These Are Not the Earnings We're Looking For, Part LVIII

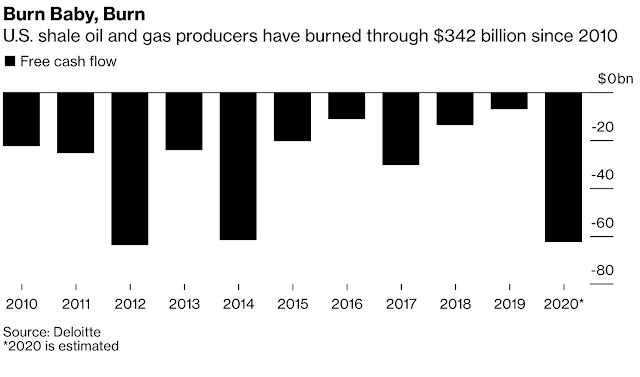

I’m continuing with Wednesday’s discussion of how the revenues of the producers need to be substantially higher in order to cover the full costs of capital, operations and overhead of exploration and production. This is in order to earn not only a “real profit” but also generate the cash that’ll be necessary to fuel their future capital expenditures, dividends and pay down debts. Wednesday’s analysis showed that on a cash basis the investments that had been provided to the producers from investors were diligently invested. It is the return of that cash from the retirement of those assets that is frittered and wasted in the process of operating these organizations. Where depletion, which was more than inadequate to recognize the real cost of capital, provided the excuse for the producers bureaucrats to have ignored their impact as “just accounting adjustments” and to deal with them as “sunk costs.” Their ability to ignore these capital costs as a significant part of the cost of oil and gas exploration and production has allowed producers to deceive themselves into “building balance sheets” and never recapturing the real cost of oil and gas from the consumers of those products. The costs that were passed on to the consumers were heavily subsidized when the investors were picking up the tab for the capital budget each and every year. Now that this is no longer happening the value that was built within the organization is being cannibalized, sacrificed and destroyed through low commodity price production in order to continue the consumers subsidy and the bureaucrats personal bounty.

I have suggested consistently that the real cost of oil and gas exploration and production in North America is in the range of $135 to $150 / boe. That would have commanded a far higher price than what was realized in the third quarter of 2020 and even higher than what would have been required in my revised revenue number of $195.72 billion of revenue in Wednesday’s post. Based on our sample of producers production profile the average price received for 2020 as of the third quarter is $45.38 / boe. This considers all forms of revenue from tariffs, royalty, production and hedges. Therefore the price needed for the revenue of $195.72 billion would have been $79.89. Still well below the minimum threshold of what we believe would be necessary to cover all the costs of oil and gas exploration and production. At $135 and $150 / boe revenues for the nine months would have been between $330.7 and $366. billion. Note these are just the costs, an element of profit would be incremental to these prices. These will be the numbers that we work from for the remainder of this post.

The first aspect of the need for these heightened revenues is the fact that they would be subject to much higher taxes. These would be incremental to the taxes that have been paid and have what I would consider to be a material impact on those revenues. What that amount would be is unknown and to be determined. Our first point regarding increased capital costs is represented in the discussion of the ERP market space in oil and gas. On page 18 in our white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale” we discuss the difficulties that have been created in this market over the past number of decades. There has been and will be no funding of investment made by anyone into these ERP systems at any time in the foreseeable future. The producers activities with respect to the expectations and their behaviors of how the ERP providers were treated has left a bad taste in the mouths of those investors. Large systems providers such as Oracle and IBM also left town as there was no ability to deal with producers that expected everything to be built on spec and once ERP providers investors were able to put their system on the market, and the market being so small, succumbed to producers not paying anything for these systems. Producers will now have to pay for their systems in advance such as the offering People, Ideas & Objects are providing. There will be no other way in which new systems will be brought to the market.

I raise this as I feel it is now the precursor to understanding the service industry. Who invested diligently and faithfully to service the oil and gas producers and were used and abused in similar ways to the ERP systems providers. Where will the service industry find the resources necessary to rebuild their organizations? Who will be the provider? We saw Oracle and IBM leave in 2000 and 2005. Schlumberger is just leaving now. Haliburton and others appear to be of like mind. Who is going to fund these operations and rebuild the capacities and capabilities of the service industry to support the operations of the oil and gas industry at the capacities that are needed in the near future? The funding of People, Ideas & Objects will become the defacto method in which things are completed in the future. Producers have destroyed their business but most importantly their credibility. If they’re unwilling to fund the next iteration of development, based on the providers Intellectual Property, then the producers will have no choice or opportunity otherwise. Just as People, Ideas & Objects suggest to the producers now, if they can’t invest in their organizations profitability, why would they expect anyone to invest in them? There will need to be direct involvement in the areas that the producers need to conduct their exploration and production. Not involvement from sticking their fingers in things, direct involvement from the point of view of providing the financial resources upfront. The only source of cash that I see for the next 25 years in which the producers will be able to do this will need to come from the consumers in terms of they’ll be paying for the full cost of exploration and production. Producer bureaucrats have now destroyed all other methods of funding for at least a generation. When their credibility has been summarily destroyed as the producers have so effectively done, that’s it they’ll never get it back.

You want a new pipeline to where? Well then that’s going to cost you. Shifting the burden of developing the infrastructure for oil and gas onto pipeline companies and others is not going to fly any longer. Especially when in the past as soon as the producers commissioned a new line they paid the annual bounty necessary to stop Greenpeace and all the others from picketing their head office. Now that producer bureaucrats have taken a more “progressive” attitude toward clean energy, carbon capture and climate change, why would the pipeline companies want to be the companies that violate this goodwill on behalf of the oil and gas producers in the eyes of their new clean energy and climate change communities. Producers should add Paymaster to the name of their companies. It would better define what it is that they’ll be doing in the very near future. Oil and gas is a primary industry indicating they receive their revenues from the resources they extract. These resource revenues continue irrespective of the actions of the producers and account for the actions of all the sub-industries activities as well. The service industries involved in oil and gas are secondary industries who do not have primary revenues and do not service other industries. Drilling rigs, oil and gas ERP systems and the like are unsuitable for any other industry. Therefore if the primary industry that wants these services will have to start paying for them. Expecting that others will do it for them is over. Investors have been burned comprehensively in every aspect of oil and gas and won’t be back. I only continue to mention investors as they are the ones that initiate action. Action that leads to the activities that generate value, employment throughout the greater oil and gas economy. “Building balance sheets” and “putting cash in the ground” just doesn’t have that old time appeal anymore. The industry has been broken and can only be fixed through a decade of prudent and effective management that mitigates the memories of what has gone on. A decade at a minimum, and People, Ideas & Objects will have years of work to do before that clock even starts ticking.

There have been some instances where producer bureaucrats thought they could walk away from the assets they’ve benefited from over the past decades. However, a tiring and aging infrastructure is not something that taxpayers are going to accept as a gift from the industry. As more administrations become wise to the actions of those few there will be steps taken to ensure that the burden of one irresponsible producer attempting to abandon their environmental disaster will be shared across the industry in some form. These costs are minor in the great scheme of things today. However, in five to ten years they will become trillion dollar costs of remediation and will exceed bureaucrats comprehension. They most certainly will not be granted the license of muddling through. Expectations will be that these are either refurbished or reclaimed and the demands for energy met. What return on investment will bureaucrats be offering investors on these reclamation, rebuilding and infrastructure projects? Investors just might not be enamoured with "building balance sheets" or "putting money in the ground" anymore.

How do the producers come up with the money to pay for all of this? And to do so in this new era of abundance brought about by shale? Simple, as a primary industry producing commodities that fall within the definition of price makers they start with the development of People, Ideas & Objects Preliminary Specification with its decentralized production models price maker strategy. Which provides the only fair and equitable method of production allocation. If it’s profitable, considering a standard accounting across the industry that includes all of the costs of exploration and production, it should produce. Until such time as there is this method of fair and equitable production allocation in North America, we will continue on this downward trajectory. Once the price maker strategy is implemented then and only then can these producers begin to produce oil and gas profitably from the real sense of the word and consider the full cost of oil and gas exploration and production. What’s going on today is far from this. With a group of self interested and distracted bureaucrats who are only concerned with their needs and looking good to John Q. Public. They have no idea, no ideas, no plan and no strategy but most of all no concept of the looming difficulties and why they’ll be so complex. The energy safety and security of this continent is not something that can be fooled around with. It is reasonably evident that these bureaucrats are satisfied with themselves. They haven’t done anything for over a decade now and should be happy. Please note, within the Preliminary Specification there is the Resource Marketplace module that provides the means in which to establish the methods necessary to rebuild these markets in the secondary industries that the oil and gas producers will need and to move the industry forward.

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. And don’t forget to join our network on Parler @piobiz, anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.