These Are Not the Earnings We're Looking For, Part LXIII

In the broader sense of spelling out a compelling vision. I’m finding once again some discussion within the industry that bureaucrats will continue with the work they’ve been doing in reducing the costs of oil and gas exploration and production over the past half decade.

In Forbes

Let’s all remember that the U.S. shale industry boomed like never before throughout 2018 and 2019, a time during which WTI traded in a range of $53 to no higher than $72 per barrel. While it is true that the financing market for new shale projects remains tight, it is also true that shale producers who have spent the last two years heavily-focused on cutting costs, increasing efficiencies and deploying improved technologies are now able to present a far more attractive profile to potential investors than they could in 2018. That’s what a depression will do to the companies that manage to live through it.

In World Oil

A round-up of data on shale drillers shows they’re sticking to their pledge to cut costs, return money to shareholders and reduce debt. If they stay the course, it would validate the OPEC+ alliance’s high-stakes wager that it can curb output and drive crude prices higher without unleashing an onslaught of supply from U.S. rivals.

We’ll recall that while oil and natural gas prices were in steep decline the producers were able to sharpen their pencils and what could be produced “profitably” yesterday at $60 / boe could suddenly be produced “profitably” at $50 / boe. This went on from $50, to $40 and $30 and so on. I marveled at this capability and suggested that it may be the most miraculous occurrence in the history of business. As oil and gas prices continued to collapse due to overproduction the immediate bureaucratic response was to claim they could still make money at the new threshold of pain the market was applying. Market signals be damned. The difficulty that I have is that these comments and commentary that were asserted over the past half decade and these quotes from Forbes and World Oil, and particularly that which I’ve italicized, are contrary to the reality of the situation and these claims took on mythic proportions throughout the rampantly optimistic oil and gas industry. Bureaucrats obviously have some method of distributing their talking points so that they’ll all be singing from the same hymn sheets. This ensures that no alternative “thinking” as to how they so radically reduced their costs would ever be heard or considered.

My response to these claims of reduced costs was a further assertion of the nature of their specious accounting that has been undertaken in oil and gas. Where “building balance sheets” and “putting cash in the ground” became a key part of its culture. If we think about the producer firm they’ll have thousands and in the larger producers hundreds of thousands of wells that have been drilled over the prior decades. Of the current year's activities which will total as many as a few hundred wells, I do not doubt that costs have been reduced, and we’ll discuss how later in this post. However, the question that needed to be asked was how is it that the historical cost of all the properties of those thousands and hundreds of thousands of wells that were drilled many years before suddenly had their costs reduced and can now perform profitably at the lower price, and remarkably even half the commodity price? In a capital intensive industry how is this possible? Have there been new innovations in historical accounting that I am unaware of? Or is this just an extension of the specious accounting that People, Ideas & Objects have been writing and concerned about?

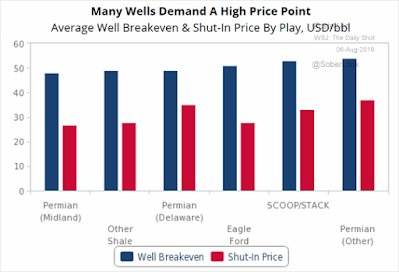

Well it turns out that it has nothing to do with accounting or the financial statements of the producer firm. It’s a story about what could or might possibly happen in the future, if they chose to drill wells in the places where the bureaucrats have identified future drilling locations. These costs and their declining costs per barrel are what are called “Recycle Costs'' in oil and gas. A mythic being that roams the earth at night and invades only the minds of those bureaucrats who need an excuse, someone to blame or a viable scapegoat. They are the answers to questions such as “With today’s depression era service industry prices, what could we contract a drilling rig for, and how much would it cost for the lateral to be fraced?” It’s not that they would ever contract the rig for the work being asked about, they’re only wanting to spec out the cost of a well and then determine what that cost would be and if it would be “profitable,” from their perspective, in the current commodity market.

How these recycle costs have become so much more “profitable” than what the historical costs of the producers have been. Is easily understood when we consider the devastation that occurred in the oil and gas service industry. If oil and gas we’re in a depression, then the service industry would be devastated. First, when producers did not want to spend their cash they cut their field activities in half, and then significantly further from there. The service industry was faced with layoffs, idling capacity and difficult business decisions as to what to do. At one point producers, unable to find the funding to maintain their contractual obligations in the service industry, were willing to continue the work and extend the payments for these services up to 18 months. That time has now passed and is history, however the service providers were not aware of these changes in payment policies. Having financed the producers activity for a period was not what they wanted or were capable of doing, even though they were at half capacity or less. However, producers being the smart ones they are, knew they were the ones with the money, eventually, and had leverage over the service industry who they knew were desperate. They therefore were cutting the day rates and service costs of any activity to the level where the service industry was experiencing their revenues would not provide for anything more than the variable costs of the activity. After all, the bureaucrats thought, if the producers were conducting their business in that manner for the last four decades, why wouldn’t everyone else?

Therefore just using these two factors the service industry was faced with a drop of approximately 75% of their revenue streams. Conversely producers were receiving bids for their recycle costs where the costs of the service industry was at best half of what the “normal” business environment would have offered. The two factors that I’ve used here are also incorrect and only used as an example for simple math purposes. We know for example that drilling activity decreased approximately 75 - 80%, therefore the revenues were barely 10 - 12.5% of what they were. And, if we were to look at that from the producer bureaucrats point of view. When producers pay the service industry on an 18 month schedule that’s not a lot of money the service industry had to finance.

It was about this time, if anyone wants to recall, that scrap metal was all the rage in the oil and gas service industry. Cutting up oil and gas field equipment was sometimes enough to pay for the light bill. Except, some weren’t able to maintain their operations and closed permanently. The devastation in the service industry has always been historically worse than what is experienced in the producers. The producers earned the primary revenues, or as People, Ideas & Objects call it the bureaucrats money, which although were lower from the low commodity prices, were still enough to keep the bureaucrats happy. The service industry has no customers or hopes of any customers in any other industry other than oil and gas. The commensurate drop in the capacities and capabilities of the service industry can only be exacerbated in knowing that oil and gas is up and running, but truthfully who cares? People in the service industry will want and need more than just the first paycheck promised and the vendor will need more than just a purchase order. The expectations will be different and they will be driven out of necessity. Business done the old way will be a bit of a stretch to consider. The ability of the service industry to restaff with experienced personnel may be difficult. How much of the critical knowledge has walked, taken their family and mortgage to work at WalMart where at least they know they’ll be able to work continuously and also be paid? The offer of lucrative pay is not going to offset the poor quality of life they experienced when working in the field and the shoddy treatment producers inflicted on the service industry.

This also assumes that the service industry vendors will be lining up to receive their beatings once again. Where is Schlumberger, Halliburton and in Canada BJ Services and why are they no longer answering the phone? Enough of the big guys how about so and so, where are they? The fact of the matter is the service industry has been at the beck and call of the oil and gas industry for the past four decades in ways that would redefine customer service as spectacular. These people should be commended and thanked for their service to the oil and gas industry for stellar service that always went twice as far as what was expected of them. They were also the innovators that had their hands and eyes on the issues and opportunities that were happening in the industry. The development of coil tubing and Packers Plus, for example, took almost a decade of hard work and slogging to finally get the attention of producers. Prior to that they were shunned and had to persevere much as what People, Ideas & Objects have had to do. The innovators that producers claim to be is nothing more than hog wash and lies. Regardless, when times were good in the mid naughts in oil and gas, all that the service industry ever heard from oil and gas producers was how greedy and lazy they were. These producer bureaucrats have earned the right to be shown the door with a swift and stern kick from the muddiest work boots that can be found. They are despicable. Such a history should be bronzed for permanent display in the town squares where all the producers reside.

The costs of rebuilding the service industry was part of the New Cost Structure series we detailed and wrote about in late January 2021. The service industry investors and bankers were left holding the bag, as they say. They’re not standing up for another round and the ability to recapture the North American service based capability and capacities are going to be done on a volunteer basis by the producers philanthropic efforts. This is going to cost more money than what bureaucrats could ever imagine. If they want to contract a new rig, they’ll need to find the operator qualified to build and operate it for him. All on the producers gracious willingness and courtesy, but mostly those primary revenues they’ve been hoarding. And pay the day rates, or whatever basis the driller determines they’ll charge the producer to drill wells in the future. And the producer will be so grateful and thankful for the next few decades they’ll buy all the drillers kids Christmas presents. Bureaucrats should understand that it’s a new day, one in which you get to reap what you sow. And though the producers have always been standing on the top of the heap because they owned the Petroleum & Natural Gas Lease, as I’ve shown them the 21st century is not about physical assets, it's about Intellectual Property. It is the means and methods to have things done in the field that is held in the minds and hands of the service industries operators. This Intellectual Property, much like People, Ideas & Objects Intellectual Property and all Intellectual Property in the 21st century, is going to be expensive.

It’s good to criticize, which I subscribe to and am endearing at. Far better to have a solution. The Preliminary Specification was published in December 2013 and contains the Resource Marketplace module which captures these facts in the same form. From seven years ago! Nothing ever changes with the producer bureaucrats, something you can bank on. The Resource Marketplace has the means and methods to rebuild the service industry based on the understanding that these resources are a critical part of the North American oil and gas industries, profitable and energy independent production profiles capability and capacity. The service industry is solely responsible for 100% of the industry's innovation. Never let a bureaucrat mouth anything different. I just didn’t know when I published the Preliminary Specification that the bureaucrats would destroy things as badly as they have, however that is where we are today.

And that is how the industry will have to deal with the service industry or there will be no service industry capable of dealing with the producers needs, ever. In addition to that stack of other costs we identified in our New Cost Structures series of blog posts. Those being the reclamation costs that have even Shell trying to avoid, rebuilding and refurbishing the infrastructure that has aged. There is the expansion of that infrastructure which emulates much of what the service industry has gone through and will need to rebuild its capabilities and capacities. Remember the producer bureaucrats who were standing in front of everyone selling the needs for the Keystone XL Pipeline, or in Canada with the Transmountain Pipeline that Kinder Morgan started? Actually no one remembers these things because they never happened. Kinder Morgan gave up the fight, as I think all the pipeline companies will be doing, and sold to the Canadian government for similar reasons in the failure of Keystone XL. If producers want a pipeline from there to there, then the pipeline companies can talk, but they’ll want to see all of the money upfront just like People, Ideas & Objects and the service industry either demands today, or in the near future. Issuing a purchase order, sitting back on the couch and waiting for someone else to do the job, while you belittle them as greedy and lazy while you never lend a hand is over. Maybe if the bureaucrats had some skin in the game they would saunter down to where the rest of us live and start doing some work too. And when it comes to paying the blackmail from Greenpeace and all those environmentalists threatening to protest you in front of your head office, bureaucrats can continue that, however as the pipeline companies have learned it's very counterproductive to do so. “Muddle through” and “putting cash in the ground” have certainly made it into the bureaucratic hall of fame. Management should be there to manage the business and build value, mostly by way of real profitability, everyday and everywhere no matter what the situation is.

So where are we going with this one sided dissertation that is well past due. Oh yes, “Recycle Costs.” That utterance right there may be the last time anyone, anywhere says those words again. “Recycle Costs,” no wrong again, will be a minimum of 4 times higher than what they were before. These are the consequences of filling one's pockets at the expense of everyone else in the industry. Filling out the balance sheets as if they’re wish lists. And saying things in the public domain that are just not true, are absolute falsehoods and could never be because they defy reality.

Producers only wanted to work with the service industry members of size and therefore new and innovative service industry providers were shunned. Then when the depression hollowed out the service industry, much of the critical infrastructure was cut down for scrap metal etc. Schlumberger walked as did many others. Not much can be done with that scrap metal today and the service industry, much like the oil and gas producers themselves don’t have a deep rolodex of investors anymore. Their only source of capital for their rebuilding is the producers themselves. By having them fund much of the rebuilding process of their industry with much, much higher oil and gas prices. Rebuilding the service industry with those primary revenues of theirs. Primary revenues that were generated in the past with the efforts of the service industry and pipeline companies that have been fundamentally betrayed by the oil and gas bureaucrats. These new costs will be reflected very soon in the “Recycle Costs.” As a result of these factors the days of having these “Recycle Costs” quoted may be over. No one will claim they can be profitable at $200 / barrel. Unless that’s a real good price in 2025.

I have to suggest that the bureaucrats be advised not to go on the record today and make these claims to World Oil and Forbes. This would be for two reasons. The first is that those ambulance sirens they’re hearing are really lawyers who have all that they’ve needed to file a variety of class action lawsuits. They’re coming for all of the bureaucrats, what we kindly call the officers and directors of the producer firms and the more they draw attention to what it is they're doing the more difficulty they’ll be causing themselves. Secondly, this is exactly the issue that has motivated these lawyers. They see the SEC investigating Exxon and issuing subpoenas to the shale producers for their asset valuations and now bureaucrats decide to run around town fudging the numbers (again) with mythic tales of super hero status. Can I hear that production can be had profitably in single digits? Oh come on, why not?

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. Anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.