New Cost Structures, Part I

First, I want to comment that my arguments and accusations directed to the producer bureaucrats in 2020 became rather sharp. Some may think with a new year I’d revisit my approach and amend my ways. Which I’ve done. I can’t hold any respect for these producer bureaucrats. The damage and destruction has been epic as I’ve discussed throughout the past fifteen years. I have difficulty holding any respect for these producer bureaucrats, those being the C suite and directors, it is they who are responsible for all the damage, it is they who should be accountable and it is they who have had the authority and power to do something about it. Let us not forget it is they who have profited from their administration at the expense of everyone else. And we have seen, as I enter my thirtieth year of attempting to resolve these issues that they continue to play their Mr. Magoo, Sgt Schultz, and Bernie Madoff routine for their own personal financial benefit. They must be shown the door. On a lighter note I’ve awarded all these bureaucrats 2020 participation ribbons to go with their prior “awards.”

I want to begin the new year with the identification of three new cost categories oil and gas producers will need to deal with for the next few decades. The material nature of these costs will put an exclamation mark on their chronic non-performance and make investors want to run the other way, even faster. This is due to the nature of these costs and their inability to ever generate a return on investment at any point in the bureaucrats current business model. These are the types of costs that will haunt the industry in whatever configuration it takes and it is these costs that can be clearly identified today due to the lack of the producer bureaucrats ability to pay attention to the business of the business. For them it is all about earth science and engineering. It is only the Preliminary Specification and the business models that are inherent in our offering that provide the industry with a methodology that deals with these costs. It is these costs that we identified much earlier and which materially inflate our value proposition to the $25.7 to $45.7 trillion dollar range. We have seen some unsuccessful methods used in the industry to try and deal with these costs, which we’ll discuss. None have been effective and the methods used have only served to provide further financial losses and an inability to command the necessary higher commodity prices in order to capture and recover these costs. We’ll be discussing in detail each one of these cost categories over this and the next two posts and then provide an overall summary as the fourth. The overall question that we’ll answer in this series is how will producers pay for these costs and where will the money come from?

The first category of costs will be familiar as a result of the discussion we’ve had over the past number of years. We’ll be reviewing these points once again with a few new attributes added to the discussion. Although the first category of cost we’re discussing will be looked down upon by the bureaucrats as financial or accounting losses. These are real, tangible losses over the course of the organization's life cycle. Our first category of costs is the fully discussed issue of bloated property, plant and equipment as recorded on the highly distorted financial statements of the producers. To suggest that these financial statements are generic and oddly similar throughout the industry would be an understatement. The size of the producer is the only difference between them. All of them have massively bloated property, plant and equipment offset by essentially very high levels of debt. The working capital is miniscule if it exists, with most reporting a strong trend toward diminishing working capital on a quarterly basis. This trend has left most of the producers with negative working capital. Shareholders equity in many producers no longer exists as the retained losses now exceed the capital that was raised during its lifetime. In most producers the losses have materially diminished or extinguished the retained earnings of the producers, and in many cases shareholders equity. If as we suggest property, plant and equipment is overstated, and these are what support the very high levels of debt, then the leverage is far in excess of the criteria that are claimed and these producers are seriously overleveraged. It is however sunshine and rainbows as far as the bureaucrats are concerned.

People, Ideas & Objects have asserted that the “assets” in property, plant and equipment are nothing of the sort. They are the unrecognized capital costs of past production. This is how we perceive the distorted nature that producers have interpreted the SEC requirement for Full Cost accounting and associated Ceiling Test. These accounting regulations suggest that the capitalization of the firm should not exceed the reserves value of the organization. Since the late 1970’s when the SEC implemented these regulations producer bureaucrats have interpreted the reserves value as the target of their spending in property, plant and equipment. This has, as a result, taken on cultural distortions that reflect that any and all costs are capitalized in order to achieve their "target." This includes the receptionists time, phone service and Post-it-Notes as capital costs. Nothing is immune from their capitalizations justification, as the SEC has pursued litigation in the industry for the capitalization of operating costs. These distortions are not readily apparent when the industry is recapitalized each and every year by investors that are duped by the increasing assets of the producer, its subsequent profitability and bloated cash flow.

We’ve argued consistently that consumers have paid the operating costs while investors were paying the capital and overhead costs of exploration and production. Therefore these costs in property, plant and equipment were the consumers capital cost subsidy financed by investors. I stated earlier in this post that these three costs that I’m identifying in this series were unable to provide a return on investment. I could be wrong, but then I’m somewhat immune to the charm of producer bureaucrats, maybe they could have these capital costs in property, plant and equipment provide a return on investment for their future prospective investors? That’s an idea, have investors pay for the same cost twice, what do you have to lose Mr. Bureaucrat! For that is what they are now asking by seeking investors to support their dilapidated failures. This gravy train only stopped in 2015 when investors realized the ponzi scheme of money only went in, was spent and never came out. Some producers declared dividends certainly, however those were financed by next year's investors or friendly bankers. The steady withdrawal of the financial investment into the industry has created the crisis that is today’s oil and gas industry. Banks in 2020 began to catch on to the game and are now beginning to withhold their support.

The danger that producers face as a result of the bloated balance sheets from property, plant and equipment. And assuming we are correct that these are nothing more than the unrecognized capital costs of past production. These producers are not only obscenely leveraged, their actual losses subject to a reasonable accounting, would leave their financial statements in the most dire condition imaginable. We have asserted that analysis of the producers should include a pro forma adjustment that would move 65% of property, plant and equipment to depletion. Better reflecting the financial condition of the producer firms. This would then show a unanimous consensus that the bureaucrats must be removed.

Throughout this time the value that had been established in the industry was eroded away and now the industry has no ability to support itself. The business requires a constant stream of new money just to maintain its current status quo of chronic decay. It is an industry that is a drain on society in other words. This drain has been perpetrated by the bureaucrats, the C suite and directors, who have prospered handsomely as a result of their past decades of inaction. Also known as their “muddle along” and “do nothing” strategy and operating procedure. Oil and gas being a capital intensive industry will always generate high levels of cash flow as a result. This cash flow has been used and abused to compensate bureaucrats in new and highly innovative ways. And those are just what's publicly known. This cash flow is due to the return of the high level of prior investments in the form of cash. The issue today is that the damage and destruction that has been experienced in the industry through all the take and no giving bureaucrats, has diminished the value of the assets, and therefore the relative size of the cash flow. These cash flows were and are overstated on the financial statements as a result of reporting everything as capital costs initially, then realized over the course of decades in the form of depletion deferring the recognition of the real cost of exploration and production. When G&A is capitalized to the tune of 85% in the industry, that is the average, no one refutes my number, those overhead costs are not deducted from the fake profits that are reported to determine cash flow and therefore overstates cash flow. This is reflected in the fact that each month these overhead and other expenses are incurred, capitalized and deferred over the course of decades. Leaving the producer unable to recapture those costs in the current price of the commodity, and as such, on the hunt for the necessary cash to fund next month's overhead. This occurs in each and every producer, each and every month. There is no float of cash that is used to pay the overhead costs that should have been returned the following month in the price of the commodity to replenish these overhead costs. This was not an issue when the investors were easily duped to reinvest each year by the bureaucrats' specious accounting. This is currently one of the primary ways in which working capital continues to diminish at remarkable rates across the industry. Producers in reality never made any money and were wholly dependent on chronic dilution of their investors through annual issuances to new investors. Bernie Madoff sends his congratulations and admiration.

Producers therefore have organizations that stand with no structural capital support from investors or banks. They have an organization that is incapable of funding itself on a day to day basis without making drastic measures to raise the required cash to continue to operate. Their cash balances are continuing to evaporate as a result of low oil and natural gas prices. Liquidity is claimed to be healthy, when they include the amount remaining on their lines of credit. How much it actually costs to produce is unknown as the financial statements are distorted to the point where the ability to know the truth is not possible. And they never made any money. The industry, as are the producers, is valueless at best. Consolidation is the current trend, bigger bureaucracies will certainly be the answer to all of these questions! Really, trust them. That Chesapeake failed far quicker at that strategy is their exception that proves the rule. The accounting trickery has been expanded to the point where the fact that cash balances continue to “miraculously diminish in unexplained and unexplainable way’s” where nothing is done or said about it.

When I discuss accounting trickery I mean accounting trickery in the underlying fraud and abuse that the bureaucrats have exorcised against their investors. Again I focus on the investors but look to the larger oil and gas economic structure. Without having the clear, honest accounting that the investors should have received, they were deceived, profitability was falsified. When investors are deceived they leave, sending the only message bureaucrats need to hear. You have failed! Without profits in the greater oil and gas economy, there is nothing for the rest of the people that are involved in oil and gas and we fall into the economic super depression that we’ll soon find ourselves in.

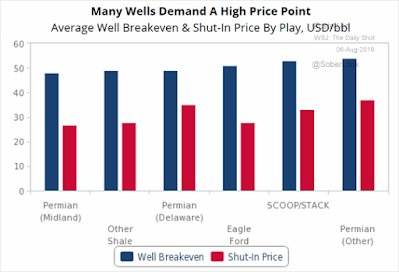

One of the most overt accounting tricks that was perpetrated was the serial claim by all producers that they would be profitable at the new, lower prices the commodity markets were providing from chronic overproduction. This was due to their cost control, diligence and innovativeness they’d claim. The lower price was lower than their prior threshold they claimed to still be profitable at, such as we can make money at $50, then they could make money at $40 etc. These claims are specious and fraudulent. They’re based on the costs that current operations could prospectively be conducted in the field by squeezing the service industry and not based on the actual accounting facts as they are represented to be. How, without any write downs as a result of the ceiling test, would they then begin to reduce their costs from $80 to $50 to generate the continuous alleged profit? Would they have to have been innovative as they claimed? Or would they just need to be innovative in terms of new ways of approaching historical accounting? The majority of those $80 costs are capital in what is generally agreed to be a capital intensive industry. The costs of 97% of their wells and facilities are fixed in the past and not subject to change. Certainly future operations may be conducted less expensively, but that is not what the blanket statement that they can then be profitable at $40 means. This is deliberate, deceptive and designed to keep the lining of bureaucratic pockets filled and filling. Only one of the many ways in which deception has been perpetrated. In response producers will assert they have more reserves in which to allocate their capital costs towards. Which is true however, do those reserves need to be restated as a result of the price drop from $90 to $40 due to their subsequent inability to be produced profitably? In fact what has happened is the reserves volume decreases as a result of large portions are no longer commercially producible when the price drops $50. Quoted prices were determined from the following WSJ graph.

What about shale? The method used to account for capital costs is to allocate the total spending to each of the boe in the known reserves. This practice has continued and People, Ideas & Objects believes there needs to be a reclassification of costs to better reflect the activities in areas of shale based reserves. We know a number of characteristics of shale that make it a significant and valuable resource for the profitable North American energy independence industry needs to provide. Shale reveals substantial reserves, its production is prolific and its decline curve is steep. Allocating the substantial capital costs of drilling and completion of shale wells to the tremendous shale reserves that are exposed reduces the capital costs to a reasonable variable on a boe basis. However, the work necessary to maintain the production profile over the long term is also substantial in terms of cost. These costs are added to property, plant and equipment as capital costs, as are any incremental increase in the known reserves. Does anyone else see the mouse catching the cheese? We suggest the costs of the incremental work be classified as operations and have them retired immediately. Otherwise the objective of bloating the balance sheet by the bureaucrats will continue. We believe that the cash consumed in the capital intensive nature of oil and gas needs to be recaptured and reused on a high frequency basis in order to a) realize the actual costs of oil and gas exploration and production and b) enable producers to internally fund the enormous capital costs they claim are necessary in the near future.

Today we are seeing the majority of the producers which include BP, Shell, Exxon and Chevron instituting large writedowns of their property, plant and equipment due to the SEC required ceiling test. All these write downs are displaying clearly and unequivocally that the past spending efforts of the producers have failed to generate the value of their spending. And indeed the value of the producers reserves are less than the value of what they’ve spent. These writedowns now account for the waste that has been conducted by these bureaucrats over the past decades and is effectively the destruction of that value being cast to the wind. I also assert the write downs are only beginning. The bureaucrats will claim, as they have always claimed regarding the ceiling test, that these are accounting charges and no one is concerned about them, they are in the past and no one cares. Their capacity to ignore their responsibility and accountability for the money they spent is evident in these fraudulent lies they've uttered over those decades. This chronic lack of accountability and responsibility for the truth has now led to a lack of faith and trust in the bureaucrats themselves and that is why the investors and bankers are and will continue to withdraw until the bureaucrats are gone. Trust and faith has been breached, when you have no credibility, it has gone for good.

It is these costs in property, plant and equipment, what People, Ideas & Objects call the “unrecognized capital costs of past production” that we assessed as the only remaining residual value in the North American oil and gas industry. They are of value as they could be used in the Preliminary Specifications decentralized production models price maker strategy as capital costs in future oil and gas prices passed on to consumers and recovered in the form of cash to recapitalize the industry. These rebuilt cash balances would then be used and reused to cycle repeatedly and frequently through as capital expenditures once again, and then recognized so as to be returned to the producer as cash on a basis that was consistent with the industry's cash needs. As these writedowns now occur this future opportunity is lost and the only value that we were able to identify in the industry is being frittered and wasted by the chronic “muddling along” of the producer bureaucrats. The Preliminary Specification has been available to them in final form since December 2013, and in development for a decade before that. Yet nothing has been done but abuse People, Ideas & Objects for the threat we represent to the bureaucrats personal cash flows. Disintermediation challenges all industries with new and more effective ways to organize and manage their operations. For further reference on the effects of disintermediation call up your local record store manager. The Preliminary Specification disintermediates these bureaucrats.

People, Ideas & Objects Preliminary Specification ensures that oil and gas is produced profitably everywhere and always. We ensure that the total cost of production is always accounted for on a standardized, objective, reasonable and compliant basis. Ensuring the financial resources that were committed, in a capital intensive industry, are also reflected in the costs of the commodities prices. If the industry is a capital intensive industry it would stand to reason that the commodity prices would contain costs that were capital intensive as well? Instead bureaucrats collect and savor their out of control spending in property, plant and equipment as assets so they can strut down mainstreet in a competition to see who will dominate as the greatest fool. Our perspective looks at this foolishness and provides a better way where the cash consumed in the industry is returned to the producer in the prices that are necessary for profitability, and that is real profitability based on actual, factual accounting of the capital, operations and overhead costs.

The other key aspect that has to be mentioned here that differentiates us from what is done in the industry is our method of production allocation. There is no fair and reasonable method of production allocation other than the Preliminary Specifications decentralized production models price maker strategy. Government mandates, OPEC limits or any other style of production allocation will always have half the industry unhappy with their allocation of what can be produced. Political influence becomes the means in which to produce more. Our choice of profitability is the only fair and reasonable method. If the property can be shown to produce profitably based on the Preliminary Specifications standardized, objective methods of accounting facts then it will produce. The myriad of excuses of the bureaucrats as to why our method can’t be used have all expired as a result of their arguments being as specious as their financial statements.

Investors sent their signal to producer bureaucrats half a decade ago. What’s been done as a result. All that I can see is the lies, excuses, blaming and viable scapegoats that have come and gone. The list exceeds 20 items and is well known by all. These all began with natural gas ten years ago or more with bureaucrats “waiting for a cold winter.” How many cold winters have we had in the last decade? I’ve also seen first hand the abuse that I’ve had to take, which has motivated my new attitude this year. If it’s their choice not to do anything and just reap their bounty nonetheless then it leaves not much in the form of questions to ask of them. When I raised the point of their culpability and guilt last summer they, on a wholesale basis, increased their officers and directors liability insurance. Which is a form of action to be sure. There is not much to litigate in the producer firms themselves. No one sues over a failure. The bureaucrats however were responsible, accountable and authorized to do something. That is all that is needed to launch personal litigation against them for any of the shareholders losses that were incurred. It’s too bad that the insurance proceeds cover their liability first, it should seek to liquidate the bureaucrats personal property first and any overage in terms of claims handled by the insurance. But I don’t always get everything I want.

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. And don’t forget to join our network on Parler or Gab @piobiz, anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.