How Producer Bureaucrats Overstate Cash Flow, Part IV

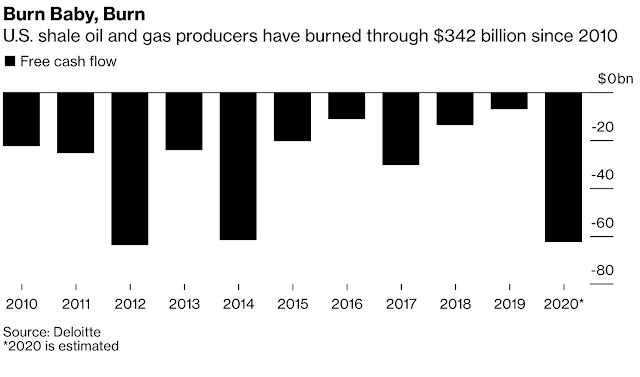

Bloomberg reports that “Energy has slumped to less than 2% of the S&P 500 Index, down from more than 11% a decade ago, even as the wider market rose to record levels.” Reflecting the reported earnings and cash flow of the producers has been questioned by more than just People, Ideas & Objects! Those that have been responsible for this destruction have proven many things during this past decade. They have a litany of excuses, blaming and viable scapegoats in which to draw upon. Executive compensation has never been better. “Muddle along” and “do nothing” are now proven to be viable strategies, when they're focused on the “right” personal objectives. Will it be for these reasons that investors will turn to these producer bureaucrats, who were in control of the firms during this era of destruction, to move them back to the 11% of the S&P they once knew. Well actually no, it won’t be. Why would you place your bet on a field mouse in the Kentucky Derby?

People, Ideas & Objects noted in our White Paper “Profitable North American Energy Independence -- Through the Commercialization of Shale” that there has been a distinct trend in the industry over the past number of decades. It is also evident in the litany of excuses that are used by all producers singing in harmony from the same hymn sheets. The trend is what I have referred to as the “Keystone Kops.” This first showed itself in Canada during the late 1990’s when “SAGD” (Steam Assisted Gravity Drainage) was suddenly all the rage. Soon it moved on to heavy oil in any of its forms. If you weren't into these assets you weren't in the oil and gas business. Producers would shift their investments overnight into the “next thing” and make the announcement. This trend moved on to unconventional natural gas and then from there… The rest is history just as pretty much most of the industry is. Today the Kops have a new calling and its consolidation. If you’re not merging with someone this month you’ll be the one left out, as in the game of musical chairs. Shotgun weddings are being arranged every day it seems. This is the future of the oil and gas industry. The great, innovative, creative and intelligent minds of the producer bureaucrats have all received the same precinct alarm telling them to merge or die. They know and understand the math, it's one decimated and financially crippled producer plus another equals the super hero they know they can be. When you’re on the verge of drowning the worst thing you can do is start holding on to someone else. You’ll find that was your final, fatal act.

The purpose of these consolidations is to provide synergies between the two firms assets administration. Or in other words they can cut overhead further. When did overhead become an issue in oil and gas? It seems that the Preliminary Specifications ability to make all of the producers' costs variable, and particularly the overhead costs of administration and accounting, based on production, is not understood by the producer bureaucrats. Or they have no desire to learn. It will be interesting to see what the outcome of these mergers will be in terms of their accounting treatment. The focus of building balance sheets may be ending as the bloated values of those producers that are acquired may be written down to their market value at the acquisition date. No such luck on writing down the debt though. This will be further evidence of the Keystone Kops type of management. Not knowing fully the implications of their actions. I guess this is why muddling along and doing nothing was always so attractive.

Regarding the Preliminary Specification we’ve also heard from these bureaucrats that “there is no issue, they have it under control and their plans and vision on how to remedy everything are beginning to be prepared now.” In 2025 they’re promising you’ll be impressed. I just checked, the first document I published regarding the use of the Joint Operating Committee was the Preliminary Research Report in May 2004. I started writing this blog in December 2005. After 2,906 blog posts; all to do with the use of the Joint Operating Committee and the research associated with how the producer and industry would use that innovative organizational construct in order to provide the most profitable means of oil and gas operations. Just as Qatar’s Oil Minister Mana Saeed Oteiba saw and warned of the dire consequences to the North American producers business as far back as July 26, 1986. Both OPEC and People, Ideas & Objects have tried to work with these bureaucrats to avoid this outcome. Maybe I should add the producers’ investors to our little group as I’m sure they’ve had some disagreements with the way things have been moving these past years. I think I now agree with the bureaucrats, they do have bigger issues to deal with, but those would have to be classified as personal issues. What I can assure my readers is that I was in no way part of this disaster. Once I published the Preliminary Research Report that was it for me. I was clientless and in retrospect it seemed like it was almost overnight. Which means I’ve earned no revenue from these producer bureaucrats who see nothing but threats of disintermediation and I’ve done no work for oil and gas outside of this project since May 2004. I therefore have clean hands, as they say, but probably could use a manicure.

Back in the 1980’s interest rates were designed to punish and destroy anyone who came within a 100 yards of a bank. Topping out at over 20% for most loans it was no time to be in debt. Therefore the motivation for producers to “innovate” on the basis of capitalizing more costs to property, plant and equipment. As with all innovations of such characteristic the tradition across the industry became an inherent part of its culture that continues today. It’s interesting to note that since we began questioning the validity of capitalizing interest, these types of adjustments to property, plant and equipment have become more transparent in the producers financial statements. The percentage of interest that is capitalized appears to also have been scaled back. Overhead however has achieved no such transparency and nothing has been scaled back there I can assure you.

In almost all cases I was able to determine what the producer incurred in terms of interest from the financial statements. Many only show the net interest costs after the capitalization and netting of any earned interest income. I was only interested in the gross interest paid. Today with interest rates falling into the negligible category this “feature” of capitalizing interest has become less of an issue. Possibly the reason for the transparency and the scaling back of the amount of capitalization. Nonetheless the amount of interest recorded by our sample of producers in 2019 was $7.8 billion. If we add accounts payable, deferred liabilities and bank debt of $338.3 billion we see the producers incurred a total interest cost of 2.31%. Basing these interest costs just on the bank debt of $152.4 billion the interest rate is 5.13%. Which is inline with the expectations of the investment community for a producer to be paying in terms of an interest rate. However, I know that interest is not just charged on the bank debt. The producers are successful in general not paying any interest on the accounts payable debts owed to their suppliers. There are times in which they are unable to avoid the paying of interest on debts other than their bank debts. These costs are fought with a fierceness that is rarely seen in bureaucrats. Increased charges for interest will set one's career off in another trajectory. They are generally avoided.

Capitalization of interest follows the same route as the overhead costs we’ve documented earlier in this series. Initially overstating assets and earnings are well understood and the follow on consequences of these over reported earnings is they become excessively attractive to investors which eventually leads to chronic overproduction and unprofitability. The interest cost deferrals in this process are substantially higher than the amount of interest that would be deemed to have been included in depletion. If we take a non-GAAP measure of the total capital expenditures and divide it by the amount of depletion for that year we come up with a figure indicating the number of years it would take to deplete the remainder of the balance holding all things equal. A situation that would never occur. What we do see by calculating this amount over time is that in 2016 it was 6.18 times, 2017 is 6.74 times, 2018 is 7.71 times and 2019 is 8.01 times. A number that never quite seems to be lower than the prior year. In specific cases producers can have this factor as high as 26 times. There is a constant growth in the amount of property, plant and equipment due to the fact that rarely is depletion larger than capital expenditures, and sometimes materially so. This “leakage” or “slippage” is the differential of what is imputed for depletion for overhead and interest, vs the actual overhead, interest and what we’ll be discussing tomorrow that occurs in the fiscal year that is capitalized. It is this leakage or slippage that I suggest is material and as a result overstates cash flow in addition to the earnings and assets.

Professional accounting firms have never heard of anything so comical in the business world before. The deficient level of sophistication in my analysis is wanting and I agree with them that it is not within their understanding of what is appropriate accounting, its analysis. We do however need to keep in mind that it is these Professional accounting firms that have been signing off on the financial statements of these producers for the past four decades. I therefore question their motives in their alleged criticism of my analysis. The point I would like to make is that 8.01 in 2019 minus 6.18 at the end of 2016 reflects 1.83 years of capital expenditures having been increased over the course of those 3 years (2017 - 2019) over depletion. Showing the leakage or slippage here is in effect for a three year increase of $183 billion in capital expenditures. Therefore our factor of 1.83/3.0 = .61 shows that $111.63 in capital expenditures qualifies as the leakage or slippage that we’re discussing. Go big or go home should be the motto of the oil and gas industry bureaucrats.

The producers will claim they have the reserves to back up their property, plant and equipment. Those values are not prepared by the company but by independent reserves engineering firms. Using industry standard engineering principles. I am in no way suggesting that is inappropriate. What I am suggesting is that accounting is about performance and not valuation. The competitive producer would want to ensure that their sales were cost appropriately to ensure that their assets, profits and cash flow were stated on the basis that they were real and could be relied upon. Not “build balance sheets” for whatever reason. What we can clearly see now in the decimated landscape of North American oil and gas is that the investors have been paying for the capital costs and the consumers only ever paid for the operating expenses. For evidence of all this, just look at the balance sheet of any producer and note that the only thing that sticks out is that property, plant and equipment might have been transplanted from another company. They are disproportionately, in material ways, weighted to long term assets, negative working capital, heavily in debt particularly from the point of view of leverage if we adjust for the “bloated” aspect of property, plant and equipment. And shareholders equity is a comedy routine. We recommend a pro forma adjustment be made to move 65% of any producers property, plant and equipment account directly to retained earnings. That will provide readers with a better understanding of the situation of any North American oil and gas producer.

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. And don’t forget to join our network on Twitter @piobiz, anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.