New Cost Structures, Part IV

I just have to include this Tim Cook CEO of Apple quote in Inc. magazine. It captures for me where we are in society and why things are collapsing everywhere we look. Collapsing yes, but in a good way. Being cleared away so that we can rebuild anew.

The path of least resistance is rarely the path of wisdom. We're here today because the path of least resistance is rarely the path of wisdom.

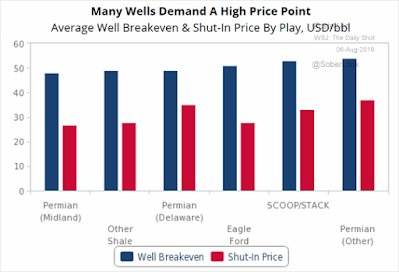

Producer bureaucrats may have a point. The argument that People, Ideas & Objects have overstated the severity of their crisis is a possibility. Therefore let's look at the facts. Since 2015 investors have steadily withdrawn from their interests and investments in oil and gas. Bankers took a while longer and are finding the producers current difficulties leading to their loans being put at risk. The lack of any structural financial support may be a non-issue, as the producers assert, however the follow on consequences of diminishing working capital and exposure of their chronic overproduction, unprofitability and specious accounting were exposed as the cause of the industries demise. They managed to keep things quiet, except for one annoying blogger, for decades prior to this slip up. The long term effects of ignoring the need to remove the unprofitable production from the market, since at least July 1986, has been systemic and tragic throughout North America. Let's be reasonable, simply managing the oil and gas business as all other industries and businesses do, by managing the unprofitable overproduction and excess inventories would have seen OPEC’s repeated declarations of war never occur. Here’s a few questions: would OPEC’s declarations of war affect North American producers if they produced profitably everywhere and always? When bureaucrats are happy with their take of $1 to $2 per boe coming off the top, do they really care if the full price realized is $40 or $140 or where the rest of that money goes!

The legacy of non-performance is a bureaucratic asset that provides an ease and comfort to them. To suggest that People, Ideas & Objects have a plan, a strategy, a business model and hope for the future of the industry, fails to pass as interests to those in the rarified air of the C suites and Boards. We know that oil and gas is subject to a never ending increase in the underlying cost of exploration and production. This cost increase affects not only the pursuit of new supplies in technically challenging areas but also the recovery of the remaining resources in place. The escalating costs are a result of the ever increasing technical difficulty of earth science and engineering effort involved in each incremental barrel of oil equivalent produced. Which is translated in the service industry with increased effort and time necessary to release the resource. With People, Ideas & Objects Preliminary Specification ensuring that all production is produced profitably everywhere and always. These escalating costs of oil and gas are captured and covered on a day to day basis as an inherent part of our business model. Everywhere and always. Note too that the $1 to $2 bureaucratic burden we just discussed would be removed from the equation.

What we know is the petroleum reserves are there. Today they are worthless as they require cash in order to be produced. They are a drain on society. They’ll need a new approach in order to build the value that will be necessary for the industry to move forward. The rest of the infrastructure has been designed and built in an era when, metaphorically, the America’s Cup was generating speeds just above the speed of the wind. We can do much better. We certainly won’t be getting to that higher performance trajectory on the “muddle through” and “do nothing” strategy of the current bureaucrats. That should be obvious. We also know the retirement of the unrecognized capital costs of past production, the reclamation costs and the costs of rebuilding and refurbishing the infrastructure need to be done nonetheless, these will not be financed by investors or banks. They’ve already paid for them, and they would be foolish to pay a second time. When an investor invests in a business it’s generally understood that their investment would generate a number of “things.” Those include dividends, reductions in debt and the funding of future capital expenditures. After they collapsed the commodity prices, these aspects of the oil and gas “business” were diverted to feed the hungry bureaucrats with their “innovative,” excessive, executive compensation. Investors would be interested in knowing how their oil and gas reserves are going to pay for the recapture of unrecognized capital costs of past production, reclamation, rebuilding and refurbishing of their infrastructure. We do not need this rebuilding process to be short changed by the bureaucrats diversion into clean energy. It is here that we can begin to see the real cost of the management failures and the absolute capitulation of responsibility with the bureaucrats viable scapegoat of moving to clean energy as a diversionary fraud. This loss of faith, trust and credibility in the bureaucrats is maybe what we should call the producers' sixth crisis. It’s not that I’m numbering these in any particular order, it's just as they’re mentioned they take the next number in the series. These crises were documented in 2020 and are summarized as follows.

Crisis # 1,

The chronic overproduction and oversupply of oil came home to roost. Since July 1986 we’ve documented that the same issue has plagued the industry with no response or recognition from said bureaucrats. It was the financial crisis in late 2009 that saw the natural gas prices follow the same footsteps of chronic overproduction and oversupply that collapsed the North American oil prices.

Crisis # 2

The second crisis was the effect that the virus created. Who would have thought that a pandemic would affect the most vulnerable industry? Certainly not the always unprepared bureaucrats.

Crisis # 3

The third crisis was the prediction of mine that there was going to be a looming debt crisis about to play out as soon as the October 2020 bank reviews were completed. Producers are heavily indebted. That’s based on their published financial statements. If we accept People, Ideas & Objects arguments that most of the costs in property, plant and equipment are in fact the unrecognized capital costs of past production, adjust for this with a pro-forma adjustment of 65% of property, plant and equipment to depletion. These producers are in a debt situation that will be terminal to many and action will be precipitated by the banks review. I see the consolidation trend playing out as a defensive strategy to offset the bank risk.

Crisis # 4

The bureaucrats fourth crisis is nothing other than the virus induced OPEC+ reductions in oil production of around 8 mm boe / day. This surplus capacity, with the unknown surplus capacity they had prior to their declaration of war on the North American producers is a dead weight on the price of oil for at least a decade. This of course does not consider the doubling or tripling down of the praying that has been done recently by the bureaucrats. We saw towards the end of 2020 Russia begin to assert their desire to increase their production. Strategically and tactically if they were in a war with the North American producers, their sense of timing is good.

Crisis # 5

A fifth crisis will come about when the capacities and capabilities of the industry, and what the producer once enjoyed, are no longer available. The retirement of the knowledge base of the industry has been undergoing for the past five years has been at an accelerated basis. The service industry has been cannibalizing their equipment and the people who once worked for them have found stable work in other industries. The reputation of the industry is the money is good at times, the stability however is unable to support a mortgage or family. Recently we heard the identification and utterance of a new viable scapegoat that went like. “Current employees have been poorly trained, this new generation is not as good as the old.” There is no depth to the bureaucrats capacity to point fingers.

Crisis # 6

Crisis # 7We also identified that the risk to bureaucrats accelerated when we noted in our June 2, 2020 post the potential scenario in which their insurance providers may trigger the future withholding of coverage of the directors and officers liability policies. We then noted in a Reuters article that this knowledge was taken as fact by bureaucrats and they immediately increased their coverage by 70%. Implying a guilt and culpability in the bureaucrats documented actions. Triggering what I believe to be a systemic and complete lack of faith, trust and credibility in management by their investors. If the overproduction issue has been documented to be in existence since at least July 1986. And the Preliminary Specification has been available since December 2013. Why have the bureaucrats not undertaken their fiduciary duties?

Joe Biden. This will become the producer bureaucrats new, favorite viable scapegoat for the next four years. Nothing will be able to be done due to the bureaucratic nightmare they're being exposed to. There is nothing more that a bureaucracy loves than facing a government bureaucracy. If the industry is unable to progress in the next four years. I suggest we develop some software and organize ourselves as proposed in the Preliminary Specification for the desperately needed work that will follow Joe Biden.

It was recently announced that 26 Republican Senators wrote a letter to ask for a meeting about the White House's Executive Orders regarding oil and gas. Seventy five percent of the deplorables believe that the presidential election was stolen. Evidence exists of severe Chinese government influence in the Biden family. The Democratic party is seeking to silence any opposition and deprogram these "white supremacists." And Republican Senators sent a letter!

When you don’t tend to your garden the weeds tend to steal the nutrients from what you expect to eat. The culling of the weeds in the industry would be the prompt removal of the bureaucrats. In light of these current and looming crises. A weed infested garden is an excellent analogy of the situation. The capital costs that investors have already paid for and are essentially resisting the bureaucrats request that they fund for a second time. Assets should generate a return that would have the capacity to maintain them in commercial condition. Secondly there are the reclamation of the assets that have been in service for their entire useful life. These costs are accelerating and are being monitored closely by the governments, environmentalists and John Q. Public. They will be hard for the producers to ignore. It will also be difficult to convince any investor or banker that producers will have any capacity to generate a return that will support further investment into their organization after reclamation costs are considered. And lastly those rebuilding and refurbishment costs will be done on someone else’s dime, not the investors and bankers. With new issues such as aging of the assets, rebuilding capacity increases and new technologies the producer bureaucrats can also view the landscape of devastation they’ve caused throughout the greater oil and gas economic structure. Bringing industry giants like Schlumberger and Baker Hughes back will be a task that will not happen serendipitously no matter how much praying is done. Bringing in new talent and training them over the long term…

Oh wait a bureaucratic just called, (facetiously of course) they’ve found even more drilling locations!

The Preliminary Specification seeks these funds from the price of the commodity. The consumer is the only source of funds large enough to approach these needs as we’ve identified them. Our value proposition is broken down into two components. The first is the demand for future capital, reclamation, rebuilding and refurbishment costs and are estimated to be in the range of $20 to $40 trillion. The second component is the $5.7 trillion in pure, incremental, and real profit, the kind that you can take to the bank. These funds can only come about with a mechanism that allows for a fair and reasonable method of production allocation across the continent. That is our decentralized production models price maker strategy. If these costs don’t get passed on to the consumer the industry will continue to operate as a charity with no donors. That’s opposed to what they’ve been these past four decades, a charity with fraudulently deceived donors.

It’s alway good to look on the bright side and there’ll be plenty of work for everyone. Even the bureaucrats. They’ll be busy defending themselves in litigation from those that they deceived, aka as their prior investors. But as we noted last summer, there could also be a new class of litigation for them. Their insurance providers may have felt deceived when the industry began increasing their coverage by 70% after I had detailed the issue was present since July 1986 and our solution, the Preliminary Specification has been available since December 2013. Insurance companies may want to know why producers increased their coverage in July 2020 after I pointed out their lack of fiduciary duty and risk on June 2, 2020?

As for the rest of us it may seem like an impossible job, but that’s the fun part. Instead of walking around in the mindless sludge of “muddle through” for another bad year in an endless string of bad years in oil and gas. We’ll be focused on performance in order to provide the rebuilding of the industry to what we all know oil and gas could and should be. A bit of a different vision. Negative prices in April 2020 will be last year's news and we can all laugh at how bureaucrats had their satellite based Rube Goldberg machines analyzing shadows of floating tanks and crunching out paper that predicted absolutely nothing. Such an elaborate system, employing how many, that could not foresee negative $40 oil! Very effective. Bureaucrats will never take responsibility, they’ll never act in anyone’s interest but their own. They’re conflicted and compromised as all bureaucrats are focused on themselves. We should not expect anything from them other than the few words they’ll get in edgewise when we toss them out. We’d be fools not to and they certainly don’t deserve any more chances.

What we know is that we face great difficulties in this industry. We are standing on financially unstable ground. Our capabilities and capacities are diminished and the leadership of the industry hasn’t been seen in over four decades. The three costs that we’ve identified, the recovery of the unrecognized capital costs of past production, reclamation, rebuilding and refurbishment costs will swamp the demand for capital for productive operations. Productive operations being new business. What should be clear in this series is that our solution provides the resources necessary to cover all of these costs from the only source large enough to provide that scale of financial resources, the consumer. By invoking our decentralized production models price maker strategy the industry can insure that all production is produced profitably everywhere and always based on a standardized, actual, factual accounting. That these costs will be returned to the producer firm in the form of cash to be redeployed again and again. Bureaucrats believe investors will provide the capital for these costs and their unauthorized use of oil and gas revenues to fund their diversions into clean energy. People, Ideas & Objects ensure there is no longer any need, and certainly no ability, for the investment community to expand, or is it “build the balance sheets” or “put cash in the ground” totaling $20 to $40 trillion dollars and wait for the day when…

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. Anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.