"That Jarring Gong," Part I

From Sir Martin Gilbert’s Authorized Biography of Winston Churchill book # 5. “Winston Churchill: The Prophet of Truth, 1922 - 1939 (Volume V)”

When the situation was manageable it was neglected, and now that it is thoroughly out of hand we apply too late the remedies which then might have effected a cure. There is nothing new in the story. It is as old as the sibylline books. It falls into that long, dismal catalogue of the fruitlessness of experience and the confirmed unteachability of mankind. Want of foresight, unwillingness to act when action would be simple and effective, lack of clear thinking, confusion of counsel until the emergency comes, until self-preservation strikes its jarring gong—these are the features which constitute the endless repetition of history.

- Reviewed, edited, updated, and published the Preliminary Specification in late 2023.

- Discussed and revisited the issues and opportunities within the North American oil & gas industry, completed by June 2024.

- Started promoting the Preliminary Specification to raise the first year’s development budget by August 12, 2024, for a September 2, 2024, commencement.

- Establishing an alternative means of oil & gas organization as insurance against producers' plan of consolidation and its inevitable failure.

Our motivation behind updating the Preliminary Specification was the significant changes in Oracle Cloud Infrastructure and Oracle Cloud ERP offerings. These changes, demonstrated at Oracle CloudWorld in October 2022, include advanced levels of business automation that provide incremental value beyond what People, Ideas & Objects offer for the oil & gas industry. For further information, please review the series "If You Don’t Like Change, You're Going To Like Irrelevance Even Less" which can be accessed here.

At Oracle CloudWorld 2023, Oracle introduced Artificial Generative Intelligence (AI) to Oracle Cloud ERP, enabling users to derive new and intuitive information from system data and leverage automated processes to generate new outcomes. Oracle is the premier Tier 1 ERP provider, and their state-of-the-art products will be integrated with our Preliminary Specification. For example, only last week, Oracle announced Oracle Code Assist, which is AGI assistance in writing Java and SQL. We will provide the business attributes of the North American oil & gas industry to Oracle's comprehensive business solution, ensuring we provide the most profitable means of oil & gas operations, everywhere and always.

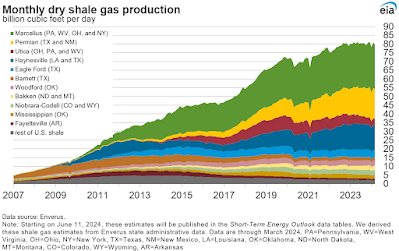

What we’ve been able to achieve in these past 21 months has placed People, Ideas & Objects in a position of having an updated product on the basis of Oracle’s technological offerings and developments in the oil & gas marketplace. We’ve been able to take the original business model inherent in the Preliminary Specification, update it and retrospectively apply it to the historical record. We then verified our $25.7 to $45.7 trillion value proposition provided to oil & gas producers. Identifying that this may be an underestimate when natural gas in the shale era, which destroyed the natural gas market pricing structure, is responsible for $4.1 trillion of revenue losses and 764 TCF of uncommercial gas production. Calculations can be found here.

Other issues we’ve identified include a lack of business knowledge among the officers and directors of oil & gas producer firms. The industry’s culture has been driven by a focus on building balance sheets, resulting in a fundamental mismanagement of market developments such as LNG exports. This reflects a serious deficiency in the capability of industry leadership, exacerbated by their ventures into unrelated industries like clean energy without proper approval. The current trend towards consolidation, a retread from the 1950s, runs counter to the value generation achieved through decentralization provided by the Internet. We discussed these topics in detail in a series of blog posts, available here.

The current state of the North American oil & gas industry raises questions about the level of failure and value loss. We believe the industry has generated a substantially negative net present value, consuming resources to produce. This situation poses a significant risk not only to the business but also to the energy security and economic power of North America. The value proposition of oil & gas to consumers provides 10 to 25 thousand man-hours per barrel of oil equivalent for only $77.18 a barrel, highlights the critical importance of this industry. Should producers fail further, the consequences will extend beyond the oil & gas sector, affecting the entire economy and national independence.

People, Ideas & Objects Opportunity

September 2024 provides us with an opportunity to pursue the development of the initial year of the Preliminary Specification. Losing this time could very well mean the loss of several years or even more in terms of having the opportunity to restart this initiative. Thankfully our first year's development costs are not significant and we can stop wasting time by proceeding through the first year's development instead of doing nothing.

Therefore, People, Ideas & Objects urgently needs these funds by August 12, 2024.

Request For Proposal (RFP)

During 2021 anticipating we may receive an RFP, we published our response on our wiki. This includes a summary of key discussion points and was rewritten in August 2023 as part of the overall Preliminary Specification update. You can view it here.

We believe that the most feasible way to raise our entire development budget is through the production of oil & gas, leveraging our Profitable Production Rights. Producer officers and directors have shown a lack of awareness and willingness to address these issues, effectively locking us out of both debt and equity markets. Last year, we discounted the initial Production Rights to 10% of their price in order to raise our first-year budget of $10 million, a stance we maintain today.

Service industry firms face challenges similar to those encountered by oil & gas ERP systems providers in the 1990s. Investors have recognized that they lack the necessary legal and business foundation to thrive, leading to a long-standing stigma against ERP solution providers and now the service industry. This has and is continuing to lock us out of equity markets. It is evident that producer officers and directors are conflicted in their dealings with People, Ideas & Objects. Leaving us with the Profitable Production Rights as the means to access oil & gas revenues as a source of income for People, Ideas & Objects et al. Disintermediation is revolutionizing every sector, and those who have survived, such as the producer officers and directors, have learned advanced methods to resist these forces.

Three Times Lucky?

Will People, Ideas & Objects be able to rally if we fail to raise the funds for our first year's development budget? This will be our third attempt to generate interest and resolve these issues. Our first attempt in 2017 faced the false claim that shutting in production would damage formations—a mistruth dispelled during the COVID-19 shutdowns. Our second attempt in 2021 involved writing our RFP to communicate our solution to the market.

In September 2024, we have a pivotal opportunity to commence the initial year of developing the Preliminary Specification. Delaying this effort could potentially set us back several years, or even longer, in restarting this initiative. Fortunately, our first year's development costs are modest, allowing us to make meaningful progress without further delay.

It is increasingly challenging to regenerate market interest without producer uptake, financial resources, or cultural support within the industry. Preconceived notions that nothing will ever be done are reinforced by the lack of our financial backing. Currently, we are experiencing our highest level of support, participation, and activity. However, failure to secure financial support will result in another significant setback, as seen before, taking at least 21 months for a new opportunity to arise.

That said, there is a greater chance of another opportunity for People, Ideas & Objects than consolidation ever becoming successful. Should I be able to hold this initiative together, consolidation's inevitable failure could provide us with an opportunity in three to four years, given the current destruction rate of at least $40 billion per month in lost revenues. A loss of a possible political rejuvenation if there’s a change in the administration and further deprecation in the performance of both the oil & gas and service industries. If the log at the top of the mountain is showing some motion towards rolling down the mountain, timely intervention would be wise.

Producers, Focused Like a Laser

Producer officers and directors can be described as laser-focused, but it's unclear which industry they're truly working in and for whom. They seem to be using oil & gas revenues to explore numerous interesting industries, and with consolidation, they'll have even more cash at their disposal. It might be more accurate to classify them as hedge funds, investing wherever they see fit, leaving investors unable to retrieve their money.

Who will stand up to them? Who will say no? Has short-term passive investing failed? These are challenging questions. What we do know is that the liberties that allowed officers and directors to act as they have did not result in any significant consequences. No one fell on their sword or faced the guillotine for the damage caused. It’s reasonable to suggest that the fear of such repercussions never crossed their minds. As the number of producers decreases and their power becomes more concentrated, what will dissuade them from further exploiting these liberties?

Alleging these revenue losses are nothing more than opportunity costs is a fallacy they’ve been able to get away with. Just as claiming natural gas is a byproduct of oil in the Permian. $4.1 trillion in calculable damage is not an opportunity cost or a byproduct. Not when a commodity subject to the economic principles of price makers is sold at depressed prices due to chronic overproduction. The consequences and damages of which can be found throughout the industry. Where the officers and directors prescribed solutions in their past two attempts was to declare “shale would never be commercial” and “they had to consolidate.”

If you have insights or concerns, feel free to reach out via email or phone as noted above.