Once Again, This Time With Feeling..., Part II

We have an unusual situation in oil and gas. It was during 2015 that the producers investors were frustrated with their performance and began progressively removing themselves and their involvement in the producer organizations. Investors leaving is a unique and rare occurrence that can happen in business. It reflects their ultimate message they can send to the officers and directors of the organizations they once believed in and supported. It says they no longer trust or expect anything of value from the organization and will seek opportunities elsewhere. A loss of faith such as this can be highly detrimental to a firm, as we’ve seen every producer being subject to difficulties of accessing capital since and their subsequent, absolute financial deterioration. It’s not that the investors have left permanently. They would return once changes were made to enhance the producers performance and improve what it was that disenfranchised their investors to leave. If producers were able to compete on the basis of capital markets expectations, then investors would return.

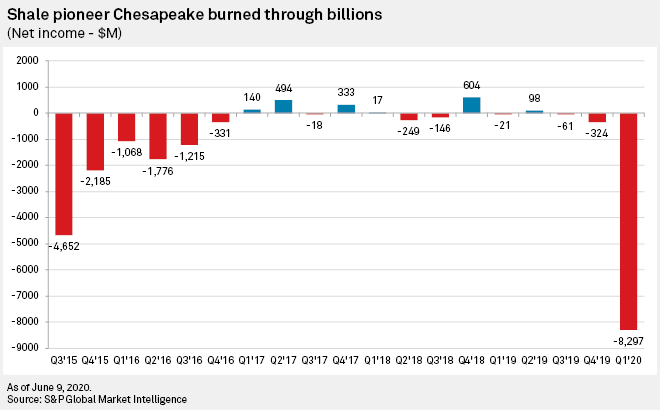

Today the bureaucrats expectation is that investors will be racing back into the industry to participate once again. After six years of doing absolutely nothing to remediate their behavior, accept or acknowledge their deficiencies and work on their issues, the red carpet has been rolled out for investors to return. It doesn’t seem to permeate the skin of the bureaucrats that this isn’t going to sell. Why would anyone want to return? People, Ideas & Objects have documented many of the reasons that the future of the industry will be more problematic than even the past couple of years. How the producers chronic mismanagement has caused serious financial jeopardy to all concerned. With seven ongoing unaddressed crises, a fistful of New Cost Structures worth trillions of dollars over the next 25 years. “Muddling through” and doing nothing is the best way to summarize the producers attitude and behavior regarding performance. It is not in the culture of the producer firms! What we discuss in today’s blog post is that the bureaucrats' message doesn’t just dance around the topic of performance, it avoids it.

I have said in the past, though I haven’t stated it recently. Why would anyone invest in an oil and gas firm with the characteristics of a wholesale lack of performance and cultural inability to focus on profitability. People, Ideas & Objects have been looking to build the solution to resolve the industries issues since December 2013. Providing the industry with the ability to produce profitably everywhere and always. Why is this such an issue? A solution with a $25.7 to $45.7 trillion dollar value proposition over the next 25 years. Does anyone doubt this value is attainable in comparison to how the industry is managed today? And what do we see from the bureaucrats? A giant “take a hike” message. I think at times they’re trying to direct that message at me. It is in fact the investors that are receiving the message. The point is that an industry that thinks they can sit around and “muddle through” for a half decade and just wait for their investors to return. Will be disappointed when the investors see that the firms that they’ve sent the ominous message of walking out on. Can not take the time, money or effort to recognize, invest or safeguard their investment and focus on the issues that offended them in the first place. Why then would the investors just return? If producers can’t invest in their own businesses profitability, why then would anyone invest in them?

This is why the communication coming out of the industry is so problematic. It has no historical context. Less than a year ago oil prices were negative $40 and major producers such as Occidental were begging for a life line from the government. Now, after meekly participating in the global reduction of oil production, $60 oil has allowed them once more to resume their lofty positions upon their thrones. Dictating that “capital discipline” will once again be what rules their domain. This time they’ll be producing shareholder returns at rates that, well actually not one of them defines that variable do they. Not once is profitability mentioned, and never in the context of “real” profitability. Performance is not a criteria in which they consider, evaluate or measure themselves. What we do see is the return to the secondary criteria of oil and gas bureaucratic boasting. Those being the “building balance sheets” and “putting cash in the ground.” History is in a geological context for them. Change is over an era.

Evidence of the construction of balance sheets is present in the consolidation phenomenon overtaking the bureaucratic mind. When the spending machine is challenged as to its effectiveness and efficiency in building value. There is only one thing left to do, go big or go home, as Forbes describes. Therefore the consolidation theme of acquiring their peers is the “bright shiny object” that will get them through the critical phase of these early days. Don’t have the leverage, that’s ok, acquirees are so broke they’ll accept the shares that no one else finds any use for. And thank god for Michael Milken and his 1980s creation of the “Junk Bond.” These are the two tools at bureaucrats' disposal to allow them to spend like they’ve never spent before. The only difficulty is that they have to pay far more than what the assets are worth. Which isn’t an issue, it's optics. If a producer paid the market price for oil and gas assets people would see the bottom had fallen out of the market in terms of oil and gas property values. Therefore it is up to all of the producer bureaucrats to make sure that they continue to pay more than what they’re worth so that any comparison to the acquirers current holdings makes their current holdings seem effectively “built” or cheap in comparison. Doing so just requires that you ask for more Junk or issue more shares when that time arrives.

The business of the business of oil and gas is all good in the hands of the bureaucrats now. The spending machine that we all knew and loved from the past four decades. Derived from money spent like drunken sailors to boost their capital assets in property, plant and equipment, building balance sheets and putting cash in the ground. Now that the commodity prices are in positive territory these asset values, are they assets or costs, are questionable and being evaluated as worthless due to the fact that they were never profitable and demand cash to produce. The market for oil and gas properties collapsed only a few years ago with no one interested in the business and producers desperate for cash. But now these properties are commanding premium prices due to the need to make the amounts recorded in property, plant and equipment look as if they represent a real market and for no one outside of industry to question their “true” value. The currently ordained king of oil and gas consolidation is Pioneers Scott Scheffield. Acquiring Parsley in the last quarter for $8 billion and this quarter he picked up DoublePoint Energy for $6.4 billion. Spending ridiculous amounts for “assets” that others have included ridiculous amounts of every kind of cost for, is not a good business. Including 85% of the overhead which includes the receptionists time, the Post-It-Notes and phone service costs as well as a host of other specious costs. This is happening in a capital intensive industry. If oil and gas was going to compete in the capital markets and capital is considered a cost, why would the producer overspend? Remember performance is not a criteria contemplated or understood by these people. And in this instance I would have to ask that question twice. People, Ideas & Objects assertion has always been that a pro-forma adjustment to the amounts in the property, plant and equipment account should be conducted to reclassify 35% as property, plant and equipment and the other 65% as an impairment. The justification for this treatment is that our perception is that the 65% represents an amount that is nothing more than the unrecognized capital costs of past production. Therefore, to now buy these high cost “assets” off another producer at premium prices is not good business. People, Ideas & Objects may need to look at revising our recommended allocation between property, plant and equipment and depletion now that the property, plant and equipment account of these producers is being bloated exponentially.

In our white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale” we discussed the Occidental acquisition of Anadarko. A transaction that saw Occidental pay an enterprise value of over $64 billion for Anadarko’s lifetime earnings of $695 million. Earnings that never saw a reasonable amount of capital included in the costs passed onto the consumer. Therefore the $695 million is highly overstated. Since then Occidental has begged the Federal government for direct support to save it. What the Anadarko and Pioneer acquisitions may prove is that the amounts being paid by these producers are for only one reason. To maintain the image of the value of oil and gas assets. And therefore by association endorse the well built balance sheets and the amounts of money that have been put in the ground. An endorsement of the past four decades of management's focus of “building balance sheets.” Performance, what’s that, certainly not something we’re going to be seeing from oil and gas companies. Here we have articles from Forbes and WorldOil that imply the focus of the acquisition. Land and drilling locations in the form of drilling inventory.

All the rock in the U.S. worth owning is already owned and the Permian is the only oil play with significant drilling inventory, and is therefore, the only basin that matters. To “win,” you must ‘drill your returns’ with huge scale to maximize supply chain savings, lateral length and footprint efficiencies and manage the ever growing ESG pressure.

There is no reason to exist if you are less than a $20 b company, he continued. The capital markets are closed unless it’s for debt (and it’s expensive if you are small), the cost pressures are too high to compete with OPEC when API supports carbon taxes and sooner or later, U.S. companies are going to need to focus internationally again.

And from WorldOil

Pioneer will increase its position to more than 1 million net acres through the deal, acquiring “primarily undrilled” new land.

What else has been going on? Dumb question I know. The efforts to hide the argument in enhanced spending, such as buying others at inflated asset values is their solution to an overcapitalized industry? If dilution of shareholders value through stock issuance and high interest rate bonds are what are necessary to continue the facade, that’s fine with the bureaucrats. Bureaucrats are still getting paid. We need to ask ourselves what is the issue with the development of the Preliminary Specification? Enhanced profitability throughout the industry would bring the producers to a level of performance that they’ve never attained before. The cash flow as a result of being able to retire the capital assets in a capital intensive industry on a market competitive basis would be tremendous. This would be a powerful industry with its future in hand and its destiny under its control. Instead we get the spendaholics driven by stock certificate printing machines. Why is it that crying to the government for support while prices are negative $40 is deemed acceptable to the bureaucrats as the first step after a $64 billion acquisition? The Preliminary Specification disintermediates the oil and gas industry. That means one thing and only one thing. These bureaucrats are gone, as is this nonsense.

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. Anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.