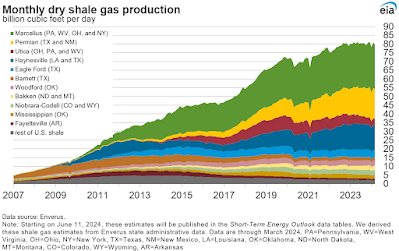

The hidden, hollowed-out capacities and capabilities of both the oil & gas and service industries may have profound effects on North America's production profile. What if production begins to decline and people realize that the cupboards are bare? This scenario underscores the urgency and importance of our efforts.

Innovation and Initiative

In recent years, the oil and gas industry has shown signs of activity and evolution through various significant decisions. Initially, there was a shift from shale to clean energy, only to pivot away from clean energy later. Now, the focus is on consolidation, with substantial acquisitions aimed at achieving "efficiencies" within the industry. However, these decisions are primarily made at the executive level, while the rest of the industry experiences a troubling paralysis. Reflecting a "muddle through" mentality, the industry seems to be waiting for a miracle—a resurgence of investor cash, full capacity operation of the service sector, and a return to being seen as heroes. This approach requires no action or decisions, just a belief that past successes will repeat, benefiting from the primary revenues of the industry. The service sector, crucial in generating these revenues, is left to fend for itself, despite being wholly dependent on producers. Today, producers are only learning now they too are wholly dependent on the service industry.

Moreover, the industry faces an unprecedented level of obstruction. According to executives, factors such as President Biden, OPEC, weather, pipeline companies, greedy investors, the service industry, consumers, and even the Easter Bunny, have all conspired to create a constant crisis. This mindset dates back to the 1986 oil price crash, fostering an addiction to making excuses, blaming others, and finding scapegoats. This culture of excuse-making has become deeply ingrained, with consolidation now justified by blaming small producers for flooding the market with excess production.

Addressing this cultural issue is evident in this blog's persistence in tackling the industry's profitability challenges. Initially, the idea of prioritizing profitability was met with ridicule. The industry's pervasive "muddle through" mentality is evident in daily frustrations, such as the lack of basic business knowledge in areas like the LNG market, as documented last year. The systemic nature of this issue across organizations results in an inability to make decisions or provide clear answers, reinforcing the culture that People, Ideas & Objects argue has been in place since at least 1986.

Motivation

The oil and gas industry is hurtling towards a crisis, yet many within it are content, convinced that a career in this sector is as secure and lucrative as ever. They believe that simply holding on will guarantee substantial financial rewards and pension benefits. This complacency is pervasive, driven by the leadership exemplified by current officers and directors. It is a despicable yet understandable reality, making any dissenting voice a rarity. For anyone to even raise an eyebrow will soon be forced to pull up a keyboard in the cubicle next to me.

Reflecting on my own experience, after a significant setback in 1997, I was reminded of why I started this journey in 1991. I foresaw the industry's downfall due to rampant overproduction, leading to price crashes in 1986 and beyond. The solution seemed simple: identify unprofitable properties and shut-in their production. However, producers' accounting systems were and are woefully inadequate for this task. I couldn't be part of a flawed system, knowing I had a solution and doing nothing about it.

A recent post by James O'Keefe, a controversial figure known for undercover video reporting, resonated deeply with me. It highlights a broader societal decline and poses a critical question we all may face in the coming years:

We’re all going to be tested over the next few years with a terrible choice.

Preserve your livelihood and lose your soul.

Or preserve your soul and lose your livelihood.

Will you live a lie in order to survive?

Or will you live the truth and face ruin?

People, Ideas & Objects do not seek to motivate through fear. We have seen our governments use fear—through climate change and COVID-19—to control behavior. They resort to fear because, in North America, they can't use force. My point is to draw parallels between the decisions I had to make and those that may soon confront everyone. The upside, of course, is that chaos also brings opportunity.

Decisions, Decisions

If we fail to secure funding in 2024, how can People, Ideas & Objects refine the Preliminary Specification to make it more appealing to the market? What additional steps are necessary to move forward again, potentially for the fifth time? We must determine these steps and incorporate them into our strategy.

And who would be so wise to attempt an alternative to the Preliminary Specification, recognizing our Intellectual Property needs to be avoided and extend to the greater oil & gas economy what the “muddle through” impact is.

It's crucial to consider whether anyone could successfully propose an alternative to the Preliminary Specification while avoiding our Intellectual Property and addressing the broader oil & gas economy's challenges. Demonstrating yet another failure, such as the industry's consolidation, seems redundant and unproductive. How many times have officers and directors evaded the consequences of their actions? It's naive to assume that the outcome would be different next time. Conversely, those who believed in the Preliminary Specification as the solution have been disappointed by the lack of response. They understand the actions and consequences and recognize that People, Ideas & Objects has made a commendable effort despite persistent cultural pushback. These individuals will question what can be done beyond merely surviving for the sake of their families and careers. Particularly when what is being asked here is to carry the weight of the industry's destruction on the personal budget of one individual these past 20 years.

The stigma of a failed initiative is unavoidable, and that's where the Preliminary Specification stands if we fail to secure funding again. We face constraints from investors and bankers due to several factors:

- The scope and scale of the issues.

- The producers' behavior towards ERP providers in the 1990s, which demonstrated to ERP investors that they were the target or mark.

- Our inability to provide returns to investors using the standard software business model.

The cultural and disintermediation forces against producers participating in our developments.

Our only viable source of funds is the primary revenues of the industry, with our Profitable Production Rights being the only, albeit unattractive, means to access them.

How would this failure impact the industry? Within the oil & gas ERP marketplace, it would have minimal effect. Most vendors have been in the market as long as I have and have experienced similar challenges. IBM and Oracle exited decades ago, and while SAP offers ERP solutions, they do not have a specific oil & gas ERP solution.

Outside the ERP marketplace, the situation is more intriguing. Consolidation is already causing concerns, as seen with Nitro, a service industry provider that declared bankruptcy after losing half its revenues overnight due to a primary customer's consolidation. Chesapeake announced layoffs despite their consolidation with Southwestern being on hold. Our failure might simply reinforce the existing issues.

Our intellectual property represents 20 years of research and publication. If this isn't sufficient for producers, the next individual attempting to develop a new solution will need to invest a decade in research to at least match the Preliminary Specifications. Since this has been deemed inadequate, they will need to go further, though we have no idea what that would entail. We wish them luck, as we do anyone in the industry seeking to address the officers' and directors' firm grip on primary oil & gas production revenues. As the saying goes, "Who needs profits?" Perhaps we should start calling them "Czars." One thing People, Ideas & Objects knows for sure is that our research legacy and the Preliminary Specification stand alone—there are no other fools or solutions.