These Are Not the Earnings We're Looking For, Part LVI

A quick note to point out I've placed a Patreon button at the top of the left column to help keep the faith.

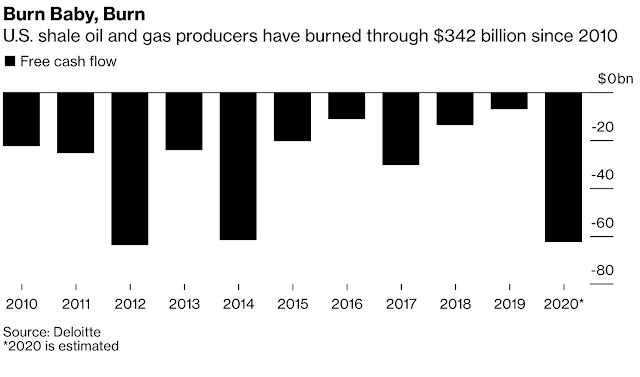

I can now stand by my claim that the oil and gas producer bureaucrats' universal claim of “building balance sheets” or “putting cash in the ground” are about as false, unreasonable and meaningless as any claim has ever been spoken by anyone in authority. And there is a broader implication involved in this by way of the fact that building balance sheets was code used by bureaucrats to sell their specious accounting to those outside the industry to believe that everything was being conducted equitably. Throughout the time I’ve been writing this blog I’ve noted that the accounting has been purposely deceptive. Producers seeking to uphold the SEC’s requirement of recording their property, plant and equipment account to ensure that it never crossed the threshold of their reserves value was a misinterpretation and fabrication designed to line the pockets of said bureaucrats with the value that they were fleecing from investors each and every year. The SEC does have that requirement, no question about it. However the cultural interpretation by these bureaucrats that they must reach that value each and every year is a distortion. The SEC’s requirement is a safeguard against the lack of performance by the producer spending more than the value they are generating. The fact that most if not all producers over the past number of decades have been subject to reductions of their property, plant and equipment accounts, via the dreaded ceiling test write down, is evidence of the fact that they consistently, and on an industry wide basis spent more than the value they generated. When confronted with this there was a consistent claim that “these were accounting changes and those were sunk costs.” Never once holding any moral obligation to account for their out of control spending or chronic lack of performance. Building balance sheets has no basis in reality or fact. It is not a business objective and does not exist outside of oil and gas. It is code that the producer was actively participating in the fraud as all corporate citizens in the industry do.

To repeat uncontrolled spending in this manner leads to overstated assets on the balance sheet which lead to over reported profits. Which attracts more investment and this overinvestment leads to overproduction. Which is the systemic and chronic problem that we’ve proven has been present in the global oil and gas industry since at least July 1986. These are not “assets” and are nothing more than what we describe as unrecognized capital costs of past production.

The evidence that arises from the third quarter 2020 reports verify these claims and are precisely the facts that should be the most embarrassing in the history of the industry. For example, the third quarter report of Apache Corporation, on page 1 of this report you’ll find the following.

While significant macro headwinds continue to persist, our strategic approach to creating shareholder value remains unchanged: we are prioritizing long-term returns over growth; generating free cash flow; strengthening our balance sheet through debt reduction; and...

There it is, at the end of that quote and in clear text they’ll be strengthening their balance sheet along with a list of things they’ve never done or believed. So why is this so relevant to the claims that I’ve just made. It is for the fact that Apache’s balance sheet reflects the dead zone. If this is what they have to show after decades of building, someone desperately needs to take it away from them as they’re either wholly corrupt or so naive as to be inappropriate for the role in which they’re employed. Apache is sitting at the end of the third quarter of 2020 with negative equity of $37 million and to note, Paid in Capital was $15.418 billion in the third quarter of 2017. That is a total loss to date of $15.455 billion. In their defence I would suggest at this time they could only build as they’ve destroyed all of the money their investors ever gave them. They’re “safely” just destroying debt now. On February 1, 2011 Apache had a share price of $133.37. Almost three years later, in December 2013 People, Ideas & Objects published the Preliminary Specification. Detailing a solution that specifically addresses the issues that are plaguing the industry today. In November 2020 Apache is trading at $9.75 as of Monday. 7.31% of what it was worth almost a decade ago. I checked with the bureaucrats and they said they lost money in the process too, but are otherwise fine and thank you for asking. The efforts of these bureaucrats, and lets be specific here, the C suite and board of directors have been working at cross purposes to all those that work at Apache, the service industry and its investors. To quantify what has been lost in terms of market capitalization is the easiest method of calculating losses. Similar and equal losses would have been incurred within both the entire staff of Apache and the service industry just from these Apache bureaucrats.

The point that I am making is something that I want to make perfectly clear. There was time for the bureaucrats at Apache to have acted to participate in the development of the Preliminary Specification. Let's assume for a moment that they participated as if their life depended on a successful development and implementation. People, Ideas & Objects are one organization and this will take the will of the producers to make it successful, most of all. If they should continue to sit around with their finger in their ear then they’ll have wasted everyone’s money. But what if they hadn’t. The cost based on Apache’s current production profile to participate in our development would be $140.3 million dollars. However it would have provided the avoidance of the losses that they’ve experienced. Taking only those losses that we are aware of in terms of market capitalization. Those losses total $50.33 billion, only a very small fraction of the costs and what I would think Apache would agree is a good return. The destruction in the industry is something that People, Ideas & Objects have discussed throughout the past number of years. Starting in August 2003 in fact. We’ve always pointed to the bureaucrats as the reason for the issues and their inability to act to rectify these issues was maybe a close secondary issue. I want to say at this time that I appreciate the fact that they went out of their way to prove without any doubt the validity of the following three facts. Our belief the industry was headed for disaster if they didn’t act in a timely manner. That the bureaucrats were responsible in every and in all ways. And lastly that the losses were the most material losses that any issue has caused the oil and gas industry at any time in its history. I guess congratulations are in order, which bureaucrat should we nominate for Bureaucrat of the 21st Century?

Why are profits, the real kind of profits and value generation that People, Ideas & Objects have been discussing in the Preliminary Specification, profits that account for the full costs of exploration and production in each barrel of oil produced, considered so evil and vile by these bureaucrats? Why the violent response to People, Ideas & Objects and our Preliminary Specification? The determination and persistence shown in fighting us since August 2003 has been impressive. The reason that we believe this has happened is because the effective disintermediation that our system does to these producer bureaucrats. Just as iTunes terminated the dreams of record store managers. They are redundant in a post deployed Preliminary Specification world. And, we believe that it’s fundamentally easier to manage a firm that is focused on spending. Whereas profits, and particularly profits that are real and earned take significantly more work, effort and difficulty to attain in terms of skill than what has been displayed or understood by these bureaucrats. Why would they want to try now to reach for attributes that were previously satisfied through accounting wizardry? The differences between these methods of profitability are as large as what is required to earn the vote vs what’s required to stuff a ballot.

Back in 2017 we noted that BP’s Chief Economist stated that the world had twice the amount of oil it needed for the next 32 years, or until 2050. Therefore, it would be in the best interest of the OPEC producers to produce what they have and provide the market at whatever price is offered for the next 32 years. With the abundance of supply on hand OPEC’s low cost producers would find that they would be profitable at any price, but their margins would be slim. For high cost producers like those in North America, they’re out of business. That in essence was the message that the BP economist was admitting to. Twice the supply of oil that is needed up to 2050 will be long after the virus has subsided and is therefore the long term issue producers need to be focused on. The business model of North American oil and gas producers has to change in order to accommodate this supply change from scarcity to abundance and shale’s high cost. This environment, unlike the virus, is not a temporary situation in either oil or gas and will need to be addressed by acting to develop the business model of the Preliminary Specifications decentralized production models price maker strategy.

Commodities are too valuable to be produced unprofitably. Continuing to do so aimlessly, or is it purposely, is damaging the industry and its capacity to profitably fuel North America for the remainder of this century. It’s going to take at least that long for a working prototype of the pocket fusion reactor. These major producers are just shifting to clean energy because it makes them look like they’re active in the eyes of John Q. Public. They’ll have to admit at some point they have a responsibility to fuel the economy. Producers are continuing to manage as if they’re in the pre-shale era. References to how they expect the business to behave are based on those assumptions and they’re flawed as the dynamic of shale is destructive to that business model. The point for them is what’s a few more years of poor performance when you have such a record? As I noted they said they were fine.

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. And don’t forget to join our network on Parler @piobiz, anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.