The Issue, Part III

The Toll This Has Taken

The issue is best expressed as chronic, industry wide, unprofitable production or overproduction. There is an understanding by the officers and directors that the commodities of oil & gas are driven by markets that will accept anything that is produced. And therefore they always produce at 100% of their capacity. Assuming that the markets will absorb unlimited levels of production without having an affect on the commodities price and therefore they believe that these commodities fall under the classification of price takers.

Whereas the primary characteristic of oil & gas commodities needs to be understood by producers that they are price makers. Where increases in production only occur when profitable from a reasonable, financial, and accountable basis using the actual, factual costs incurred. We've learned just in the last few years the sensitivity of oil & gas pricing to overproduction and underproduction is significant. A known characteristic of a price maker. To deny that oil & gas are price makers today is to deny the facts.

The second aspect of this issue is the financial understanding that drives the industry. There are many false assumptions that drive decisions and the culture that has grown over the past number of decades understands no difference.

SEC profitability

Is one method of portraying the financial statements. And only one way. It is a corporate perspective that has no basis in evaluation of performance. It distorts accounting from measuring performance to evaluating asset value.

Recycle costs

Are not factual in terms of performance. They reflect the “what if” scenario involved in the costs and economic benefits in drilling wells etc. to release further reserves in today’s field cost environment. When the potential of tomorrow's drilling costs are stated as being profitable at $25. That does not alter the performance of the other 97.5% of the producers' properties that incurred their actual historical costs recorded by accounting. Despite what the producers press release may impute when the $25 is stated.

Accounting is focused on the corporation

The corporation under the SEC method is reputed to be profitable. As we’ve seen all producers qualify as profitable under their method. The performance of the property is unknown and unknowable throughout the North American oil & gas producers. Their ERP systems do not capture the data necessary to measure the properties performance on any reasonable or accurate basis. As a result there is no understanding where the corporation may be losing money. Unprofitable properties dilute the profitable properties and therefore diminish the corporation's earnings. An unreasonable approach for any company to pursue.

Overhead costs and interest are capitalized

From an overall asset perspective that is what has been allowed and for those purposes it may be acceptable. However producers need to understand the actual performance of each of their properties to make the appropriate decisions. On the basis of actual factual costs incurred, not on the basis of overhead allowances and never on their mythical recycle costs.

Over the past decades I have focused on capitalized interest costs and overhead. The follow-on consequences in terms of cash drainage from the firm. An interesting result of these arguments occurred about five years ago. Interest costs then began to be detailed in the financial statements and scaled back in terms of the amount capitalized. I’ve also alleged that creative, excessive, executive compensation has been included in the overhead that’s subsequently capitalized. Please note however, that we have seen no change in the treatment of overhead during this period.

Cash is only consumed

The culture created from the SEC’s permitted methods of accounting have permeated all thinking within the producer firm. That accounting can and should be used for many other purposes is a foreign subject. The dedication to this principle is such that they capitalize every possible cost for the long term and the short term despite these costs draining the cash of the producers each and every month. Never including a reasonable accounting of the cost in the product as they pass them to the consumer. Investors pay for the capital costs in a capital intensive industry, consumers pay the royalties and operations.

Revenues pale in comparison to the capital asset

Over four decades of this culture's development. With no critical evaluation done outside of People, Ideas & Objects throughout this period of time. Spending became what’s known as “capital discipline.” The business performance was obscured through growth fueled by massive investor funding, fueled by investor dilution. The SEC’s method of accounting ensures any individual who has the capacity to spend money can operate a profitable oil & gas producer. Therefore the overall industry performance has degraded to the point where productivity of the asset base today is barely a shadow of what a performant industry would provide.

Consumers are therefore subsidized by investors.

The amount of this subsidy is the majority of the capital costs of a capital intensive industry that are and have never been passed on to the consumer. Investors are left with the cost, because that is the “risk” they undertook, the officers and directors allege. Such is the thinking in oil & gas. The asset value listed in property, plant and equipment is best considered as the unrecognized capital costs of past production. People, Ideas & Objects believe it’s necessary to adjust, on a pro-forma basis, these balances by way of a reduction totalling 75% of the balance to depletion. Upon doing so, property, plant and equipment, the profitability and performance of the corporation will be accurately reflected.

Consumers are not paying for the capital costs of the energy they consume.

The actual costs of oil & gas exploration and production being subsidized by the investors for over four decades has caused consumers to heavily consume these products with little respect for their value. This is contrary to the unique nature of the products irreplaceable and irretrievable characteristics. The limited supply needs to be better managed both on the producer side by only producing profitable production everywhere and always. Passing a healthy and prosperous oil & gas industry and sub-industries on to future generations. And consumers can make the appropriate decisions on how they choose to consume the commodities based on their appropriate prices.

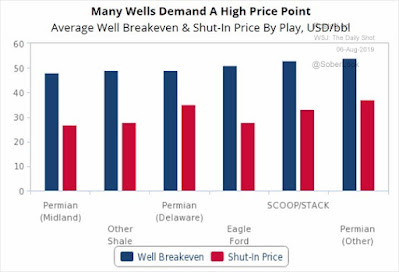

What this August 2019 graph reflects clearly is the culture and understanding of the oil & gas producer officers and directors. The level of confusion and misunderstanding of basic business concepts in their decision making is evident in this graphs presentation.

It was sourced from Lev Borodovsky who publishes on Twitter @SoberLook. Looking at this from the perception of the producer officers and directors. The total costs of each barrel of oil produced in the various shale formations is in the range of $48 to $54. The operating and royalty cost of each barrel varies between $28 and $37. I would point out the $18 to $23 in capital costs are based on an allocation of all of the capital costs across the entire reserves of the property. We’ve argued that this allocation is unreasonable in a capital market where the demands for the performance of capital are far greater than what can be achieved when a producer is cycling their cash through their investments in a manner that retrieves their cash over several decades or more. As an alternative, for performance purposes, People, Ideas & Objects recommend in our Preliminary Specification that the producer retire all of their capital costs within the first 30 months of the properties life to provide for the reuse of their previously invested cash. Providing them with the means to meet the demands of their future capital costs, shareholder dividends and bank debt repayments, all at the same and all the time. And to better match the rapid decline rates experienced in shale. Instead of “putting cash in the ground” People, Ideas & Objects, our user community and their service provider organizations will put producers' cash to work.

This can only be achieved if the producer is selling their commodities at a price that is above their “Breakeven point.” Which we assume in this instance that it considers an appropriate accounting of the costs of exploration, development, royalties, operations and overhead. A more timely recognition of their capital costs in a capital intensive industry that competes for capital in North America. Note that what this graph reflects is that “Well Breakeven” and “Shut-in” prices denote that at any point, and as long as the commodity price covered the royalty, operating, and remaining overhead costs, the property would continue to produce regardless of the impact on capital costs. If a dollar of capital costs was being returned, or one dollar above the shut-in price, that would enable the production of the property to continue. Only at the point in time where the commodity price dropped below the operating costs would the producer allegedly shut-in their production.

This is a fundamental misinterpretation of the term break even, it is the reason the industry is in the difficulty that it’s in and why the producers have continued to lose money for the past four decades. Break even is not what is being interpreted here. What in fact the producer is assuming is that as long as there is cash flow above the operating costs then they’re making money and will continue to produce. What they’re stating is acceptable is they may not be breaking even, but they’re generating “some” cash flow. Over the course of four decades the shortfall created in systemically accepting this logic. The capital costs of exploration and development have been borne by the investors on behalf of the consumers as the majority of the capital continues to be unrecognized as the product is sold below their “Well Breakeven” price.

What People, Ideas & Objects provide in our Preliminary Specification, if we could assume the accuracy of this graphs numbers, is the point at which the property would be shut-in is the breakeven point and below. The reason for this being the production discipline gained through knowing that producing any property unprofitably only dilutes the producers corporate profits. Producing below the breakeven point is the point where unprofitability begins. Producing below the breakeven point for one producer, in an industry who’s commodities are price makers, will have the effect where the price of the commodities will be dropped below the breakeven price for all producers. When all producers continue to produce below the breakeven price for four decades you have an exhaustion of the value from the industry on an annual and wholesale basis. Times were only “good” when investors were willing.

With the inherent value contained within each barrel of oil. With the supply possibly limited to the next half dozen generations. Why would we ever produce any oil or gas that was unprofitable? What would be the purpose of doing so? Would we not be robbing future generations of the resources they’ll need to expand their quality of life? On the one hand the costs of oil and gas exploration and production continue to escalate with each barrel of oil produced. This is due to the increased difficulty and science necessary to extract the resource. Therefore a more accurate accounting is necessary than what has been provided to the industry in the decades past. People, Ideas & Objects, our user community and their service provider organizations are designed to provide each Joint Operating Committee with a more accurate accounting of the costs of exploration and production. When only profitable production is produced it is implied that we're accurately capturing the timing and accuracy of all costs and passing them on to the consumer on a reasonable basis. Profits and innovation will be used to ensure an abundant, affordable and reliable supply is provided for the long term. Conversely, consumers paying the full cost of their energy will ensure that they’ll choose the most efficient and effective use of the resource.

What producers need to be doing is to begin informing consumers of the choices they have to make. Understand that each barrel of oil equivalent has the mechanical leverage of 10,000 to 25,000 man hours of labor. The global oil & gas daily output of 147.25 mm barrels of oil equivalent production is therefore equivalent to the daily output of 27 to 68 times the world's population of 8.0 billion people. If consumers want to rely on alternative means of energy then there will be a wholesale downward swing in industrial capacity compared to what oil and gas provides today. Without oil and gas there is probably 97.5% overpopulation and the quality of life for the 2.5% would be prehistoric.

What is clear is that the officers and directors believe that the associated risk of the business of oil & gas exploration and production needs to be borne by the investors. I see this differently. The risk of exploration and production needs to be passed to the consumer as the ultimate cost of the oil & gas they consume. That is what it cost. The risk adopted by the investors is in putting their money on the wrong horse. By knowing the difference, predominantly through the financial statements reflecting real profitability and superior performance they should be able to wisely determine who are the heroes and who are the zeros. The heroes will invest in profitable operations that recover their costs quickly and effectively. Generating the level of cash necessary to pay appropriate dividends and fund themselves. Zeros will flounder and spend investors money that generates little in terms of value or profitable production. Will soon fade into the distance as so many of the status quo producers should have done decades ago. This doesn’t happen in oil & gas because you can’t tell through the status quo financial statements that have been produced since the late 1970s, whether the producer has been effective in generating value. They’ll state they generated reserves and we see the value that they hold in today’s market when none of the producer's reserves can produce “real” profits. They’re useless. All of the producers for the past four decades have spent lavishly, recorded it as property, plant and equipment, added interest costs and overhead, and therefore whatever revenue is generated is literally profit.