People, Ideas & Objects et al need to worry about the startup to junior sector as much as any other classification within the industry. And we provide them with the most cost effective solution possible. This is purely because of the fact that the industry’s rebuilding will be done on an innovative basis. Innovation is the basis of the Preliminary Specification. It enables People, Ideas & Objects, our user community and their service providers to achieve our two opposing objectives of providing oil & gas producers with the most profitable means of oil & gas operations everywhere and always, and providing consumers with the lowest possible cost of an abundant and reliable domestic energy supply. With our decentralized production model and price maker strategy, we ensure that all production is profitable. Including Exxon's, Shell’s and that startup oil & gas firm that began this morning. And to do so innovatively to ensure that the ever escalating costs of oil & gas remain affordable to consumers. In addition, the commodities production profile and reserves continue to expand. Achieving profitable North American energy independence.

Enter two variables not available in prior decades and centuries. The cloud computing era coincides with the maturation of the overall technological infrastructure represented by the Internet. We are in the infancy of the Internet. Second, there is the "service" aspect of our user communities' service providers. We found that the level of innovation attributable to the small and medium sectors of an industry was as substantial as the larger sectors. Although the larger sectors contributed large amounts in terms of total expenditures, their impact was no greater than that of what the other sectors contributed. People, Ideas & Objects et al provides our solution for all sectors of the North American oil & gas industry and for all producers. Professor Giovanni Dosi was one of the key sources of research we used to determine the framework necessary for an innovative oil & gas industry. Innovation within a science and engineering-based business is therefore an inherent part of both profitable operations and consumer affordability. Professor Dosi’s paper “Sources, Procedures, and Microeconomic Effects of Innovation” September 1988, discusses and asks what are “the sources of innovations opportunities, what are the roles of markets in allocating resources to the exploration of these opportunities”?

People, Ideas & Objects research in oil & gas focused on these points:

The main characteristics of the innovation process.

- The factors that are conducive to or hinder the development of new processes of production and new products.

- The processes that determine the selection of particular innovations and their effects on industrial structures. (p. 1121).

According to Professor Dosi, there are two major issues that need to be addressed:

- The first issue is the characterization in general of the innovative process.

- And second, the interpretation of the factors that account for observed differences in the modes of innovative search and in the rates of innovation between different sectors and firms, and over time. (p. 1121).

Professor Dosi then states that:

Typically, the search, development and adoption of new processes and products in market economies are the outcome of the interaction between:

- (a) Capabilities and stimuli generated with each firm and within the industry of which they compete. (p. 1121).

The purpose of People, Ideas & Objects research in oil & gas focused on the organizational capability and capacities of the producer firm. Specifically in the earth science and engineering disciplines. It was also emphasized that innovations are based on both the firm and the industry. Coordination of the capabilities and stimuli of both the firm and the industry would therefore need to be advanced through changes in the organizational structure of both.

- (b) Broader causes external to the individual industries, such as the state of science in different branches, the facilities for the communication of knowledge, the supply of technical capabilities, skills, engineers, and so on; (p. 1121).

Additional issues include

- (c) The conditions controlling occupational and geo-graphical mobility and or consumer promptness / resistance to change, market conditions, financial facilities and capabilities and the criteria used to allocate funds. Microeconomic trends in the effects on changes in relative prices of inputs and outputs, including public policy. (regulations, tax codes, patent and trademark laws and public procurement.) (p. 1121)

People, Ideas & Objects propose that innovation represents a critical Organizational Construct which compels organizations to either flounder or flourish. Innovation serves not only as an Organizational Construct in its own right but also, as we have defined in the context of the Joint Operating Committee, it is one of the seven key frameworks of this construct. From this perspective, innovation is seen as a defined and replicable process, which can be systematically established through thoughtful organizational design. Crucial to this design is the integration of ERP software, tailored to identify and support the specific needs of the organization and its industry. In the 21st century, innovative organizations are fundamentally reliant on such ERP software systems. The Preliminary Specification lays the groundwork for these innovative producers. It is up to the competitive nature of the officers and directors to harness their innovative potential, coordinating their earth science & engineering capacities and capabilities effectively.

Our second source of primary research material regarding innovation came from Professor Richard N. Langlois. Throughout our review of his work we determined the appropriate nature of the organizational design of the producer firm and the oil & gas industry itself. Selecting specific areas of the firm or market where the process and its management should be. Where capabilities should reside. By fully implementing the Internet and using Professor Langlois' research, which included Professor Carliss Baldwin's determination of where exactly that transfer between firm and market should occur. We designed the appropriate software tools, such as our task and transfer system. This will enable our user community to define which processes to undertake and manage in their service provider operations. Introducing enhanced efficiency in oil & gas administration and accounting.

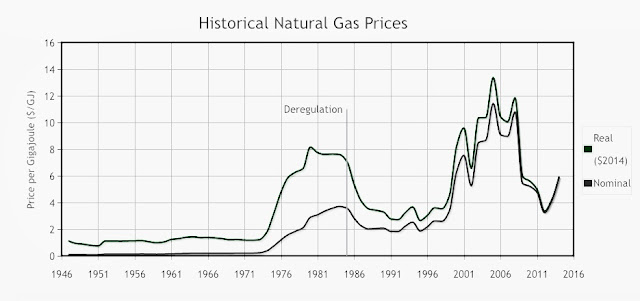

Building on other innovations that provide value generation such as cloud computing. People, Ideas & Objects, our user community and service provider organizations can accomplish this through the introduction of Cloud Administration & Accounting for Oil & Gas. A service that turns the fixed producer overhead into a variable industry-based overhead that can be provided to any producer no matter what their size or production profile. It is possible for producers to shut-in unprofitable production and produce only profitable properties, increasing shareholder value as a result. A substantial portion of our published value proposition of $25.7 to $45.7 trillion over the next 25 years is attributable to introducing this production discipline. This is to eliminate the known $4 trillion in damage and destruction caused by overproduction in natural gas since 2007.

The Preliminary Specification has captured this understanding of innovation and incorporated it within the culture of the industry we are rebuilding in these Organizational Constructs. It is also part of the Joint Operating Committees innovation framework. Each of the fourteen modules of the Preliminary Specification is materially affected when we identify the Joint Operating Committee as the key Organizational Construct. Which provided us with an opportunity to incorporate this understanding of innovation into the design and reorganization of the oil & gas producer firm and industry. These can be identified by several major processes of innovation within the Preliminary Specification. One of these ensures that failed innovations and experiments, and their underlying processes are not repeated in separate and distinct areas of the organization each year. Using the same failed “ideas” repeatedly is not innovation. Another major process of innovation is to enhance the scientific basis of producer firms and the industry as a whole. Moving forward on the basis that an idea that generates a dollar today will only produce ten cents tomorrow. We therefore must increase the volume of ideas generated and incorporated into our work processes to continue increasing our value. Various other innovation processes have been incorporated throughout the Preliminary Specification based on primary research conducted by Professors Giovanni Dosi and Richard N. Langlois. Enabling producers to earn the unquantifiable value that needs to occur throughout each producer firm and all tiers of the oil & gas industry in the decades to come. Value that will need to fund the innovation for tomorrow.

Oracle Cloud Infrastructure (OCI)

Continuing our discussion regarding the recent Oracle CloudWorld 2022 & 2023 conferences. Producers can generate incremental and continuing value from enhanced innovation through the development and implementation of the Preliminary Specification. Oracle’s products are the premier technologies in database systems development and their ERP systems are the base of the Preliminary Specification. Oracle is now partnering with service providers to enhance their products with a variety of services in order to bring about the innovation-based benefits we have discussed throughout the Preliminary Specification. Theirs will be in the domain of generic business processes such as banking etc, or the non-oil & gas specific processes that we handle through the 14 modules of the Preliminary Specification.

Our proposed combination of Oracle Cloud ERP, People, Ideas & Objects, our user community and their service provider organizations are designed to deliver the foundation in which the producers, the oil & gas industry and all the tertiary industries can succeed in the 21st century. Without these facilities and capabilities the question we would ask is how will the industry “muddle through” so many of these issues and opportunities otherwise?

Since Oracle’s beginning they have pioneered the development of their technologies to be the premier tier 1 provider in all categories of their offerings. Oracle has been a critical and essential innovator in each of their products and markets. They continue today with products such as Oracle Cloud ERP and Oracle Cloud Infrastructure that continue that heritage. Recently with the Oracle CloudWorld 2022 conference we saw an innovative direction beginning with their development of service providers to augment their products. These enhanced products and services bring tremendous incremental value to oil & gas users. And are consistent with the work People, Ideas & Objects has undertaken on behalf of North American producers.

Innovation throughout the business and industry specific process management, built upon the premier tier 1 Oracle products. This augments the dynamic, innovative, accountable and profitable nature of what is demanded of North American oil & gas producers. This is not a static environment. It will be through our user community and their service providers that producers will be able to interact with all aspects of business and industry specific process management. To make changes, innovate and develop these further which is an inherent part of People, Ideas & Objects and our user communities permanent software development capability. But there’s more.

A production configuration oriented toward this innovation Organizational Construct. With the Joint Operating Committee, that Organizational Construct holds innovation as one of its seven frameworks. Not only oil & gas producers, but the entire oil & gas industry and its tertiary industries and supporting institutions will be culturally aligned and oriented through Oracle Cloud ERP and People, Ideas & Objects Preliminary Specification towards innovation in the earth science and engineering disciplines. Providing the means to rebuild the industry in this configuration with software that defines and supports these objectives. Where the industry's approach to its next 25 years can be the most dynamic, innovative, accountable and profitable in its history. A future that is the most demanding, challenging and exciting in its history.