How Producer Bureaucrats Overstate Cash Flow, Part III

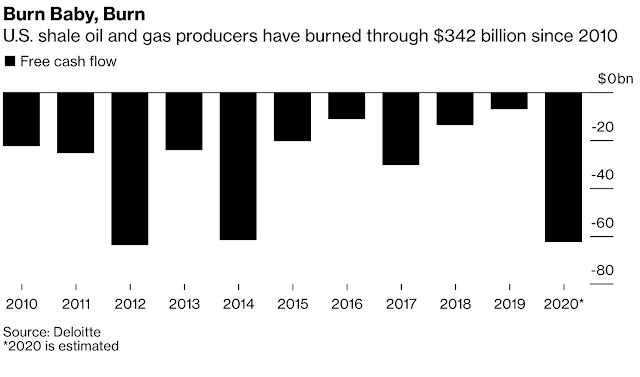

What producers fail to account for is the impact that shale has had on their business. Oil and gas is a business that we could all agree, I would think, is suffering as a result of an abundance of unprofitable production. And as I’ve documented in this blog, throughout the Preliminary Specification and in last year's White Paper, a business that has been suffering from a cultural propensity to produce everything, everywhere and always. With no idea, no understanding and no regard to the performance of the property. The business model of the oil and gas business has been in jeopardy since at least July 26, 1986 (newpapers.com) where we’ve noted The Calgary Herald on that day documented the effects of the oil war OPEC had declared on mostly North American producers. This article oddly reads as if it were written for today, and in my opinion, the issue we have been dealing with every day since. We have defined overproduction as unprofitable production as that is what it is. Throwing the prolific nature of shale reserves on top of this business model, a model that was suffering from a lack of performance for many decades. Only proves there is no future for anyone outside of the chosen few who have taken control of the oil and gas producers themselves. If overproduction is the chronic issue underlying the steep downward trajectory that we’ve been on these past 34 years, shale bends that curve further and accelerates the destruction of the oil and gas industry and all those associated with it. It is therefore inevitable that the demise of the industry is within the current foreseeable future. Unless there is a fair and equitable method of production allocation such as the Preliminary Specifications choice of profitability, based on a standardized accounting of the properties performance. We will be riding this downward trajectory to the point where North American supply falls into jeopardy. Only People, Ideas & Objects provide a fair and equitable method of production allocation through our decentralized production model’s price maker strategy.

“My assets are bigger than yours!” says one bureaucrat, “Oh yeah,!” says the other.

And that is in essence how we got into this mess. The desire to have the producers' balance sheet bigger than anyone else's. The purpose was to ensure the CEO’s could strut down mainstreet. That eventually became the sole purpose of the industry and we see that today parroted by these same CEO’s when they state they have to “build their balance sheets.” Apple’s objective is to “make insanely great products.” Chick-fil-A's core values comprise “customer first, personal excellence, continuous improvement, working together, and stewardship.” The slogan "Moving at the speed of business" referred to the swift delivery of packages but also described the rapid manner in which UPS continually adapted to the changing needs of its business customers. These last two examples are provided by Google. We see in these examples that all businesses have a corporate objective focused on providing something of value to their customers. Each one is different and are as unique from all others as one could possibly imagine. Yet the entire oil and gas industry is consumed by the corporate objective of “building balance sheets.” Even I can come up with a better one than that. People, Ideas & Objects provide oil and gas producers with the most profitable means of oil and gas operations. It’s not that hard after all.

With the comprehensive industry adoption of this “objective” firmly in place the “need” to increase the balance sheet to the highest level that could be attained became the only competition in the industry. The calling of “having to put cash in the ground” and other such nonsense was derivative of it. This “need” then settled in for the long term to become the comprehensive culture that now consumes the industry. Does anyone wonder how it is that oil and gas is suffering through a catastrophic depression, or is it just a collapse, and nothing is ever done other than to blame others, and of course build balance sheets. When it comes to running an oil and gas business the only thing producers need to be able to do is to prepare a budget, then spend it. That’s it, and that is why there is no business understanding or knowledge being applied anywhere that I can see. Only clinging on to the overall corporate objective of “build the balance sheet” augmented by today’s “protect our balance sheet.” The Preliminary Specification, our user community and their service provider organizations are able to provide an alternative. A corporate objective that is worthy of the people who work in oil and gas companies, the service industry and all the associated businesses that support them. Our focus on profits everywhere and always has been laughed at, ostracized and ignored for the past decades by those who drove the industry into the ground for what they could gain in terms of unearned personal financial compensation. We don’t need those that have caused so much destruction. We need to begin the redevelopment process of rebuilding the industry brick by brick and stick by stick in the vision of the Preliminary Specification.

Overhead is capitalized at high percentages across the North American oil and gas industry. And when we talk about overhead we’re discussing any and all of it including the receptionist time, the phone service and the Post-it-Notes that are used. All of the producers overhead costs are adjusted to the tune of 85% on average, in one accounting entry to property, plant and equipment. The accounting principle behind this is that producers should include costs that are involved in putting the asset in place and operational. Which these overhead costs would certainly qualify. And that is what oil and gas companies do. Without consideration of any other factor and to the exclusion of all else. But why, and is that the best way? Has never been asked. What would be the most competitive posture of the producer firm? Have the producer cost product sales with the appropriate costs when almost all of the overhead is deferred in this manner? Where will the cash come from, or float, to pay next month's overhead if they’re not included in the commodity prices that producers charge consumers? The search for the Holy Grail in oil and gas is to have the asset value in property, plant and equipment resonate with the value represented in the reserve report. Why? This is defined by the SEC as the outer limit of what is acceptable for a producer to report on their financial statements. I don’t think this was set out as an objective for each producer to attain each and every year. The claim “you have to put cash in the ground” which our good friends the bureaucrats sang in harmony to the investment community these past few years shows the obscenity that oil and gas has become.

Once they’ve achieved bureaucratic nirvana the world becomes their oyster. Not only are they a god at the local Ferrari dealership they’re able to control the variables like no one else before. Producer bureaucrats proudly claim they’re able to know the market supply situation throughout the globe. Using Artificial Intelligence and satellite imagery they’re able to determine the volume of oil in floating roof storage around the world. They’re then able to predict the market response and the future pricing of commodities. What I don’t understand is why they weren't able to anticipate the market prices turning negative in April 2020. Or didn’t see the buildup in inventories responsible for the overall decline in prices since 2014. When they have a ready supply of unlimited cash provided at no cost to the bureaucrat or producer, other than a larger number of shares outstanding each year. Producers become a spending machine that loses perspective of what is and isn’t valuable. The only thing that the Preliminary Specification looks to is if the property is profitable based on the price received and using a reasonable accounting of all of the costs of the operation. Here the price received is providing all the information that is needed to be known regarding the world supply and demand of oil. A property is or is not profitable, then act accordingly as the Preliminary Specification provides. Markets inform us of one thing and only one thing, information in the form of its price. Producers contrive great science experiments with other people's money for reasons that could never be justified as part of the business. Just imagine with today’s technologies what else they’ve got going and are thinking about?

When producers have a willing and engaged investment community buying the financial statements that showed profits and cash flow throughout the industry, investors followed. But it wasn’t real. The specious nature of the numbers has always been difficult for me to understand who was winning and who was losing. It looked to me as if anyone involved in the business was spending money lavishly in year one, all to have it go egg shaped by year three. If asked about the money that was spent last year or the year before that, investors received the same commentary that those were all “sunk costs.” There was never any accountability anywhere for any of the prior spending. The point I’m getting at is the industry has lost the ability to fundamentally understand that financial statements are to record performance, not replicate value. A producer that is performing at a high level would want to reduce their capital costs by recognizing them quickly, if commodity prices enabled them to. A producer with zero capital costs would be seen as the high performer that they are. They’ve paid for all their costs. They would then continue to be profitable at reasonable prices. All of the earnings that are achieved will be returned to the producer in the form of cash that will fuel growth in future earnings, and get this, without having to dilute the shareholder base at any time in the next decade! In fact producers could dividend out the proceeds of these earnings and still have their capital budget funded. And if executives decided to buy shares, think of their motivation and compensation. It might actually be productive! This is me thinking of sugar plums and such again with this scenario being the polar opposite of the current industry operations. Somewhere between would be the scatterplot of performance achieved by each producer. Something that the financial statements would reflect, the hero’s and the zero’s. Today financial statements are homogenous between all the producers. Those that retired their capital costs would also have higher volumes of short term assets having traded property, plant and equipment for... cash.

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. And don’t forget to join our network on Twitter @piobiz, anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.