I Thought This Was Just an Investor Problem? Part II

The number of companies that have made the decision to permanently work from home appears to be increasing, at least in the Calgary market. As a proponent of this method of organization I support the trend and find that the best of this change has not yet been experienced. During lockdown and fear mongering by dictators people haven’t been able to get out as they would normally. And once living as free individuals again they’ll begin to find that working from home has many attributes and advantages above those already experienced. The many key features of the method realized today include the ability to control your day’s effort from both a professional and personal standpoint. Higher productivity from the employers point of view. Reduction in the travel time to and from work, but also to meetings and a possibly temporary reduction in business travel. These are just a few of the highlights with the constraint of a 9 to 5 office being somewhat of an archaic idea that is seemingly limited in its purpose. Companies can experience reduced costs and an expanded number of working hours per day. Covering off all the time zones of the North American continent as the time in which they’re operational. Accepting that some people are morning people and I am not.

This is an opportunity that is embraced in the Preliminary Specification and was considered prior to the virus induced trend. Our solution provides a means in which producers are profitable everywhere and always. It also resolved the reason that producers consume cash in the horrific manner they have in the past four decades. Looking at the overhead costs incurred by the industry we see in the financial statements of our sample of producers have incurred 3.59% of revenue as of the second quarter. These are immaterial amounts and no one would be concerned about those. However they’re also not the amount of overhead that is incurred by the producer firms. People, Ideas & Objects suggest that on average 85% of the overhead in the industry is capitalized to property, plant and equipment. We’ve requested on many occasions that producers could educate us on what these amounts are, and what they consist of, however none of them have taken us up on our free audit offer. Of course we don’t want to belittle a cost of only 3.59%. I can only go on my personal experience in the industry which is what defines the 85%. What’s included in those accounts are what we believe to be material amounts of executive compensation above and beyond what may be known. But that is just a suspicion based on that same personal experience gained in decades of employment in the industry. Remember boom times are good times. Perks, once established…

Overhead costs are recurring monthly expenses that are recaptured in the prices of the products and services a company sells. However, when a producer sells oil or gas, their defined purpose is to “build balance sheets” and “put cash in the ground.” This overhead treatment of capitalizing large portions of overhead ensures they’re meeting their defined purpose. However leaves them short of material amounts of cash that were incurred in paying the overhead costs of the firm each month. When investors were compensating for the entire year's capital budget, these overhead costs were included there and as a result were covered in their majority. And now they have to be sourced by “new” sources of money each month as they’re not included in the price of the commodity other than the sliver of depletion recognized each year. The disappearing cash issue is there is no cash float in the oil and gas producer where the majority (85%) of the overhead costs are replenished through the sale of oil or gas. Cash and working capital have diminished into a critical issue in the industry as a result of these “3.59%” overhead costs. This material and constant drain on cash has been rectified in the Preliminary Specification in a variety of ways.

First we eliminate the overhead allowances that are used to charge the Joint Operating Committees for the approximate costs of the overhead incurred. The issue that People, Ideas & Objects have with these is they’re not adequate for the purposes of dealing with the costs of overhead in the industry. Secondly the monthly and annual value of all the overhead allowance charges incurred within the industry total nothing. Zero may also not be an accurate representation of the overhead costs in the industry. Swapping charges in the Joint Operating Committee are not representative of the true cost and avoid the reality of recording actual overhead to the property during the month in order to determine the Joint Operating Committees actual performance and spontaneous, summary and universal declarations of profitability. Other than during periods of negative $40 oil prices. The Preliminary Specification, through our decentralized production models price maker strategy, reallocates the administrative and accounting resources of the producers into the service providers that are owned and operated by our user community members. These are the individual firms that are handling the individual process of accounting and administration on behalf of the industry. They’ll charge a fee for their services directly to the Joint Operating Committee. Therefore each property will now be evaluated on the basis of its actual, factual costs and if it remains profitable it will remain producing. Returning the cash of all of these overhead costs back to the producers in what is considered a cash float. If it is shut-in due to its inability to produce profitably then no information will flow to the service providers, no services will be provided and no billing will be rendered to the Joint Operating Committee. Therefore the property would incur a null operation, no profit, but also no loss. Our decentralized production model changes the makeup of the industries overhead costs from the fixed cost, producer based accounting and administrative capacity and capability. To become industry based, variable cost, accounting and administrative capacity and capability. Variable based on production where production is only produced if it's profitable. This is only one aspect of the many changes we make in the Preliminary Specification. We need to tack back to the point of the post now.

The topic at hand is working from home in combination with these complications from the producer's overhead issues. The ability of the Preliminary Specification to convert the Joint Operating Committees overhead to the actual, factual costs that are incurred by the individual service providers. And do so on a variable basis depending on profitable production that includes the actual overhead costs. The reallocation of the administrative and accounting resources of the producers into the service providers can be done in combination with the permanent shift to the work from home of these resources. That assumes the service providers choose to work from home with their staff. That would be their decisions as to how they operate their business; however, accessing the talent pool that they need may require them to have access to a geographically diverse resource base in order to provide their most competitive offering.

The competitive advantages that are being brought forward through the development of the Preliminary Specification and formation of the service providers are substantial. Turning overhead costs from fixed to variable nature is necessary but another key point may be missed in the transition. And that point is the secondary reason profitability is an issue in oil and gas. That is the desire of each bureaucracy to build their necessary infrastructure of administrative and accounting capabilities and capacities, which are substantial in oil and gas, into each of the oil and gas producers. None of these costs are shared or shareable in their current configuration, or form part of the producers distinct competitive advantages. Each of the producers are incurring 100% of these costs individually. These costs are not in any way different than the hundreds of other producers in the industry. People, Ideas & Objects et al standardization and building of an industry wide administrative and accounting capability and capacity eliminate the redundancies of each producer attempting to replicate these same costly non-competitive attributes within each firm. If overhead was 3.59% it would be a waste of time. With the diminishing cash and working capital consumed by the capitalized overhead it becomes a necessity. The extent of these two changes of making overhead costs variable, and an industry based shared and shareable capacity and capability are dramatic. We have discussed the development of industry based capabilities on many aspects of the producer firm to include our ERP systems, which include Oracle Cloud ERP. Oracle now has a 90 day release period that demands executive attention. These system changes have to be accommodated in the organization and need executive focus on how they’ll do so. Attributes such as these, when using an industry based capability as contemplated here, can disperse the workload across the industry on a shared and shareable basis. Implementing the solution within the service provider organizations.

Additional competitive advantages of the service providers include and are not limited to the following. Quality, specialization, the division of labor, automation, innovation, leadership, integration, issue identification and resolution, creativity, research, ideas, design, planning, thinking, negotiating, collaboration, compromise, financing, reasoning, judgement. There is a strong division of labor between People, Ideas & Objects delivery of the software and the service providers as well. The Preliminary Specification captures the explicit knowledge within the software and the service providers use their tacit knowledge in deployment of their service in combination with our software. When CFO’s in oil and gas have had difficulty over the course of the past four decades in determining where their cash has been going. Hence the demand for repeated stock issuances. You can only imagine the difficulties that I’ve had in trying to market this kind of logic. Discussing fixed vs variable, shared and shareable, cash float by recovering overhead costs, corporate vs the Joint Operating Committee did nothing to help them “build balance sheets” or “put cash in the ground.” Or maybe, it was the director's choice not only to ignore the opportunities to adopt our initiatives, but to also mismanage their cash these past decades? Keeping their ERP systems providers on the starvation diets makes for ready excuses. After all, what is it they’ve been telling us?

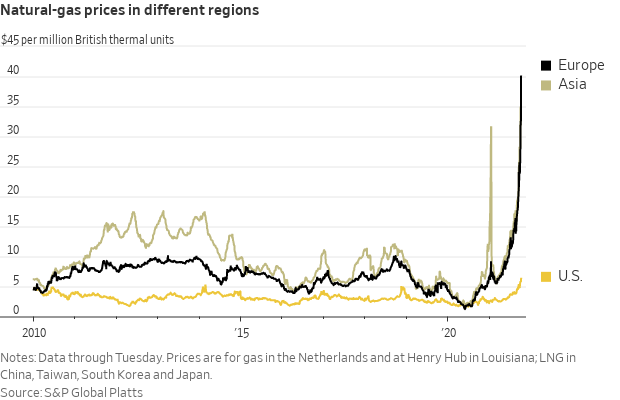

The point of this series is to show why this is not just an investor problem. That it has now manifested itself into the financial destruction of the producers. Which has taken the service industry and comprehensively destroyed it. Where the capacity and capabilities of both oil & gas and the service industries are unable to meet the needs of consumers. To hire back the people with the promise of healthy compensation is met with the reasonable question, for how long? Investors in the service industry are far more jaded than the oil and gas investor. Having watched their equipment being cut up into scrap metal for cash. Natural gas is currently selling for $40 in Europe (as of Tuesday October 5, 2021), homestead of windmills where the wind never blows. Which is not all that high considering Russia has now increased its price guidance to $295 to $330 (Approximately $8.80 to $7.73 /mcf)for the winter months. It was also 9 degrees in Helsinki and 21 degrees celsius in Rome on that day. This is the road that these producers directors chose to take their firms when they decided that all of their previous decisions, made in Keystone Kops fashion, didn’t reveal the riches they promised. I can categorize the discussions I’ve had with directors over the course of the past twenty years into two different types. Paraphrasing in both instances of course. The first would be “what’s that.” Meaning what are ERP systems. The second would be “I’m not talking to the management about this, they’re doing such a great job that this would not be worth their time discussing.” As a consumer of oil and gas, and if you’ve been reading this blog for any period of time, this is the unfortunate but absolute 100% and easily determined outcome of such bureaucratic… fix your own adjective here. Officers and directors of oil and gas producers are wholly responsible for this. People, Ideas & Objects have proven the cause of this began as far back as that Calgary Herald article from July 26, 1986 “OPEC Minister Can See Economic Destruction” which eerily sounded like the difficulties over the past thirty five years and predicted today’s outcome. People, Ideas & Objects solution to this was published in the form of the Preliminary Specification in December 2013. How many more second chances should they get?

No one outside of these officers and directors received any of the financial benefits from any of the prior periods activities. Nothing has or ever will change as we’ve documented that the shareholders representatives, or directors as they call themselves, will never consider alternatives. If you think they didn’t have enough time to consider their options then please scroll down to the time I began writing about these issues. What makes anyone believe now that prices are headed to a period of unconstrained panic driven premiums will we now see any of the proceeds from these producer bureaucrats. The last thing that we will ever see happen is the investors move back into the oil and gas and service industries while these officers and directors occupy their current positions. They left in 2015 and bureaucrats' proven and absolute behavior will stand as it has for the past number of decades. To have a dynamic, innovative, accountable and profitable oil and gas industry requires these people to be purged with extreme prejudice, the investors will then return with new officers and directors in new producers to begin the development of the Preliminary Specification et al. Besides, current management can move on to their chosen direction in clean energy. Let them feel the burn as a startup clean energy company without the revenues from oil and gas making them complacent and idly biding their time. Motivate them to do the hard work while the heat is on to get it done before they run out of their personal money. Only through that risk will clean energy issues be resolved.

On the other hand we have no shortage of work to do. Much needs to be done in the next few years. The Preliminary Specification needs to be built. The engineering and geological explicit knowledge needs to be captured as Intellectual Property and developed. New oil and gas firms need to be formed, capitalized and organized. Assets need to be transferred to these new producers in innovative, strategic and tactical ways. In this process we’ll all be helping the current producers to travel faster down their chosen journey to clean energy by disposing of dirty oil. This transition to the Preliminary Specification is something that must be done to deal with the financial difficulties the industry is plagued with from the current administration. This also needs to be done as preparation for the future. And to learn from the experience of this transition as we’ll be faced repeatedly with situations that share this same scope and scale of change in the near future of this business. We’ll therefore be somewhat prepared and experienced in challenges of this nature. Please review our Production Rights to see how everyone can participate in making this new oil and gas industry happen. An industry where it will be less important who you know, but what you know and what you're capable of delivering, what the value proposition is that you’re offering?

Those interested in joining our user community are People, Ideas & Objects priority and focus. The Preliminary Specification, our user community and their service provider organizations provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence, everywhere and always. In addition, our software organizes the Intellectual Property of the exploration and production processes owned by the engineers and geologists. Enabling them to monetize their IP for a new oil & gas industry to begin with a means to be dynamic, innovative and performance oriented. Providing a new investment opportunity for those who see a bright future in the industry. A place where their administrative, accounting, exploration and production can be handled for the 21st century. People, Ideas & Objects have joined GETTR and can be reached there. Anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.