These Are Not the Earnings We're Looking For, Part LXI

The mechanism we use in the Preliminary Specifications decentralized production models price maker strategy, that enables producers to produce oil and gas profitably everywhere and always is being summarized here in answer to the questions raised in Monday’s blog post. This is the methodology and the reasons in which we began our research in August 2003 into using the Joint Operating Committee, which subsequently enabled the development and publication of the Preliminary Specification in December 2013. That shale has changed the oil and gas industry from scarcity to abundance is the reason that things are as desperate as they are today. However, with the state of affairs in terms of organization and application of Information Technology, oil and gas would nonetheless have needed to approach the development of systems to better manage their organizations. That People, Ideas & Objects, our user community and their service provider organizations are timely and address a material need in the market is a benefit that we can build upon and turn the industry into a value generating enterprise for all concerned. All the while providing the energy necessary to ensure the North American economy remains the largest consumer of energy, hence energy independent and the most powerful economy.

The organizational structure that we’ve chosen is one that fits within a decentralized oil and gas industry. Centralization has had its day and fulfilled its purpose in society, however the Internet is enabling new methods of organizations to be formed based on the underlying Information Technologies. Other methods no longer remain a choice due to their inefficiencies, particularly in the area of speed and their capacity to deal with issues. Therefore we have taken the Joint Operating Committee as the key organizational construct of the dynamic, innovative, accountable and profitable oil and gas producer and industry, redesigned and reconfigured them to determine the “what and how” they would need to look like in order to operate based on that change. The Joint Operating Committee being the legal, financial, operational decision making, cultural, communication, innovation and strategic frameworks of the industry. When we move the compliance and governance frameworks of the bureaucracy into alignment with the seven frameworks of the Joint Operating Committee we gain a speed, accountability and profitability that otherwise could not be achieved. We are assuming that if producer bureaucrats were able to deal with these issues, far too much time has passed, proving they’ve been unable to accommodate them. Therefore change is necessary and urgent.

It is People, Ideas & Objects fundamental belief that the overhead costs of oil and gas are material and vastly understated due to their industry wide capitalization of 85% of all its overhead. Dealing with these costs is a necessity in any new producer and industry configuration. What we’ve chosen to do is change these overhead costs from a fixed cost within each of the producer firms to a variable cost within the Joint Operating Committee, variable based on production. Moving the producers fixed cost administrative and accounting capability to become the industry variable cost administrative and accounting capability. We believe that each of the producers maintaining their own administrative and accounting capabilities is being replicated within each and every producer. These costs are not shared or shareable in their current configuration, are not part of the producers fundamental competitive advantage or offering and are costing the industry much of its profitability outside of the low commodity prices. Maintaining the theme of the decentralized organization we are then removing the administrative, accounting and related systems infrastructure and resources away from the producer firms into individual service provider organizations. These service providers are affiliated with People, Ideas & Objects as they deliver our software and their services to their client producers. This configuration enables the producer firm to focus on their key competitive advantages of their earth science & engineering capabilities, and their land & asset base. These service providers will be focused on one individual administrative or accounting process and will manage that process for the entire North American oil and gas industry. Exceptions such as production accounting, which we believe will move closer to the field, will of course need to be made.

Highlighting the competitive advantages of the service providers would include the following. Specialization and the division of labor will enable the producers and industry to increase their production throughput from the same resource base. Automation of the business process is enabled through our user community member that is the principle behind the service provider. This automation is enabled through their hands on knowledge of the day to day management of their individual process and their ability to access the software development capabilities available to them from People, Ideas & Objects. Establishing a change based leadership in the industry to ensure that oil and gas remains innovative and profitable. And will not, once again, be subject to its accounting and business related issues defining decades of destruction through a complacent bureaucracy and the use of stale, unchanging ERP systems.

With the accounting and reporting focused on the Joint Operating Committee the producers will be receiving detailed comprehensive financial statements complete with actual depletion calculations and detailed, actual overhead costs that arise from the service providers billing for their services directly to each of the Joint Operating Committees. Overhead allowances will no longer be necessary. Therefore, the producers will be able to determine with high levels of precision and confidence which properties are profitable and which are not, based on actual costs. Those properties that are not profitable can be shut-in and as a result none of the service providers will be receiving any data through the People, Ideas & Objects Preliminary Specifications, task and transfer network. Therefore no data being generated leads to no work being done for that property and therefore no billings will be rendered for the shut-in property and therefore a null operation will be reported. No profit, but also no loss. This property is then moved to the producers shut-in inventory to begin work to innovatively return it to profitable operations.

The benefits of doing this are substantial and increase the value of producers. The dilution of the producers profits will cease as only profitable properties will produce. Profitability will no longer be diluted by any unprofitable properties production. There is also the ability to extend this analysis to the field level where each well will be subject to the same critical review. Any well that is not profitable within that field or unit can also be shut-in in order to enhance the overall profitability of the specific Joint Operating Committee. It is here that the bureaucrats have accused us of collusion for well over a decade. Our response to that accusation has been. If making a fundamental, independent business decision not to lose money, based on detailed, actual, factual accounting is collusion, then… Additional benefits of using our decentralized production models price maker strategy include the reserves being shut-in can be saved for a time in which they’ll be produced profitably. Materially increasing the reserves value. The reserves will no longer have to carry the losses as additional costs that would need to have been earned if the property were to continue to produce unprofitably. These reserves can also be seen as relatively low cost storage as opposed to the high storage costs being incurred today. (Production, transportation and storage costs would not have been incurred.) Commodity markets will find their marginal cost when unprofitable production is removed from the market. Raising the value of the reserves but also the producers overall revenues which we clearly identified as necessities in Monday’s blog post. Markets provide one thing and only one thing. That is their price, which theoretically holds all of the information of the market within it. Using that information is what People, Ideas & Objects Preliminary Specifications decentralized production markets price makers strategy does. By focusing on profitability, producers will ensure investments in oil and gas are competitive in the greater market economy, which also happens to be based on price. And the overall greater oil and gas economic structure will cease to be subject to the boom and bust cycle which everyone has now unfortunately learned is so destructive and counterproductive. That being the industry that “builds balance sheets” and “puts cash in the ground.”

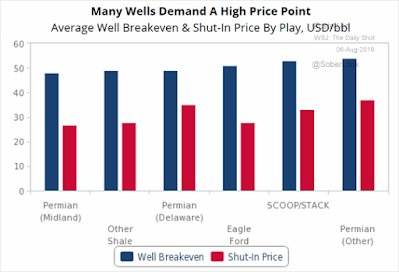

People, Ideas & Objects White Paper “Profitable North American Energy Independence -- Through the Commercialization of Shale” discussed the pricing dynamics in oil and gas further. The following is an edited version of that discussion based on this graph that captures the assumptions the bureaucracies are operating under.

Looking at this graph from the perception of the producer bureaucrats. Their total costs of each barrel of oil produced in the various shale formations is in the range of $48 to $54. The operating, overhead and royalty cost of each barrel varies between $28 and $37. I would point out the difference, being $16 to $23, in capital costs are based on an allocation of all of the capital costs across the entire reserves of the property. In our white paper we’ve argued that this allocation is unreasonable in a capital market where the demands for the performance in today’s capital markets are far greater than what can be achieved when a producer is cycling their cash through their investments in a manner that retrieves that cash over several decades or more. This unheard of luxury was enabled through the specious accounting producers were performing. As the alternative, People, Ideas & Objects recommend in our Preliminary Specification that the producer retire all of their capital costs within the first 30 months of the properties life to provide for the reuse of this previously invested cash. This was our original recommended period in which to reduce the property, plant and equipment account. However based on our blog posts discussion on Monday we see there is a breakdown in the revenues of the producers, both in price and production volume, and no capacity to meet that criteria. Even five years is outside the possibility of the producers current revenue stream. Proof the state of affairs in the industry are deteriorating at a rapid rate at this point in time.

Providing producers with the means to meet the demands of their future capital costs, shareholder dividends and bank debt repayments, to address the rebuilding, refurbishment and reclamation costs we identified in our New Cost Structures series. Matching these costs better to the rapid decline rates experienced in shale can only be done if the producer is selling their commodities at a price that is well above their break even point which must consider an appropriate accounting of the costs of operations, overhead and reasonable retirement of its capital. Please note this graph reflects that Well Break Even and Shut-in values denote that at any point, and as long as the commodity price covered the operating costs, the property would continue to produce regardless of the impact on capital costs. If a dollar of capital costs were being returned, or one dollar above the shut-in price, that would enable the production of the property to continue. Only at the point in time where the commodity price dropped below the operating costs would the producer allegedly shut-in their production. We saw with March and April 2020 prices below $20 this principle being violated. This is a fundamental misinterpretation of the term break even, it is the reason the industry is in the difficulty that it’s in and why the producers have continued to lose money for the past four decades. Break even is not what is being interpreted here. What in fact the producer is assuming is that as long as there is cash flow above the operating costs, some of the time, then they’re making money and will continue to produce. What they’re stating is acceptable to them is they may not be breaking even, but they’re generating cash flow. As long as new investors were willing to make up for producers' lack of returned cash when bureaucrats did not recognize any of the capital costs to pass these on to the consumer, things were fine. Today with reasonable prices bureaucrats will divert cash flow to new drilling to restart the destruction once again.

What People, Ideas & Objects provide in our Preliminary Specification, if we could assume the accuracy of this graphs numbers, is the point at which the property would be shut-in would be at the breakeven point and below, always and everywhere. The reason for this being the production discipline gained through knowing that producing any property unprofitably only dilutes the producers corporate profits. Producing below the breakeven point is the point where unprofitability begins. Producing below the breakeven point for one producer, in an industry who’s commodities are price makers, will have the effect where the price of the commodities are dropped below the breakeven price for all producers' production. When all producers continue to produce below the breakeven price for four decades, as has occurred in North American oil and gas, you have a comprehensive exhaustion of the value from the industry on an annual and wholesale basis. Times were only “good” when new investors were willing

The Preliminary Specifications assumption is that the industries interpretation that oil and gas commodities are subject to price taker characteristics is incorrect. This is evidenced in the past years through the actions of OPEC+ with their removal of less than 2% of the oil from the market on two separate occasions which has brought about at least a 32% increase in the global price of oil. And in their most recent action of withholding their scheduled production increase. There’s the example of the Alberta government's mandated production cuts that removed regional differentials on heavy oil that were in excess of 80% of the commodity price. This small production cut, less than 10% of the overall productive deliverability of the province, had a dramatic effect where the differentials were eliminated within one month of the announcement. These are markets that reflect the characteristics of price makers, not price takers. To state that “markets will rebalance” and continue to produce and increase production in a market of declining prices and profitability is not a business. It is foolish, irresponsible and reflects an uncaring attitude that is prevalent in today’s oil and gas producers. But then the bureaucrats did get paid. The Preliminary Specification is structured to implement the decentralized production model’s price maker strategy to rectify this behavior, establish profitability as the only fair and reasonable method of production allocation, and produce only profitable production everywhere and always.

With the inherent value contained within each barrel of oil. With the supply possibly limited to the next half dozen generations. Why would we ever produce any oil or gas that was unprofitable? What would be the purpose of doing so? Would we not just be robbing future generations of the resources they’ll need to expand their quality of life? Ensuring there’ll be no viable industry capable of providing for their oil and gas needs? On the one hand the costs of oil and gas exploration and production continue to escalate with each barrel of oil produced. This is due to the increased difficulty and science necessary to extract the resource. Therefore a more accurate accounting is necessary than what has been provided to the industry in the past decades. People, Ideas & Objects provides a more accurate accounting of the costs of exploration and production as part of the Preliminary Specification, our user community and their service provider operations. When only profitable production is produced it is implied that we're accurately capturing the timing and accuracy of all costs and passing them on to the consumer. Profits and innovation will be used to ensure an abundant, affordable supply is provided to consumers for the long term. Conversely, consumers paying the full cost of their energy will ensure that they’ll choose the most efficient and effective use of the variety of resources they have available.

Let's look at another “business” dynamic of profitability everywhere and always. If producers are interested in instilling some “capital discipline,” as they’ve claimed so many thousands of times before, we have what they’re looking for in the Preliminary Specification. When only profitable production qualifies to be produced: when do new wells get drilled? When is land purchased, and at what price? These are not going to be determined based on the same criteria their grandfathers used. A criteria which has been recycled in the industry for the past many decades. New ideas and understandings of the “markets” will need to be developed and employed to determine when and where activity can and will be conducted. What we have seen is the price of oil and gas recover to a reasonable level and the North American producers resume their parade of lunacy until such time as the price collapses once more. “Oh well, it’s boom or bust they say.” Which reflects the amount of thinking that goes into what is being done to determine the economics of oil and gas exploration, development and production! I believe I’ve called this just a science experiment in prior posts. Turning these into business decisions will be a necessity if any “capital discipline” is ever attained. Mouthing the words, once more for the cameras please, doesn’t really get it done. Wouldn’t it be something if the producer bureaucrats adopted an understate and over-deliver policy, instead of their [specious] claim of [whatever] now and undeliver always posture.

The Preliminary Specification, our user community and service providers provide for a dynamic, innovative, accountable and profitable oil and gas industry with the most profitable means of oil and gas operations, everywhere and always. Setting the foundation for profitable North American energy independence. People, Ideas & Objects have published a white paper “Profitable, North American Energy Independence -- Through the Commercialization of Shale.” that captures the vision of the Preliminary Specification and our actions. Users are welcome to join me here. Together we can begin to meet the future demands for energy. Anyone can contact me at 713-965-6720 in Houston or 587-735-2302 in Calgary, or email me here.