People, Ideas & Objects Tactical and Strategic Changes, Part II

In this the second part of a series defining the revised tactics and strategies for People, Ideas & Objects to ensure that the oil and gas industry will transition to the dynamic, innovative, accountable and profitable producer and industry we all need it to be. Patience has been applied, we’ve attempted to work with the bureaucrats, we might have said some things that offended them but so what, and even held out that we could be their best friend in light of the fact that they’re now in such legal jeopardy by not upholding their fiduciary duties. Using our car analogy to reflect the difficulties in oil and gas. The analogy being the car that was trailing oil for the past few miles, began steaming and then lost power. Parked at the side of the road, the owner tried to resurrect the forward momentum by using the battery to turn it over, which lasted about an hour. For purposes of this analogy that was approximately equivalent to the year 2015 in the oil and gas industry. It’s been seven days since the vehicle's breakdown and the owner's family are finding it more and more difficult to find the food and water they need to survive. They have the viable scapegoats of it being too hot and too far to travel to the next town and of course there is no reception. An aggravating factor is they’ve all had the flu this past week. Cars continue to pass on the highway but no one stops and even tow trucks looking for people to save, just pass them by. This family is hopeless and helpless and no one will stop or anything! This no doubt was OPEC’s fault. Other than muddle through there doesn’t seem all that much to do?

I could continue as the analogy to our good friends the bureaucrats never breaks down. “Muddling through” is a lifestyle choice that demands commitment. Just stay with the vehicle until someone rescues them. Conversely what do the producers expect to happen now? What’s their plan and will it work?

The good news for the producers is that their share values have been rallying handsomely over the past six months. The reason why is an interesting question that we’ll no doubt learn in a short period of time. The week of March 8, 2021 established itself as the high point for our sample of producer firms. Covid has had a detrimental impact on the industry and for that there is no doubt. With the vaccines distribution, relief from the lockdowns and the resumption of “normal'' coming back into focus. This however doesn’t create any benefit for the producers. And just as the impact of the virus is waning across the globe, relief from the flu provided the same effect for our family over the past week they’ve been stranded at the side of the road. It didn’t solve their problem.

Two of the kids in the back seat of the car decided they might be able to help their parents solve their problem and get them back on the road. One grabbed the playing cards while the other got hold of the checkbook. The first one, thinking that consolidation of assets was a good strategy, started distributing the cards in exchange for “assets” of the car. Representing each card as a share he started by buying the front seats and quickly moved on from there. The daughter began scribbling in the checkbook which caused a “feeding frenzy” between the kids as to who could consolidate the most assets the quickest. It soon turned out that the parents had acquired all the shares and junk bonds the kids distributed and ended up owning each part of the car that was sold. This provided the occupants of the vehicle with ample activity for the better part of each morning they were stranded. Eventually, in frustration the baby threw the cards and checks out the window on a windy day. Which began the kids' consideration of their next move in terms of financial engineering.

What to do next in oil and gas? It doesn’t seem to be a question that is being asked across the industry today. Drilling is picking up and that is consistent with the actions of the great science experiment that involves acquiring land, drilling and producing, rinse and repeat. Bureaucrats will argue that this is the business and belittle the argument that accounting performance has nothing to do with the reality of the value they produce once they access those valuable oil and gas reserves. It is here that the cultural standoff begins between those that are running the oil and gas producers and the “accountants,” as we’re called. “Accountants should do their job, pay the bills and get on the bus with everyone else.” We are told. That those involved in the science experiment have not conducted any activity in the past four decades on the basis of a competitive operation, where financial performance was a necessary and primary criteria, is not relevant to them. When accountants bring in depletion costs and impairments they’re “non-cash attributes.” Allowing bureaucrats to convince themselves they’re not real costs, “they’re history.” That these costs were incurred as a result of the money handed to them from their investors is not understood or appreciated, and to account for that spending is something they have not done and will never do as far as they’re concerned. That was never part of the plan and they foresee no reason to change any of this. Eventually, as far as they’re concerned, investors will return and the industry will resume its way’s once more. Comprehension that the reserves that are revealed are useless and valueless if they’re consistently produced unprofitably is something that will not, and can not be heard or understood by bureaucrats.

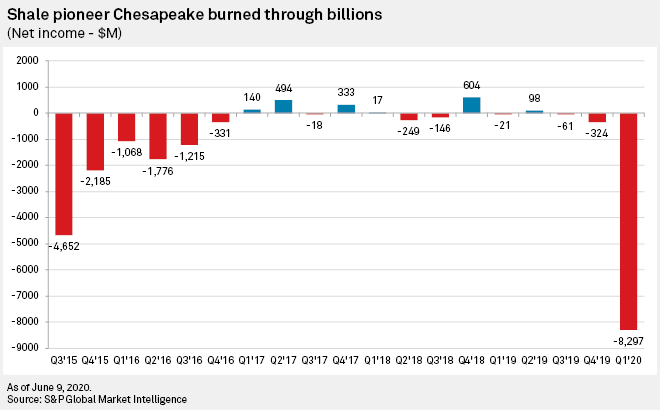

Let’s have a look at that plan and see how things are in terms of supporting it financially. During times of crisis it is considered prudent to survive in the extreme short term and to do so by not considering the cost of capital in the thinking of what is “financial performance.” The issue with oil and gas is that this is how the industry has been operated for the past four decades. Capitalizing every possible cost that is incurred by the producer and only recognizing the share of capital costs of production in relation to an allocation to the entire reserves base. Leaving as People, Ideas & Objects suggests an inordinate amount of property, plant and equipment on the balance sheet. This amount is in stark contrast to all other aspects of the financial statements and appears as a distorted figure that is not representative of the firm. We believe that it should be regarded as the unrecognized capital costs of past production. Therefore the industry has been operating in somewhat of a crisis mode by never recognizing the appropriate level of capital cost in the commodity prices it passes on to consumers. Instead storing these capital costs on the balance sheet on the basis of “building balance sheets” and “putting cash in the ground” as key corporate objectives. Producers now stand with distorted balance sheets that have become representative of the major issue in oil and gas. That being over reported assets beget equal amounts of over reported profits. Which attracts a disproportionate amount of investors creating over investment in the industry and subsequently suffering as a result of overcapacity and overproduction. In commodities that are price makers, such as oil and gas this overproduction has led to unprofitable prices being realized for 28 of the past 35 years.

The overhang of assets on property, plant and equipment became a critical audit issue in 2020 for the producers across the industry. Will it be the same for 2021, or how about 2022. How does the industry deal with the legacy of this past that distorts their performance and is more representative of a culture that feigns it doesn’t know or understand the difference? Does it continue to accelerate the depletion and impairment of its capital costs to bring it in line with the market's understanding of what property, plant and equipment is? Or should they await the results of the SEC investigation into Exxon’s overreported asset allegation and potential shale producer review. If they do finally recognize these capital costs of past production the account of property, plant and equipment will come into line with the expectations of reality and can be relied upon as a reliable gage of the producers performance. It however will also eliminate retained earnings in every existing producer, if there are any retained earnings remaining today, and in most cases create a negative equity situation where the debt of the producer is higher than the value represented in total assets. Which begs the question what do the banks think of this situation?

The majority of the producers would fall into the category of having debts larger than their assets once their unrecognized capital costs of past production are recognized appropriately. This alarms the banks and the regulators for two reasons. First the banks have clients whose leverage exceeds their lending criteria and demand that efforts be taken to remediate the accounts, write down the loans and seize their bank accounts in the most severe situations. More or less business as usual these past five years, only with a desperate sense of urgency on the banks behalf. The debts would then, and in some cases do so today, exceed the value of the reserves that are booked by the producer. Indicating to the bank their exposure exceeds what it is the producer would ever be able to generate and contribute towards the loan. I’m not a banker, but this may be a limit they’ll stop to think twice about crossing. When asked about these issues the bureaucrats will no doubt once again state that these are accounting issues and only represent “history.” Bureaucrats are correct about that however instead of calling it historical, I would suggest they think of it maybe in terms of legacy.

When questioned on the disproportionate valuation of property, plant and equipment the producer can make themselves a candidate for consolidation with another larger producer. This will restore the asset valuation as paper in the form of shares and Junk Bonds are passed about the oil and gas tycoons, much as the kids in the back seat did with the playing cards and checkbook. If they value the transaction for more than what the assets are listed at on the balance sheet, then those values will be what they’re recorded at in the consolidation process. Thankfully no one else in the world is interested in these assets otherwise the premium producers would have to pay would be so much higher. And to take the bureaucrats point of view this is all just accounting jibber jabber. The fact they’re spudding two wells next week in the Permian will be spectasmogorical.

Performance is the purpose of accounting. The timing and accuracy of all costs incurred is what is sought by accountants. Performance based on falsehoods such as the over capitalization of costs will provide substantial value to an organization in its early years. They will be attractive to investors and appear to be doing well. The reality is that they’re poorly managed and the representations being made are lies and falsehoods, much as the situation we have today in oil and gas. A misrepresentation built upon earlier misrepresentations that are attempted to be concealed by further misrepresentations in the form of consolidations, as the current flavor of the day. Oil and gas overproduction in North America has been with us since at least July 1986. People, Ideas & Objects Preliminary Specification has been available since December 2013. The alternative answer to these is consolidation? Just as our family that’ve been stranded at the side of the road are unaware why they have no help. They’re heading into another day and see their shortages of food and water coming to an end. What will they have to do, abandon their strategy of “muddle along” and get out of the car? Or will someone finally save them?

We should all thank OPEC. Recently they increased their productive output by 2 million barrels and have 5 - 6 million barrels of oil remaining to provide for our needs in the future. Relying on North American based producers for that deliverability in the long run is not going to be possible. Bureaucrats are unaware of the situation they’ve caused and are causing. They only concern themselves with their personal financial position. We can also thank OPEC for the stern warning in the article of The Calgary Herald of July 26, 1986. The one entitled “OPEC Minister Can See Economic Destruction” and “Return to Glory Days Unlikely.” They knew the results of what was being pursued in 1986 was not going to be productive and were concerned about it. It’s probably a good thing that North American producers were always so much “smarter and better than the OPEC Ministers” were in 1986 isn’t it? Is it that bureaucrats don’t listen, don’t do anything or both?

The issues are evident to most people that have an interest in oil and gas. The investors left in 2015 and I began gripping on this blog a decade before that. What is it that I know now, what is it that the investors are thinking and what do most people have to learn about the level of destruction that has been caused by these bureaucrats? I think one of the key takeaways has to be that shale will eliminate any opportunity for any boom or upside in oil and gas again. When prices begin rising the rapid increase from shale production is the immediate response. This has now become a market signal that soon additional production will be on the market and the price adjusts accordingly. Limiting any upside in the price of the commodities. This is known as an inherent part of the producers business model which is assumed not to be changing. Distractions in the form of bright shiny objects to occupy time, such as consolidation and the pursuit of clean energy will satisfy the media and environmentalists. No one will stand up and say anything to contrast the bureaucrats logic, only to be publicly persecuted, therefore nothing will change in terms of the bureaucrats actions.

The level of devastation that I see within oil and gas is more than what has been experienced in any other industry that I am aware of. It has been made possible by the large cash flows from being a capital intensive industry. These cash flows have enabled the bureaucrats to continue their methods of “management” and have proven they’re only interested in their own personal financial compensation. Diversion of these cash flows towards clean energy is only the most recent viable scapegoat that draws attention away from their performance. These diversions are not consistent with the oil and gas investors original intent in establishing these producers. I believe they should be stopped and let the bureaucrats pursue their clean energy dreams as startups and feel the rush of having no revenues to rely upon. People, Ideas & Objects will continue to hold them personally accountable for these actions and ensure that it is known that this issue was prevalent since 1986 or earlier, that our solution was available in the marketplace in December 2013 and producers have done everything in their power to avoid addressing either the issue or the solution, but also the continued destruction of the industry under their watch. If it appears as if this is a design feature of their system of self aggrandizement, you’d be 100% correct.

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. Anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.