I Thought This Was Just an Investor Problem? Part III

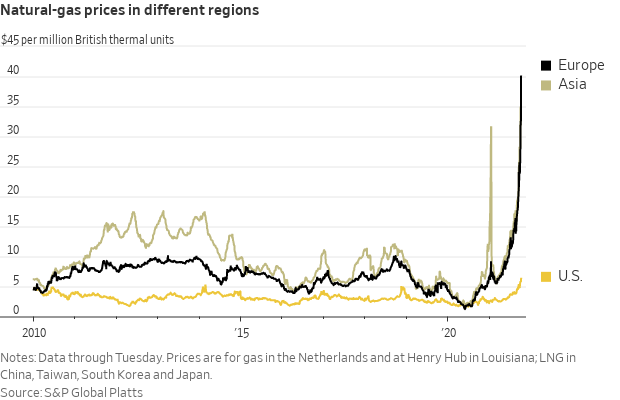

Consumers throughout the world are learning the distinct advantages of the business principles used in North American oil and gas. “Muddle along,” boom / bust cycles and “market rebalancing” are all done with the bureaucrats, our name for the producers officers and directors, wallets in mind. When markets are ignored as they’ve been in the pricing of oil and gas commodities, the cycle's extremes become more dramatic with each iteration of the cycle. One year we may see negative $40 oil and the next $40 natural gas. This of course is how you operate an oil and gas concern. Real profitability has never been earned at any point in the industry at any of the North American producer firms in the past four decades. Is profitability the symptom or the cause of these commodity price fluctuations? A profitable, healthy oil and gas and service industry are of great benefit to the oil and gas consumer. With our Preliminary Specification the only cost inflation that would be seen by consumers would be the incremental costs of retrieving the additional reserves. Shale being comprehensively more difficult and costly than what was done in the 1940’s, etc. And this trend will never stop. There would be an abundance and availability of viable resources available to the consumers at the lowest possible cost, including an element of profit. These profits enable dynamic, innovative, accountable and profitable oil and gas producers. A healthy and profitable oil & gas and service industry are the only way that these are going to come about. People, Ideas & Objects hypothesis of why there is a current lack of profitability is as follows.

The history of this issue begins with the late 1970’s SEC instituting an accounting method for the recognition of assets in oil and gas. Known as Full Cost it became the regulation for all listed producers on U.S. exchanges. Enabling the producer to claim as the outer limit of what their asset costs on their balance sheet would not exceed the present value of their reserves at the day's current commodity prices. Note the key words here of cost on the balance sheet, not value, accounting is not about valuing the company it’s about assessing performance. Over the course of the 1980’s this rule was quickly misinterpreted by the oil and gas bureaucrats to mean cash flow was the important factor of evaluation, you could include all the costs incurred by the firm as assets and they proceeded to devise ways in which to do so. Soon overhead, interest and all manner of costs were capitalized without any consideration of the impact on performance or follow on consequences. The issue is a result of the bureaucrats misinterpretation of the rule, not the rule itself. It would be the most competitive and performant producer that would seek to reduce their account of property, plant and equipment to $0.00 as quickly as possible. The real consequence of what happened is well known and understood in the business community and has been repeatedly documented as a known issue in accounting as the following.

This description of fact was well understood by bureaucrats in oil and gas, yet they chose to do nothing for over four decades. Over capitalization of the firm's asset value leads to an equal amount of overreported profitability. If none of the costs of the firm are incurred in the current quarter, but deferred for several decades later through depletion, profitability in the current quarter will be substantially higher. However, that profitability is not representative of the performance of the firm. When companies over-report their profitability then investors overinvest into the sector in anticipation of earning higher profits. Overinvestment leads to overproduction of whatever products a firm produces, and the pricing of the commodities in the producer's case will collapse. These commodity prices collapse as a result of oil and gas as commodities following the principles of price makers, not price takers which is the assumption of the bureaucrats operating in the industry. When prices are so low as to invoke losses under the Full Cost method then bureaucrats invoke the “market rebalancing” principle of capital discipline which reduces capital investment, causing the industries productive capacity and service industry capabilities to deliberately atrophy over a two to seven year period to where the market supply and demand “rebalance.” I stated the following analysis of pricing in the oil and gas industry in our White Paper “Profitable North American Energy Independence - Through the Commercialization of Shale” on July 4, 2019.

What People, Ideas & Objects provide in our Preliminary Specification, if we could assume the accuracy of this graphs numbers, is the point at which the property would be shut-in would be at the breakeven point and below. The reason for this being the production discipline gained through knowing that producing any property unprofitably only dilutes the producers corporate profits. Producing below the breakeven point is the point where unprofitability begins. Producing below the breakeven point for one producer, in an industry who’s commodities are price makers, will have the effect where the price of the commodities will be dropped below the breakeven price for all producers. When all producers continue to produce below the breakeven price for four decades you have an exhaustion of the value from the industry on an annual and wholesale basis. Times were only “good” when investors were willing.

I may not have explained myself clearly to the CFO’s in the producer firms. The difference between the graphs well breakeven and shut-in prices are what’s called the contribution margin. In these cases the contribution margin is determined by taking the total cost of the well and dividing it by the producible reserves that are allocated to it. If the well cost of $5 million dollars exposed 200,000 barrels the contribution margin would be $25 of capital costs were incurred for each barrel of oil found. Therefore the only profitable operation will be beyond the well breakeven price and that is why it has to be the point in which the well would be shut-in when prices drop below it. It had become unprofitable on a performance basis and was unable to return all of its costs. The assumption that the full 200,000 barrels would be retrieved in a period of time that satisfied the capital markets is incorrect. For these purposes let's assume the wells lifetime was 20 years. A return of capital over the course of 20 years is inconsistent with the story that has been told by producers in the past decades, inconsistent within any recent commodity pricing environment and wholly inadequate by capital market standards to have the return of just the capital investment in that time frame. Shale demands heavy rework costs in order to maintain production and to capture those reserves. The $5 million is just the starting number, there will be more costs incurred as soon as two years from the commencement of production. A more accurate, actual, factual accounting of the wells performance is part of the Preliminary Specification. Today, producers quote “recycle costs,” which are the results of engineering “what if” scenarios based on current service industry quotes. These lead to their allegations that they can be profitable at $50, and when the price drops below that, $40 until the price drops below that and they become profitable at $35. This miracle is either “recycle costs” based on abused service industry provider quotes. Or some otherwise unknown development in historical cost accounting.

“Pay no mind to those accountants over there; they don’t understand the engineering and geological brilliance of the work that we do. They’re paper pushers and we build stuff.” Allocating costs over the reserve life may have been a reasonable assumption in the 1950’s however in the capital markets of today where money demands actual returns far in excess of these in a much short period of time, these are not the points that will sell the investors to return. Note: I did not raise the integrity, trust, faith and goodwill that the bureaucrats destroyed with their investors and bankers as an issue that would preclude them from participating. The financial facts can be remedied and other issues as to the fact that people have been lied to and cheated can’t be. That’s why I didn’t discuss the fundamental lack of integrity, trust, faith and goodwill that bureaucrats acquired during my discussion in this post. But then somehow I just did! Of course officers and directors of the producer firms all know these business principles discussed here. Whether that is price maker, breakeven or performance. They chose to do nothing but ignore these and to concern themselves with their new business principles of “putting cash in the ground,” “building balance sheets,” “rebalance markets,” “capital discipline” and “we’re profitable.” I study / read Winston Churchill and have another one of his quotes, this one from his first book on WWII entitled The Gathering Storm, “Nothing was wasted that could contribute to the process of waste.” This should be put on the desk of each and every bureaucrat. For clear identification purposes that is.

I can’t imagine anyone arguing that these bureaucrats should be kept in power for a couple of more cycles of this rollercoaster. The issue should be clear in 2021 as it was for Qatar's oil minister in that Calgary Herald, July 26, 1986 article entitled “OPEC Minister Can See Economic Destruction.” (Paywall.) And the Preliminary Specifications publication in December 2013. Removing officers and directors is a difficult question. How should it be done and by whom? I’d sure do it, but if I could it would have been done long ago. Proxy wars during annual general meetings are for losers. Besides, the majority of those meetings will be held in May 2022 and that is after the winter months and two months into spring. I think we can bring consumers into our happy little party of highly motivated investors, bankers, service industry, oil and gas employees and those in the tertiary industries that benefit from oil and gas. To have the industry operated on the basis of a more reasonable approach. One that expands the thinking beyond what it is today. The solution is in hand in the form of the Preliminary Specification. How we implement this so that we all don’t freeze in the dark or pay everything we have to these bureaucrats this winter is unknown at this time and beyond my capabilities. I’m not suggesting that I can solve it this winter, it will take a while for us to do our work, and an unknown amount of time until we can begin the process and have a better understanding. My comment only suggests that we shouldn’t let those responsible benefit from the destruction we know they chose to cause.

On the other hand we have no shortage of work to do. Much needs to be done in the next few years. The Preliminary Specification needs to be built. The engineering and geological explicit knowledge needs to be captured as Intellectual Property and developed. New oil and gas firms need to be formed, capitalized and organized. Assets need to be transferred to these new producers in innovative, strategic and tactical ways. In this process we’ll all be helping the current producers to travel faster down their chosen journey to clean energy by disposing of dirty oil. This transition to the Preliminary Specification is something that must be done to deal with the financial difficulties the industry is plagued with from the current administration. This also needs to be done as preparation for the future. And to learn from the experience of this transition as we’ll be faced repeatedly with situations that share this same scope and scale of change in the near future of this business. We’ll therefore be somewhat prepared and experienced in challenges of this nature. Please review our Production Rights to see how everyone can participate in making this new oil and gas industry happen. An industry where it will be less important who you know, but what you know and what you're capable of delivering, what the value proposition is that you’re offering?

Those interested in joining our user community are People, Ideas & Objects priority and focus. The Preliminary Specification, our user community and their service provider organizations provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence, everywhere and always. In addition, our software organizes the Intellectual Property of the exploration and production processes owned by the engineers and geologists. Enabling them to monetize their IP for a new oil & gas industry to begin with a means to be dynamic, innovative and performance oriented. Providing a new investment opportunity for those who see a bright future in the industry. A place where their administrative, accounting, exploration and production can be handled for the 21st century. People, Ideas & Objects have joined GETTR and can be reached there. Anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.