These Are Not the Earnings We're Looking For, Part LVII

The one thing that I’m at a loss to find in these third quarter 2020 reports is an excuse, any blaming of others or viable scapegoats being raised as to who is responsible for the difficulties these producers are facing. They must have taken my advice, looked at themselves in the mirror and realized it was they themselves that were responsible for all of their own problems. We can understand that they’re not going to be the ones who’ll be standing up to say they're the ones that are responsible. Therefore best to be quiet about it all. And then just like that the industry shifts again. This time in a sea of red ink we have them pursue the lofty goals of renewable energy and carbon neutrality. That is in a post consolidated industry. Bigger, more bureaucratic is always better! It’s now not the oil and gas industry but what we can now call one of two possibilities. Either the Lost Cause Business, or the Politically Correct Sycophants. I of course am partial to both and will use either from time to time. Responsibility was never a requirement to be recognized or upheld by the C Suite or board of directors. Think of these people more as the politicians of the industry, formerly known as oil and gas.

These cover stories for the destruction that happened on their watch will not fly. What’s the plan, where’s the strategy? Have any of these bureaucrats uttered the word “real” in combination with the word “profits” ever? These are the visions of how they’ll move forward, get out of oil and gas, focus on clean energy and carbon neutrality? How and with what? These are crippled organizations with little to no life remaining.

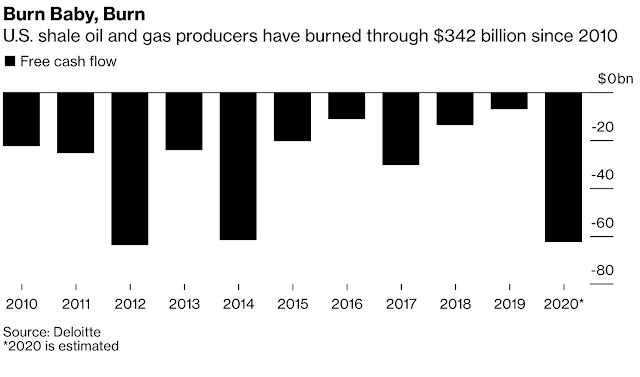

Does anyone remember how bad it was in 2016. Our sample of producers had losses for the entire year of $30.2 billion. We were assured by these same bureaucrats that they then had things in hand and would be on the upswing. So far in 2020 these producers have now created $56.8 billion in losses. I say created because that is what they do, lose money that was entrusted to them and they promised to be responsible for. Our sample represents one third of the productive capacity of North America therefore it's reasonable to assume that the industry's losses would be approximately three times that value. Let’s be fair to these bureaucrats and note that the pandemic has caused a significant distortion in the market. Creating a demand loss that further destroyed commodity prices. Therefore their write downs of property, plant and equipment due to the ceiling test were substantial. If we reversed the recorded depletion for 2020 of $84.8 billion we see that without having to account for the capital aspect of the business bureaucrats would have reported a specious profit as high as $28 billion! Which of course as People, Ideas & Objects have always claimed that would also represent a return of $84.5 billion of the previously invested cash that investors “had to put in the ground.” However, as our good friends these bureaucrats have been able to do their thing with this money, the amount of cash actually generated by the third quarter of 2020 is negative $3.6 billion. The key here at this point was that in the past there were always more ready and willing investors lined up out the door of every producer to make up the cash difference. As we’ve always said the consumers, who have as a result of these bureaucrats methods, had their consumption of oil and gas subsidized by having the investors paying for the capital costs of that consumption. The value of that subsidy is handsomely represented and accounted for as property, plant and equipment on the producers balance sheets. Yet consumers have no understanding of the fact they’ve been subsidized and no appreciation for the value of the commodity that they use to fuel their highly productive lives. To be as clear as I can. Producers would need to increase their revenues of $110.925 billion in the third quarter of 2020 by at least the $84.8 billion of recorded depletion in order to generate the cash from these assets. Revenues of $195.72 are what are necessary to pass on the “current” costs of oil and gas exploration and production. Making oil and gas a business for the first time that I’ve been involved in it.

When I raised these points in the past I was laughed at. This is certainly not in the realm of any analysis of what companies or analysts conduct. This is just crude checkbook balancing in a way. You have this much coming in and that much going out. In 2020 these producers were able to source $7.519 billion in additional debt. And they paid out a dividend of $7.515 billion. Just crude checkbook balancing, what’s in, what’s out. Cutting dividend payments will continue due to the fact that banks are making these transactions more difficult. When the laughing in the past subsided I would be lectured that “those costs of depletion were not real and are just accounting adjustments.” I would argue they represent the retirement of the assets and the producers prior investors resources. And they would state “those are all sunk costs and we don’t concern ourselves with them.” They would then turn around and state these same things to new investors who were prepared to pay next year's capital budget. Eventually their investors understood the meaning of what the bureaucrats were talking about.

The pandemic can cause a company to look at their depletion and say these are exceptional times and we have to survive them and those losses due to depletion are the consequences of these bad times. Then how is it that these producer bureaucrats have been using this same excuse for decades when they were able to line up investors annually due to the fevered excitement and “good” times they created with their specious reports and filings. Without the annual investor infusion they would not have been able to survive. For evidence of this, review the past five years when the investors have slowly withheld all of their funds from the producers. Working capital as of the third quarter of 2020 is $12.6 billion for all of our sample companies that also list total assets of $520.5 billion. Liquid assets are 2.43% of all assets and they think they’re building balance sheets? Total shareholders equity as of the third quarter of 2019 was $295.4 billion and is now $193.2 billion. Clearly I have no idea what building a balance sheet involves, what it is or how to do it. I don’t know it when I see it and who would have it. Losing $102.2 billion in equity in one year is the end result of building these balance sheets? If anyone is with the bureaucrats in this exercise then I’ll remain on the outside. I’ve always stated that I don’t have to be crazy to do my job, but I find it to be a distinct competitive advantage. I’m beginning to question who’s crazy here.

People, Ideas & Objects believe that over 65% of property, plant and equipment should be restated on a pro-forma basis in order to understand the full scope of the damage that has been done here. This would represent the capital costs of past production that has not been recognized by the specious accounting conducted in industry on a culturally systemic basis. This is due to the fact that overhead and interest are recorded as capital at very high percentages, and lastly we believe that a redefinition of what is capital and what is not needs to be ascertained in the new shale era. These in combination with the desire to “build balance sheets” has caused producers to systemically demand investors to fuel their capital needs as opposed to having the business generate the financial resources internally. With the state of affairs in the industry the only source of funding in this capital intensive industry is to recognize these capital costs stored in property, plant and equipment, ensure that the prices that producers receive for their production covers all of the cost of exploration and production which will provide them with the financial resources needed to proceed in what is agreed to be a very difficult future. Investors and banks are bowing out due to the well earned reputation of the bureaucrats. The only remedy is through the Preliminary Specifications decentralized production models price maker strategy. Once again to clarify my point. I would include a large portion of the 65% of these assets from the pro-forma adjustment to also be included in the current periods costs of exploration and production. Therefore the revenues needed would be $195.72 billion plus a good portion of those property, plant and equipment assets that would otherwise fall within the 65% pro-forma adjustment.

What I see is that producers in 2020 are not making up for any of the value that they’re consuming in the process of exploration and production. It is just a more severe example of what I’ve seen in each year of the past four decades. They’ve eroded all sense of value from the producer firms themselves in order for the chosen few within the company, those that had the responsibility and authority to do otherwise, to prosper personally and extensively. It is evident at this point that none of these bureaucrats are feeling any shame for what they’ve done as they all remain at their post and continue to reap what others have sown.

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. And don’t forget to join our network on Parler @piobiz, anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.