Once Again, This Time With Feeling..., Part I

You can always tell what the price of oil is by the utterances coming out of the bureaucrats. Today, with oil around $60 we have the choir singing “Ode to Capital Discipline,” which as we know is one of their favorites. Their melody tells the story of how they’ve failed to maintain capital discipline in the past, but this time it will be so much different, if only investors could find it in their heart to trust bureaucrats one more time. “Please, and just send cash.” In unrelated news rig deployments are on an accelerated increase not seen in many years and many producers are publishing the fact they’ve located new drilling locations! And let’s not forget consolidation of the bureaucracy's power continues. Mostly through the modern miracle known as junk bonds.

There was an excellent piece of journalism put forward by Craig Fleming of World Oil. Contrary to the usual parroting in the media of the bureaucrats talking points, Mr Fleming breaks the mold and documents the volume of Drilled but UnCompleted wells (DUC’s) in inventory of shale regions over the past number of years. Work in progress is a necessity in any business but to have such a large inventory of DUC’s is questionable as to its origin and value. I think it raises two issues and Mr. Fleming zeros in on the first issue quite nicely when he asks “The question is how much has our industry ‘invested' in the current 7,086-DUC backlog? And when can stakeholders expect a return, especially in the Permian basin? Maybe 2021 will provide some answers.” Let's hope the media begins to hold the industry to this type of questioning on a consistent basis. One of the ways producer bureaucrats have been able to get away with the fraud they’ve perpetrated for so long is a) the business is very complicated and excuses, blaming and scapegoating can be effective b) no one has held them to account for their violation of such basic business principles that can be revealed by such simple questions as to why would anyone spend so much in stranded capital? An excellent question by Mr Fleming and a question that raises many others.

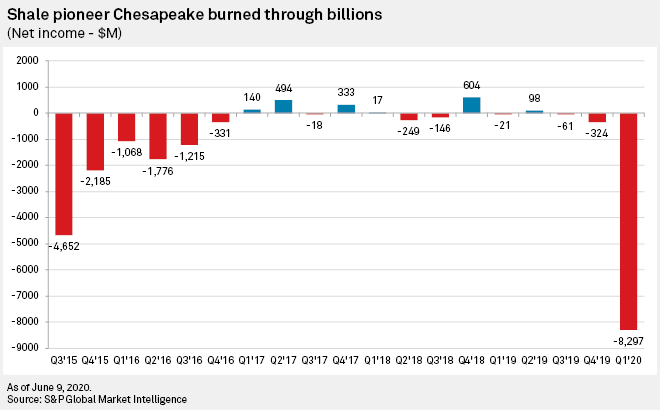

Does capital discipline, as defined by the bureaucrats, justify uncontrolled spending? What is their definition of “capital discipline?” Is it the same as what it is being interpreted by everyone else? It’s here that I think we begin to see the brilliance of the bureaucratic mind. Capital discipline to you and I mean the same thing, but is it implied to have the same meaning all those times the bureaucrats were mouthing the words. The point is that it shows one thing and only one thing. Nobody in these producer firms had a clue as to what was going on, or what the script was. It was all a product of the spending machine and as long as the investors were there, the machine was issuing more share certificates faster then they could convert them to cash, the world was a great place! “We are spending money, once again people please keep your eyes focused above the table, and Mr. and Mrs. investor will be richly rewarded.” Says the bureaucrat in the white dress shoes. The rest of the world generally sees “capital discipline” represented in the following graph of Chesapeake's overall financial performance.

This also begs the question what other “inventories” of spent capital are floating around. And I’m restricting my questions just to the assets of the producer, those that are not derivative of the bureaucrats personal bank accounts. Where else has this uncontrolled spending been unleashed and is lying dormant? The race for land might be a good place to start looking for “stranded” capital. “The competitive nature of leasing,” as the bureaucrats put it, would be the next area I’d start looking. The uncontrolled nature of “bidding” for land, assuming everyone else in the room is bidding on the same land at the same time, may very well be inflationary to acreage prices in the long run as one more aspect of the high costs of oil and gas leases.

The second aspect of the origins of the DUC inventory is the primary reason they exist. Which is the inadequate completion capability and capacity of the service industry, yes even before it became the crisis that it is today. Producers need to secure the drilling rig under a long term contract in order to have the capability to drill, if they don’t drill then they pay for the rig under contract nonetheless. If they don’t have a drilling contract they’ll lose their land leases. Therefore they drill DUC’s. The logic of the bureaucrats as determined on page 10,023 of the Bureaucrats Policy Manual section B.u.115.h., entitled “The Hammer.” Which reads that if every issue is the same then use the same process to resolve it. Here we see even before the difficulties of the current situation the fact that the service industry was no longer responding to market principles after the long term consequences of the producer bureaucrats management. A management that is represented in an example I personally experienced and is symptomatic of the industry's current failure. When I published the proposal to research the Joint Operating Committee in August 2003 I was flatly turned down. I then embarked upon it myself, as we know. What I was told at that time was “producers did not hire small research firms.” They did however hire Cambridge Energy Research Associates to do the research I just proposed. Nonetheless this reflects the attitude of the producers at the time, and has always been their attitude which remains to this day. They only dealt with the “big” guys. The unwashed were of no interest to them. And as a result over time the innovation and development in oil and gas, but most particularly the service industry, has declined precipitously. I know, it’s difficult to assert this when shale is so prominent and technically complex. However, shale was developed as a result of the innovations during the late 1990’s of coiled tubing and Packers Plus. Both were the results of “small” players and entrepreneurs. These providers were persecuted for long periods of time by the bureaucrats until producers were finally forced to accept these technologies. Therefore shale may have been available a decade earlier if the producers were more open to using a market approach to the service industry. Secondly where are Schlumberger, Halliburton and the other “big” guys now? Yes, I guess it is true, you do reap what you sow.

I can assume the bureaucrats are now thinking, “if shale was available a decade earlier we would have destroyed the market in 2011 and not in 2021 so why would that have been an advantage?” This is why there’s no way in which a bureaucrat can be reformed. They are not raised this way, they are not educated this way but are born with the regressive gene that has them seeking power. It starts in kindergarten by skimming lunch money from other kids and is entrenched soon after. They are irredeemable and habitual, they can not be reformed. The answer would have been just as it is today to manage the surplus production of oil and gas, that would be the unprofitable production, by not producing it and destroying the price of the commodity to the point where all production was unprofitable.

The Preliminary Specification establishes an innovative structure throughout the oil & gas, and service industries. Our research included the review of Professor Giovanni Dosi who has established that innovation is not a happenstance occurrence. It is a purpose built structure within an organization and industry that enables and facilitates innovation. Throughout the 12 modules of the Preliminary Specification we have included these within the oil and gas producer, oil and gas industry and service industry. It is only in this way that we can proceed with a dynamic, innovative, accountable and profitable oil and gas industry. Otherwise the distorted nature of capital allocation, or capital discipline as the bureaucrats like to parrot, will continue to destroy investors' capital and never, ever generate one penny in real profitability as they’ve proven over the past four decades.

People, Ideas & Objects also want to raise an interesting point regarding a “memory hole” that is ever present in the bureaucrats behavior. Recall I pointed out a few days ago how they were begging for money from the government just last year as they were in such desperate shape. This was after the realization that no one would “help them.” Even their revenues were so abysmal that they were not doing the job. I wonder at times how that could happen? Now with $60 oil they’re putting food on their tables again and they’ve adopted the trope of capital discipline. The virus is abating. OPEC+ are beginning to increase production, of which they’re still withholding 5 - 6 mm boe / day off the market and none of the 7 crises we’ve documented have been acknowledged by North American producers. But everything is fine now, all is forgotten, by the bureaucrats. “Investors should come in and resume their positions and fund their capital expenditures for the remainder of the century.” After all the bureaucrats have proven they have no other capacity to do so. With the details of People, Ideas & Objects “New Cost Structures” series of late January, these costs need to be included and considered into what the capital and operating cost demands of oil and gas exploration and production will be. I wonder when we’ll hear some “discipline” regarding those costs.

This will never happen, ever. The thickness and inability to grasp the situation is remarkable by these bureaucrats. As much as our sample of producers generated losses for 2020 of $69.2 billion. They still hold $407 billion in property, plant and equipment, down from $493.3 billion in 2019. This is for a production profile of 9.2 mm boe / day. That imputes a rate of capital cost per barrel of “only” $30.22 up from the abysmal recognition of $17.91 in 2019 and $16.62 in 2018. (We’ll discuss this further in my next post.) My question to those bureaucrats at this time is. They’re now being forced to quickly recognize property, plant and equipment as costs of which they should have been passing on to the consumer. Investors paid for them as a result of being duped by specious accounting in the past.

- Why would investors now join them for another round of abuse? What's the offer?

- By investing in the producer firm again, they would be paying a second time for the same assets they’ve already paid for.

- Which, thanks to the management of the producer, are more or less owned by the bank who have the right and title to those assets no matter how much money is put into the producer, and no matter how they perform in the future. Producers current leverage levels are obscene as a result of decades of capitalizing costs and not recognizing them appropriately. Borrowing money at low interest rates and prolific waste.

- Where’s the upside? Oh, excuse me, I was confused there for a second, the upside is “capital discipline!” Trust them they say, they know what they’re doing.

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. Anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.