New Cost Structures, Part II

I want to start this second post of our cost structure series with a comment that needs clarification. I’ve repeatedly noted the amount of time that I’ve been working on bringing a solution to the industry and the zero support that I’ve received from industry. Maybe I’m wrong in my approach, I don’t know, I’ll know in the future. Why I raise these points is to highlight the opportunities and timeliness that producer bureaucrats have forsaken. And to contrast their lack of action. I’ve been motivated to do this work and am very satisfied with what I think I’ve accomplished, the timeliness of the solution, the opportunity to resolve what can only be described as the largest issue in oil and gas, ever, and set the industry on a path to profitability. Altruistic and deluded, probably, but I enjoy what I do to the extreme. Lately, it has taken on an even greater appeal to me and I’m having found what feels like a new approach to this work.

Our second major cost category that People, Ideas & Objects sees escalating uncontrollably in the very near future is none other than the reclamation costs looming on the horizon. We expect these costs to escalate and make up a noticeable portion of our value proposition which we’ve valued in the $25.7 to $45.7 trillion range over the next 25 years. These are somewhat new costs as the fields where oil and gas production began are beginning to be retired and the volume of retirement of these fields will increase as time passes. Producers have been forced to account and to set aside provisions for reclamation costs by the various regulators of the areas in which they operate. However, as we all know and understand, these provisions would be classified as inadequate to fulfill their purpose. Methods have been employed by the producers to try and avoid these upcoming costs and some of the various governing jurisdictions are beginning to deal with the producers who are developing such “innovations.” The key here is that these costs are going to be significant. The point that I want to make is that the material nature of them is one area of concern. The second is that these cost’s capability to attract a return on investment is zero, they are a drag on the producers activities and will become more evident to everyone as time goes on. Especially evident to any prospective, future investors that today’s bureaucrats may have thought they might be able to rope in.

Without the capacity to deal with these costs in their high throughput production model. Today’s oil and gas producers will incur them at the expense of their alleged “profitability” however specious that number may be. The only alternative is the Preliminary Specifications decentralized production models price maker strategy that will have profitable production produced everywhere and always. Profitable from the point of a view of a reasonable accounting for capital, operations which would include reclamation costs, and overhead. Although it would be reasonable to suggest that the producer has benefited from the production of these fields that need to be reclaimed, it is also the consumer that has benefited the most from the oil and gas they have been able to consume. Therefore passing these costs on to the consumer as they’re incurred is the only reasonable method for the producers to maintain their “real” profitability as People, Ideas & Objects define it, and to deal with these escalating reclamation costs. It will be the consumer that will demand that the land be reclaimed to pristine condition and consumers will support the environmentalists in these endeavours. It is therefore reasonable to assume that the costs of reclamation and the environmentalists requirements will be passed on to the consumers as they’re incurred. Investors are not going to bite in the current bureaucratic business model that sees investors being annually called for this cash, and exposed for the liability and litigation of reclamations non-performance.

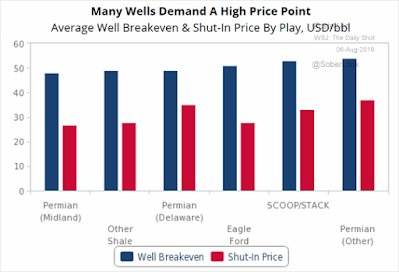

With the high throughput production model, which producers currently use, they produce at 100% everywhere and always. This is in order to cover as much of the high overhead that is necessary and incurred in order to produce at full capacity. With the introduction of shale based reserves to an already decades old toxic model of chronic overproduction and oversupply, or as we define it unprofitable production, global markets for oil and gas commodity prices have collapsed beyond what will remedy themselves. Any discussion of higher commodity prices with this model in place is as specious as the producers financial statements. Hoping and praying for higher prices has to be doubled or tripled down on or alternative solutions need to be deployed. OPEC+ have reduced their production by 7 million barrels per day due to the virus. We are unaware what surplus capacity they had, and importantly could now have, prior to this covid induced reduction. Of note and significance is that crude oil futures are $52.80 for April 2030. Natural gas prices on a global scale will not be remediated without deliberate and sustained effort within the United States over the course of many years. According to the commodity futures market, natural gas prices, primarily due to U.S. shale gas production, has obliterated any hope of commercial gas prices for at least the next decade. Without active intervention to remediate the market and return it to profitable pricing this situation in natural gas will not change. Depressed pricing in North America was the issue a few years ago. The world’s prices for natural gas remained profitable. This prompted the LNG buildout on the Gulf Coast. The oversupply in North America then spread across the globe to where the natural gas prices for LNG are at times inadequate to pay the shipping costs. Who would sit and do nothing in the face of such destruction and dismal future prospects when the Preliminary Specification offers the alternative? We’ve seen through the obstinance of the bureaucrats that they will not change. This bureaucratic obstinance is now into its second decade, or maybe that is better expressed as it's second decayed.

The Preliminary Specifications decentralized production models price maker strategy enables this oil and gas price remediation to occur through use of the commodity market mechanisms. By realizing that oil and gas are subject to price maker characteristics and that by only producing what can be produced profitability, ensuring that all costs are included in a fair, objective, standardized and reasonable accounting, can producers begin to generate the financial resources necessary to operate the industry as needed, but also remediate the commodity markets and stabilize them by removing the boom / bust cycle and pay for the looming reclamation and other costs we’re detailing here. Managing product inventories to ensure that overproduction does not destroy prices in business is about as American as apple pie. Yet the producer bureaucrats believe it to be something evil. Or, it’s just they’ve personally never had it so good under their current method. They also assume that the “market” will take all the production they can give it, which sort of defines the ridiculous nature of this issue and my discussion. For them “markets” are magical.

As we documented last summer OPEC have been attempting to work with North American producers since at least July 1986. Their inability to do so has led them to employ their last resort of declaring a number of price wars. Their last declaration of war occurred just before the virus. Inaction through the muddle along strategy has been the de facto, unanimous procedure that has solved all of the North American producers problems since 1986. However any of the issues bureaucrats may have felt were resolved by their inaction were only deferred, and assuaged by investor cash and now those issues cumulatively stand as an existential threat to their organizations and the greater oil and gas economy at large. A threat that they refuse to acknowledge or deal with. And now with these previously ignored and unidentified reclamation costs building, as just one of many aspects of this threat, their business model is unable to proceed without the structural capital support of their investors and bankers due to the critical loss of faith, trust and credibility that would otherwise be needed. It’s good to recall however the bureaucrats are fine, and they thank you for asking.

To address this requires the type of plan and strategy that the Preliminary Specification provides with profitable production everywhere and always. Alternatively and finally, bureaucrats announced their own plans and strategies during the fourth quarter of 2020. We haven’t heard from everyone yet, however, eventually we will as they begin to see the effectiveness of the plan and strategy as laid out by BP, Shell, Total, and to a lesser extent Exxon being welcomed in the media and John Q. Public. These plans include nothing other than the permanent movement away from dirty hydrocarbons to clean energy and zero emissions. Which kind of solves all these bureaucrats problems doesn’t it? I suggest we suspend their administration post haste and ensure that they achieve their objectives immediately. That is we take the oil and gas revenues and assets away from the bureaucrats and spin them off to the shareholders who paid for them. That way bureaucrats can approach their new business plans with a clean slate and start anew. Feel the fire of the entrepreneurial spirit burn as their ideas are met with the reality of the bleak revenues they generate.

One of the methods that we’ve seen used throughout the years to deal with the reclamation costs here in Canada has not been that innovative. Although it ultimately proved unsuccessful in this transaction, it also seems to have awoken the administrative state to the inherent risks of oil and gas reclamation costs to society. The method was used by Shell regarding their Jumping Pound, Waterton and Caroline natural gas facilities. Caroline being in the high 90%’s of H2S. Jumping Pound was developed in the early 1950s, Waterton in the 1960s and Caroline in the 1980s. My father worked in the engineering department for Shell and I remember tagging along on some of his trips to Waterton while it was being built. Gathering lines were being welded and the place was abuzz with activity. To cross the trenches that were dug for the lines I was too young to jump across so I was just picked up and tossed across from one adult to the other. It was very interesting to me and a much different time than it is today. Selling these properties in a package to a very small oil and gas producer that the regulators didn’t think had the wherewithal to be able to operate them. Secondly, this may have been an attempt to avoid the reclamation costs that the Alberta government assessed at many hundreds of million dollars, and in this article regarding the transaction, some are speculating that Alberta may be currently facing $.5 trillion in reclamation costs. In this sense I guess it’s been fortunate that Alberta was nowhere near as productive as the United States. A review of the referenced document will provide a better understanding of the scope and scale of the problem just in Alberta.

The story says a lot about where the world’s fossil fuel industry finds itself at this precarious moment, as it struggles to balance falling revenues against mounting environmental liabilities.

And

It’s not known whether Sorensen mentioned to O’Regan the findings of a 2018 analysis on the economics of exporting LNG from Canada. The Canadian Energy Research Institute, which is partly funded by the government, concluded any project would need at least a $100 oil price or $11.6 per million British thermal units over the life of the project to be viable. (The European Union natural gas import price is currently $2.12, a nearly 60 per cent drop from last year’s $4.90 per million British thermal units.)

Of interest is the article's noted distribution of risk of the reclamation costs to the various funding units involved in the transaction. If there was a failure of the producer these costs would fall to the remaining producers in the industry, based on the current model. Or society in general. It is the funding risk that one party experienced in this transaction that producers should analyze to determine if this will further disable their capital structures from being rebuilt in the future, if they should continue to muddle through without an answer on how their businesses will operate?

We noted the high throughput production model that producers currently use. Another aspect of that business model is cost control. Which is an engineering discipline derived from the efficiency objective. Oil and gas has become a science project with the dominance of the earth science and engineering people dominating the principal positions in the industry. This has become the culture for the past three decades with the business types taking a back seat behind the main receptionist, huddled in with the mail boy and switchboard operators. Cost control has been the only area of concern. That oil and gas is a business, and businesses are profitable are foreign concepts. Passing the costs of oil and gas exploration and production on to the consumers is considered abhorrent and the talk of the devil by the scientific culture of the industry. To paraphrase “there are investors who will help them build the business in whatever direction and to whatever size that no one knows or understands.” It’s an adventure and “you have to put cash in the ground.” To suggest that the costs be passed on to the consumer in a timely and accurate manner, and particularly the capital costs of a capital intensive industry, invokes shock and fear, but to those who suggest such hearsay, persecution.

Who benefits from oil and gas is a question that’s never asked. On a barrel of oil equivalent basis, society leverages that barrel into 23,200 man hours of labor. This is a phenomenal, unbelievable achievement that represents the brilliance of all those that have come before us throughout history. On a personal consumption basis the costs are lower than bottled water. It is therefore disrespected, abused and wasted without regard to its value or scarcity. If the prices were to triple or quadruple from today they would still provide the greatest value proposition of all time. Then they may even come to be appreciated as commodities of value and appreciate the work that is done to provide for them. Lunacy I know, but that’s why I like this job. Our movement away from hydrocarbons will be the death of our standard of living in a rapid manner. It is the most powerful economy that consumes the most energy, which today is China. Oil and gas is here to stay as our primary source of energy for the remainder of this century and any thoughts otherwise is highly regressive to our standard of living. This naval gazing about the future energy makeup is an academic exercise which distracts and doesn’t belong in the industry. Our role is to provide the economy with the most cost effective, yet profitable oil and gas production to ensure that North America reaches its full potential.

Producer bureaucrats believe that the capital costs of oil and gas exploration and production have to be funded by investors. As these costs increase and the environmental costs escalate exponentially, lets search for those naive and stupid investors willing to pay the trillions of dollars for reclamation costs? No, lets first get rid of the bureaucrats, implement the Preliminary Specification, and start fueling the North American economy profitably.

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. Anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.