Modularity, Transactions, and the Boundaries of Firms: A Synthesis.

Carliss Y. Baldwin, Harvard University

Published September 2007

Following on the user vision I posted recently, the module specification, and boundary of the firm definitions, we begin a comprehensive review of Professor Baldwin's paper. A synthesis of modularity, transactions and boundaries of the firm is timely for a number of reasons. First we have reviewed an extensive volume of Professor Langlois' work and specified a modular definition that, secondly, I think accurately captures the scope of the People, Ideas & Objects application. My primary objective in this posting is to move this discussion forward, and to do that, is to document what the role and responsibility of the user is in making the decisions and ensuring the accuracy of building this application.

I mentioned earlier that SAP does not know about miscible floods, pipelines, completions, production facilities or any specific or tacit knowledge of the oil and gas industry, the users do, and that is why they need to be involved in this software's design from the very start. This project, I can assure you, will not proceed without abundant user representation. I also want to re-introduce a concept that was discussed very briefly at the beginning of this blog. The concept is a Voucher and its unique treatment in this application. Lets begin with Professor Baldwin abstract;

Several novel implications arise from this work. Among these: Modularization's create new module boundaries, hence new transaction locations where entry and competition can arise. Areas in the task network where transfers are dense and complex should not be modularized. Instead these areas should be located in transaction free zones so that the costs of transacting do not overburden the system. The boundaries of transaction free zones constitute breakpoints where firms and industries may split apart. p. 2I am particularly focused on that last sentence where firms and industries split apart. We are after all talking about the Joint Operating Committee (JOC), which I propose will be the key organizational construct of the industry. A definition which will redefine the boundaries between the industry (the JOC) and the firms role. The firms role in this application is enhanced by these changes. The firms specification is fundamentally different with different paradigms and methods of work being done. How this work is defined, and the transactions that support the modular specification are the purpose of Professor Baldwin's paper and it is here she introduces the analytical methods of how our users could define the applications needs and where, in markets or firms, the transactions occur.

Introduction

I would like to go back to much of the work that we had done in transaction costs. Recall these are the costs of conducting business, or the "friction" that is created in getting things done. The associated cost of processing transactions for work done by a contractor vs. the cost of asking an employee to do their job. In the past it was much lower of a cost to ask the employee to do it, as there was no associated transaction to process other then the bi-weekly check. Today the advantages reside with the market, not the firm. The ability to manage the job has grown beyond the ability of the superbly slow bureaucracy. The market is expected to fulfill the expectations of it in anticipation of the demand, so that things move more smoothly as they should. And the costs of the transactions in these markets is much lower primarily as a result of harnessing the Information Technologies available today.

For the last thirty years economists have used the concepts of "transaction," "transaction cost," and "contract," to illuminate a wide range of phenomena, including vertical integration, the design of employment, debt, and equity contracts, and the structure of industries. These concepts are now deeply embedded in the fields of economics, sociology, business and law. But although economists and management scholars have explored the design of transactions in a wide variety of settings, in most of this literature, it is assumed that a pre-existing division of knowledge and effort makes a transaction possible at a particular place in the larger productive system. The theories explain how to choose between different forms of transactional governance, but they almost never ask why the opportunity to have a transaction occurs where it does. As a result, the forces driving the location of transactions in a system of production remain largely unexplored. p. 3Well put Professor Baldwin, when it comes to actual implementation of the transaction theory there is a dearth of available examples. This is also why I insist that the user be involved, analyze, determine, decide, and 100 other adjectives in the designing and building of this software. After all this is not SAP, it will be the system they use to make their living from and do their job.

Literature Review

Professor Baldwin goes through the history of transaction costs and the three main frames of thought. Each one helps to describe the terminology and overall conceptual framework of the theory. I will leave it to her to summarize and synthesis the three theories.

Transaction Cost Economics and Imperfect Contract Theories

The literature on transaction costs and the theory of the firm originates with Coase (1937). He observed that there were costs of using the market, and that "firms will emerge to organize what would otherwise be market transactions when their costs were less than the costs of carrying out the transactions through the market" (Coase, 1988: p. 7). Coase quite consistently defined transaction costs as the "cost of using the price mechanism" or "the costs of market transactions," but he was also the first to assert that transactions occur within firms. In defining transactions this way, Coase made the important point that the stages of a production process can be designed to take place within one firm or across several firms. But he also implicitly assumed that a production process involves (only) a simple sequence of stages. In fact, Coase's view was based on the paradigm of mass production, which envisioned organization in terms of simple flow lines of material goods (Chandler, 1977; Abernathy, Clark and Kantrow, 1983; Hounshell, 1985). p. 7

In contrast to Coase, who considered many types of transaction costs, Williamson (1985) focused on the harm that transactors can do to one another. Williamsonian transaction costs are the measure of such harm. But though he changed the definition of transaction costs, Williamson adopted Coase's sequential view of production and continued the practice of treating all transfers, both within and across firms, as transactions. Formally, he defined a transaction as "a transfer across a technologically separable interface", Notably, he did not define "technologically separable interface," but simply asserted that such places were fairly common in most systems of production. pp. 7 - 8.Knowledge - based Theories of the Firm

Knowledge-based theories of the firm incorporate the idea of shifting boundaries in ways that transaction cost economics and imperfect contract theory do not. However, these theories are not capable of determining the location of transactions, nor of predicting how the locations will shift in response to new knowledge. p. 8

Knowledge based theories of the firm are diverse, but have in common that : (1) they focus on what goes on inside of a firm or organization: (2) they agree that value (or "advantage") derives from things that a firm can do -- variously labeled routines, competencies, or capabilities -- that are not easily imitated or purchased; (3) they recognize that these routines, competencies or capabilities are based on knowledge, which is distributed across individuals and must be assembled and reconfigured in various ways. p. 9Recall the modular definitions that I have specified of Knowledge & Learning and Research & Capabilities. The division of these two similar modules is based on the need for similar definitions for both the market and the firm. The logic of this division is somewhat supported in Professor Baldwin's following comments.

Changing routines, competencies or capabilities based on knowledge must cause firms to have shifting knowledge boundaries. The span or scope of knowledge available to a firm will change over time as required by its changing activities. But theories based on knowledge cannot directly explain the location of transactions. First, the domain of transactions is a domain of action: goods are made; services are performed; compensation is paid and received. But actions enter the knowledge based theories only indirectly: knowledge begets capability and capability begets action. The actions themselves lie outside the scope of these theories. p. 9and

Moreover, a firms knowledge is generally not coterminous with its actions. Recent studies by Brusoni et al (2001), Brusconi and Prencipe (2001), Sako (2004), Staudenmayer et. al. (2005), and Ethira (2007) have demonstrated quite conclusively that firms generally "know more than they do." Therefore a theory about the boundaries of a firms knowledge cannot at the same time be a theory of the location of transaction for that firm. The two boundaries are related, but they are not the same. p. 9Modularity Theory

The gap in knowledge-based theories can be addressed by modularity theory, which focuses directly on actions and their dependencies. Modularity theory is rooted in the design theories of Herbert Simon (1962; 1969) and Christopher Alexander (1964). The modern literature can be traced back to three seminal contributions: Henderson and Clark's (1990) paper on product architecture; von Hippel's (1990) paper on task partitioning; and Langlois and Robertson's (1992) paper on the innovative potential of industries based on modular products. p. 10

A key element of these and all subsequent papers in the modularity literature was a principle I will call the "mirroring hypothesis." Henderson and Clark (1990) applied the concept of mirroring to product development groups: "We have assumed that organizations are boundedly rational, and hence that their knowledge and information processing structure come to mirror the internal structure of the product they are designing" (p. 27). Sanchez and Mahoney (1996) expanded this concept to encompass whole firms. p. 10

The mirroring hypothesis specifically links an organization's task structure to the actions of making and selling specific products. It implies that one can "see" the transactional boundaries of a firm by looking at its product and process designs - indeed, technically, the firms transactional boundaries are subsumed in those designs (Fine and Whitney, 1996; Fine, 1998). Thus as product and process designs change, so will transaction boundaries. pp. 10 - 11The Three Strands Come Together

Professor Baldwin comes in with a strong statement on the influence of Langlois in this area. I have found his work exceptional for the purposes that are proposed in this software development. Why I feel this way is captured eloquently by Professor Baldwin.

Although they invoked the mirroring hypothesis, early modularity theorists had little to say about the location or form of transactions. Langlois (2002, 2003) was the exception, and thus was in the vanguard of those who used modularity to explain changing industry structure. He first proposed that the economy was "modularized by property rights" and that organizations were "de-modularizations" in response to a need for interactions in the underlying technological processes (Langlois, 2002). He then challenged Chandler's (1977) thesis that managerial hierarchies were necessary to coordinate large scale productive systems. Contra Chandler, Langlois argued that in the late 20th Century, modular product and process architectures made hierarchical coordination unnecessary in many venues. As a result, Chandler's "visible hand" was "vanishing," and firms that had previously been vertically integrated were splitting apart (Langlois, 2003). p. 11I recently reviewed Professor Langlois "Vanishing Hand" here. Its also at this point that I want the user to begin to understand their role in defining the organizations modules, tasks, and areas where transactions will occur. And, begin to layer the complexity of the Joint Operating Committee's interactions to show the logic of using the organizational construct and the critical need of the users involvement.

This theory explained how new knowledge, incorporated into new design, could change the modular structure of actual products and processes. But Baldwin and Clark were unable to derive a strong version of the mirroring hypothesis form their theory of design evolution. Applying their theory to the computer industry, they were forced to conclude that changes in the modular structure of computers were necessary but not sufficient to explain the changing vertical structure of that industry (Baldwin and Clark, 2000, pp. 272-275). p. 11I am primarily concerned with the modular definition of this specific software application, however, the larger picture includes how the market forms and the interfaces between the different modules are developed. These may be new and different means of organizing the market more efficiently. In the computer example noted (Figure 2) it is only natural that the industry modularize the hard drive as its own "module" to be used in the component definition of the computer. Here Professor Baldwin begins the process of analyzing the various aspects of an industry to determine the modular makeup of the industry. It is here that the role of the user will have the broader impact of reflecting on the transaction costs and modular makeup of the energy industry. What I am saying here is that the energy industry will have application modules that will aid in managing the transactions, and will de-modularize the physical industry to a more efficient makeup.

By considering the implications of inter-dependencies for vertical integration / disintegration, these works deepened the theoretical linkages between modularity theory and transaction cost economics. And because they viewed organizations essentially as problem-solving entities, they also brought modularity theory into the realm of knowledge based theories of the firm. pp. 11 -12and

Taken as a whole, modularity theory and related empirical research suggested a new level of observation for studies of the boundaries of firms. In modularity theory, the basic unit of analysis is not a "stage" in a sequential production process, nor is it "knowledge" that contributes to a routine, a competency, or a capability. Instead the primitive units of analysis are decisions, components, or tasks and their dependencies. Decisions, components and tasks are more microscopic than stages, but more concrete and directly observable than knowledge. And the dependencies between decision, components or tasks can be represented in terms of a network as described in the next section. pp. 12 - 13and

At the deeper level of analysis suggested by modularity theory, the job of transaction design change. It is no longer enough to choose a governance form at a pre-specified location between two stages of production. The larger task involves: (1) locating transactions in the task network; (2) designing each transaction to suit the task network's local structure; and, often, (3) modifying the network's structure to better accommodate the transaction. I address these issues in sections 4, 5 and 6 below. p. 13One can see the complexity and diverse nature of the analysis necessary for this type of work. Whom is capable of this type of analysis? I think there is only one group, made up of users, augmented by a strong software development team, who can see and perceive the importance of the detail and the irrelevance of the noise. Users guided by a comprehensive vision, years of industry experience, extensive collaborative and analytical tools that can conduct this analysis and determine the optimal points of where and how transaction costs should occur, forming the module definitions and industry structure.

Definitions

The Task Network

This project is big. I don't know if its my ambition or naivete' that has brought me to this point, but this is a big project. The number of developers will total in the hundreds, the number of users will total in the thousands, easily. The scope of the undertaking is not something to downplay, but at the same time I think that the purpose of making innovation the key competitive advantage of oil and gas producers is worth trying. With Jeffery Immelt's comment that technology and innovation now have value, the costs will be returned in enhanced revenues and profits. This "task" is also clearly reflected in Professor Baldwin's next quote.

The basic unit in the design of any production process is a task (Galbraith, 1977; Tushman and Nadler, 1978; Marengo and Dosi, 2005). Tasks must be carried out by agents, but, because of physical and cognitive limitations, no single agent is capable of carrying out all tasks (March and Simon, 1958). Thus it is necessary to transfer various things - material, energy and information - from agent to agent in a productive system. Taken as a whole, the tasks, the agents, and the transfers make up a vast network of activity, in which tasks-cum agents are the nodes and transfers are the links. p. 13Using the modular breakdown that I have specified for this project, I think helps to shed the past ways and means, and allows the user to foresee the way that it should be, or what is the optimal way. This being managed by a "task network" based on Professor Baldwin's definition. If through this software development we are able to create the type of "task network" environment that the users and the software developers can work together and towards building these things. A related point is Adam Smith's division of labor. To increase the capacity of the economy requires a further division of labor. The industry therefore needs to have the tasks and agents defined in this way in order to define a greater level of division of labor.

On the one hand, one can think of the task network representation as a way of "zooming in" on the sequence of stages in prior modules in order to see what is going on in detail. At the same time, representing production as a network of tasks allows us to model new patterns of dependency and interaction, including parallel flows (of information and material), backward flows (feedback), and iterative and uncertain flows (trial and error). These more complex patterns cannot be modeled as a "sequence of stages," but they do arise - frequently - in real production processes. p. 14

The tasks and transfers in the network are people with local knowledge, local authority, local property rights, and local incentives (Hayek, 1945). Because of intrinsic cognitive limits - what Simon (1969) called "bounded rationality" - a single individual, team or company can only work on a subset of the network and on interfaces between subsets. Transactions, we will see, are a way to create efficient interfaces between subsets of tasks. pp. 14 - 15Professor Baldwin will show how this analysis is done and the simple interface that is needed to identify the tasks and designate them within one module or the other. The key point to note here is that the corporate view is too shallow for this type of analysis. This analysis must be industry wide and consider the transactions and interactions of the JOC. The JOC being the legal, financial, cultural and operational decision making frameworks of the industry will benefit greatly by the work that has been done by CAPL, COPAS, and other associations, and use these prior works to detail the interactions and transactions.

I want to start the discussion of how I perceive Vouchers operating in this system. Vouchers manage the inter-modular transactions, and maintain the integrity of the system in balance and compliance to the rules and regulations handled in the Compliance and Governance module. A Voucher, to my way of thinking in this software development project, has a strong analogy to the Google Doc's product. Google Doc's allows you to share a document with as many people as you need. Each individual may or may not have read / write privileges to the document, and their exists only 1 copy, the Google Doc's copy of the document located in the cloud. This ensures that all changes are recognized and addressed without the laborious need to edit 20 versions of the same document. This is the manner in which I see the Voucher within this system architecture operating. One version accessible by those JOC producers, those designated as authorized by the producers, and those that are in the need to know. Where the systems integrity of debits and credits and / or material balance are enforced with compliance to all accounting standards. A Voucher being a key interface of the systems and users in this task network.

Transactions

A definition of what is a transaction is provided by Professor Baldwin. Note the differences between her definition and that of Coase.

I define a transaction to be a mutually agreed-upon set of transfers between two or more parties with compensatory payment. This definition breaks with tradition: what I call a transaction is what Coase sometimes called an "exchange transaction" in contrast to "internal transactions" that take place within firms (Coase, 1937, pp. 393-398). p. 15In oil and gas, this classification of transactions is very broad. If we include transaction's between the JOC and field operations, internal transfers, and company to company transfers, this definition would include the majority of transfers that occur in the industry. We can assume that 100% of the scope of transactions is covered by this definition and that is what I am intending to include in this synopsis. Weather the transaction cost could be further classified as a Dynamic, Exchange or any other type of transaction is irrelevant to the focus of this discussion.

As indicated, in comparison to Coase, Williamson, and the contract theorists, I model production as it is seen closer up - as a network of many complex transfers. At this new, more microscopic level of observation, transaction are not the "basic unit of analysis" (Commons, 1934, cited by Williamson, 1985, p. 3), but are instead embedded in a more complex network structure. On this view, a transaction (or "exchange transaction" in Coase's terminology) is more than a simple transfer. It is a reciprocal exchange based on some degree of mutual understanding. p. 15How this voucher is implemented is through an evolving template. Starting a new relationship or property is the beginning of the voucher and the beginning of automating the associated tasks. As time passes changes in the voucher mirror the understanding of the JOC participants. This being the reason the user is so important to this development. Users and developers working together to build the base modules with all the process and data elements defined and available, and the vouchers, containing many possible transactions, used to build these processes and data elements into the demands of the JOC's.

Sources of Mundane Transaction Costs

Although we are attempting to include the entire scope of transactions of the producer, and we don't want to get to deep into the parsing of what a transaction cost is, Professor Baldwin notes the following which will be of interest later on.

To be the basis of a reciprocal exchange, a transfer (or set of transfers) must be (1) defined; (2) counted; and (3) compensated. Definition, counting and compensation are needed to create the "common ground" on which transactors establish a mutually agreeable exchange (H. Clark, 1996). But creating this common ground involves work: it adds new tasks to the network. Thus a transaction is a transfer (or set of transfers) embellished with several added and costly feature. I call these costs the "mundane transactions costs" of the transaction to distinguish them from the "opportunistic transaction costs" of Williamson and the contract theorists. My theory of the location of transactions is based on the argument that mundane transaction costs are low in some places in the task network and high in others. p. 15

Definition provides a description of the object(s) being transferred. It places the objects of the transaction into a defined category that is recognized by both parties. Defining adds the costs of describing, communicating and (sometimes) negotiating to the system. In contract theory, if both parties agree on the definition of what is transferred ("this is indeed a satisfactory widget"), the transfer is called "observable." If third parties can be brought in and also agree ("anyone can see this is a satisfactory widget"), the transfer is "verifiable." These implicit costs of observing and verifying are mundane transaction costs under my definition. Contract theorists maintain that such costs are the underlying cause of contractual incompleteness, but treat them as axiomatic, hence outside their theory (cf,. Hart, 2995, pp. 23 - 24). p. 16Definition and dissemination of the terminology used in the energy industry is standardized. The COPAS, CAPP and other organizations have had to define a shared meaning for the industry to use. These shared meanings are systemic in the industry and make up a large portion of the definition of what a JOC is. As Professor Baldwin notes as the sources of mundane transaction costs, the energy industry can see these costs are already well defined and specified. Hence, within the global energy industry it would be very easy to achieve a consensus as to what is "observable" and "verifiable" means between a variety of any JOC's. The costs of these mundane transactions are therefore minimal and the large volume of costs associated with the definition have been retired long ago, however, Professor Baldwin goes on to note;

Counting associates with the transferred object a quantity - a number, weight, volume, length of time, or flow. Definition is a pre-requisite to counting, because one can only count or measure objects within a class or category. Economics generally takes the existence of these predefined categories to be axiomatic. In other words, goods are defined outside of economics, while prices and quantities are determined inside of economics. When I say that transacted goods must be "counted,: I do not mean to imply that transactions always involve aggregation of goods, like bushels of wheat or tons of steel. Unique goods can be transacted - their count is simply "one". My definition of "counting" also subsumes all measuring processes that are used to verify the quality of the transacted object. For example, a complex good, such as a chemical plant, is a unique item (Brusoni and Prencipe, 2001). But the contract between the buyer and supplier of the plant will contain pages of detailed conditions, all of which must be met before the transaction is complete. These conditions define the transacted good. Verifying the conditions involves measurement, hence is a mundane transaction cost of counting. p. 16Lastly Professor Baldwin notes the difficult task of counting for mundane transaction costs, and hence, for the assigning of the value to each producer. In terms of the regular transactions that are incurred the value is easily determined. In the Partnership Accounting Module specification I had detailed the effects of this costing and noted that the overhead allowances that are earned by the operator should be considered a thing of the past. In the future the actual costs incurred by the pooled resources of the Joint Operating Committee will cause the costing of all the participants "mundane transactions" be realized and costed to the joint account.

Finally, compensation involves the backward transfer of "consideration" from the recipient to the provider of the transacted object. This in turn requires systems for valuing the object and paying for it. Modern market economies have highly efficient institutions and bodies of knowledge in each of the domains. Whatever the form of compensation, for a transaction to take place, two valuations must occur (one by the buyer and one by the seller), and a payment must be made. The costs of these valuations and payments are mundane transaction costs of compensation. p. 17The Determinants of Mundane Transaction Costs in the Task Network.

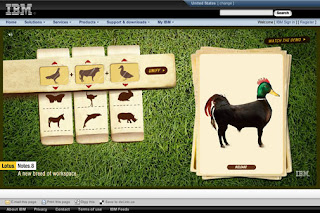

Professor Baldwin now embarks on the actual analysis of determining the tasks and transactions within the "task network". It is at this point that we are able to quantify and qualify many of the theoretical inputs from Langlois that are inherent in our module specification and determination of the boundaries of the firm. Figure 1 below shows the transactional analysis of how a pot hook is made and sold to a kitchen.

As indicated, part of the job of designing a task network is to locate the transactions among the tasks. In this section I argue that mundane transaction costs are low at the boundaries of modules and high in the interiors. Thus given a choice between placing a transaction at the boundary or in the interior of a module, one should always choose the boundary. However, to understand the relationship between module boundaries and mundane transaction costs, we must look at the task network itself in more detail. For this purpose I introduce two concepts from modularity theory: information hiding and thin crossing points. p. 17Information Hiding, Thin Crossing Points and Modularity

These concepts were originally learned from Professor's Baldwin and Clark in a January blog entry. There it was also learned the related impact of Adam Smith's division of labor theory and the starting point of the majority of the organizational economics papers we have reviewed. A review of the application of these theories to oil and gas is contained in the entry here.

Professor Baldwin defines these terms further, key to this discussion is how the intellectual property of a producer is maintained;

An economical transfer of a good from its producer to a user constrains the surrounding transfers of information quite dramatically. The user cannot know everything about how the thing was made: if that information were necessary, the user would have to produce the thing himself, or at least watch every step of production. The efficiency of the division of labor would then collapse. By the same token, the producer cannot know everything about how the thing will be used, for then she would have to be the user, or watch the user's every action. Thus, fundamental to the efficient division of labor is substantial information hiding (Parnas 1972). This information hiding in turn supports what Aoki (2001, p. 96) calls the "division of cognitive labor." The user and the producer need to be deeply knowledgeable in their own domains, but each needs only a little knowledge about the other's. This is in fact the core assumption of the knowledge based view of the firm. p. 18and

If labor is divided between two domains and most task relevant information hidden within each one, then only a few, relatively simple transfers of material, energy and information need to pass between the domains. The overall network will then have a thin crossing point at the juncture of the two sub-networks. p. 18and

In modularity theory, a module is a group of elements - in this case, tasks - that are highly interdependent on one another, but only minimally dependent on what happens in other modules (Baldwin and Clark, 2000, p. 63). By definition, modules are separated from one another by thin crossing points - in Simon's (1962) terminology, they are "near decomposable." p. 18and

Mundane transaction costs are the costs of defining, counting, valuing and paying for things transferred. At thin crossing points between modules, there are, by definition, fewer and simpler transfers than within modules. Mundane transaction costs will be thus low at thin crossing points. It follows that transactions are best located at thin crossing points, i.e., at the boundaries of modules, not in their interiors. pp. 18 - 19The JOC is the legal, financial, operational decision making and cultural frameworks of the energy industry. Using the JOC as the base construct or organization of the market in this software leads to a wholly different perspective of how the industry functions. The tacit means of the industry operations has been developed and shared amongst the users in the business. The ability to see how the industry operates through this construct, the modular specification of this software, the boundaries of markets and firms and finally the Voucher leads to a greater fit and alignment in operating an oil and gas producer. It is at this point that I want to list the module specification of the People, Ideas & Objects application so that users can see this last point of Professor Baldwin's in their own environment;

- Compliance and Governance

- Access Control & Security

- Financial Marketplace

- Petroleum Lease Marketplace

- Resource Marketplace

- Partnership Accounting

- Research & Capabilities

- Knowledge & Learning

Keep in mind the 8 modular definitions that have been specified for this application. Defining the interaction between them and the various producers is a task that the user community will be highly involved in during the analysis for this applications development. If for example, an interaction between the Financial Resource Marketplace Module and Petroleum Lease Module (the purchase of a new P&NG Lease) would need to be mapped in a similar manner to Professor Baldwin's Smithy and Kitchen example.

The matrix shows that, in terms of tasks, the smithy and the kitchen are almost, but not quite, independent. The two establishments are materially connected by pot hooks and other iron implements, which are made in the smithy and used in a kitchen. And they are informational connected by a set of common definitions of pot hooks and other iron implements. In the language of modularity theory, the common definitions serve as design rules, and, by convention, the appear as a vertical column on the left-hand side of the matrix (Baldwin and Clark, 2000). The design rules are the "common ground" of the two establishments, thus we have labeled them "CG." (H. Clark, 1996; Srikanth and Puranam, 2006). Given this common ground, the two establishments can support one another without a lot of ongoing interaction. Hence this particular pair of sub-networks displays almost perfect information hiding. p. 20

It is relatively easy to turn the completed pot hook transfer into a transaction. Because of their common ground, a smith and a cook both know what a pot hook is, and can agree on its salient features (size, thickness, shape). In this fashion, the object being transferred is easily defined. Pots hooks are discrete material objects, thus easy to count. And cooks know what to do with completed pot hooks: they can easily value them and know what they are willing to pay. Defining, counting, and paying for the pot hook add a few more tasks to the network, but not many. Thus the mundane transaction costs at this location are relatively low. pp. 20 - 21In this matrix, transfers of design information are denoted by "x"s.

The Minimal transaction Design

as operator. And a variety of smaller field service companies are involved in making the operations run smoothly. Most of the R&D in this area is done by the tier 1 vendors and little outside of the earth science and engineering effort is conducted by the Oil and gas is a unique industry and business. The makeup of a firm is classified in terms of exploration, drilling, production, and operations is unique of all businesses. The majority of the operations are undertaken through contracts to tier 1 type vendors like Precision, Halliburton, Schlumberger, and BJ Services. Second tier vendors are also engaged through contract with the producer representing the JOC's operator. I suggest in the Partnership Accounting Module that a pooling of the resources of the partners within the JOC will contribute what resources they have available. This pooling will help to mitigate the shortfall in human resources. It will however open a new dynamic between the partners around the Asset Specificity theory of Oliver Williamson.

Thus design interdependency is a form of Williamsonian asset specificity (Williamson, 1985). As is well known, given asset specificity, once Upstreams costs are sunk, Downstream can unilaterally set a low price, causing Upstream to lose its investment. Or in another hold up scenario, if the demand for laptops is unexpectedly high, upstream might demand a higher price in return for timely shipments. In the presence of these opportunistic threats, each party has reason to make defensive investments in the spirit of Grossman and Hart (1986) and Hart and Moore (1990). For example, the drive firm might spend money to make its drives compatible with other systems and the laptop firm might look for second source suppliers. But such ex ante defensive actions reduce the value of the entire systems even if ex post bargaining is efficient. pp. 24 - 25In an ideal world the partners of the JOC would all be of like mind and equally motivated. That of course is not true. Weather they are interested in the project or not can lead to differences of opinion to those that see the area as a core facility in their organization. The dynamic introduced here has many permutations and combinations. The default or penalty alternatives being well defined in the culture of the industries operating procedures. Nonetheless, Williamson's asset specificity is a risk that manifests itself in areas where thin crossing points occur. How much of the dynamic of these strategies are put in play may be minimal due to the unique nature of the industry and the methods that it uses to mitigate risks, and how a shared understanding has been defined in CAPL, COPAS and others.

In short, a minimal transaction at a thin crossing point is a hotbed of opportunistic behavior. There is no direct compensation to either firm for transferring information, and there is no promise of a future relationship to provide indirect compensation. Self interested agents will then skimp on information transfers: ex post holdups are likely; and defensive investments (on both sides) are rational and prudent. p. 25And here is the area where the risks of asset specificity may become negligible in this "pooling scenario". Contracts play a large role in mitigating the risks of asset specificity, however the mundane transaction costs are high.

Reducing opportunistic behavior in a transaction like this requires a contract, either formal or relational. A formal contract defines the responsibilities of each party; measures compliance; and establishes multi-dimensional compensation. Thus a formal contract reduces opportunistic transaction costs by increasing mundane transaction costs. pp. 25 - 26Professor Baldwin notes that relational contracts are also effective in reducing opportunistic behavior between the JOC. How many of the drilling, equipping, completing and operational costs are not under contract in oil and gas? Almost none. The behavior of the industry participants has been dealt with over time and the culture of the industry has identified and standardized many of the contracts and requirements of their partners and the groups that are employed by the JOC.

Relational contracts also incur mundane transaction costs, but in less obvious ways. To control opportunistic behavior, a relational contract creates "a shadow of the future" and provides a means of ex post settling up to make the distribution of gains more fair (Baker, Gibbons and Murphy, 2002). But relational contracts don't just happen: like any form of contract, they must be designed and manged (Sako, 1992, 2004). Two strangers cannot immediately arrive at a relational contract: there are numerous tasks (e.g., meetings) and transfers (e.g., conversations involved in defining the relationship. In addition, costs of counting, valuation and payment arise in the course of adjudicating ex post settlement. p. 26

When transfers of information are complex, uncertain and iterative- as is always the case in design processes - the burden of defining, counting and paying for transfers becomes overwhelming. Thus a maximal transaction design weighs down the productive system with a lot of extra overhead. And (as if that were not enough) if design-information transfers are counted and compensated, there is a risk - indeed a certainty - that unproductive transfers will take place, not because they add value but because they add or subtract "points" to a compensation scorecard (Kerr, 1975; Holmstrom and Milgrom, 1994 Baker, 2002). Thus with a maximal transaction design, information transfers will go from being skimped on to being overproduced. p. 27It will need to be determined to what extent the ability to cost the overhead items of meetings and time of each producers' representatives is eligible to be costed to the joint accounts. It would be easy in this day and age to cost all activity being conducted for a specific joint account amongst the producers involved. Much like Lawyers are able to bill their time and services, each resource of the producer or JOC can be easily tracked and charge out rates, or the detailed costs can be attributed to the appropriate property. This will be a question for the producers to answer in detail at what level do they wish to continue with overhead allowances and move to a more direct costing system. I would assume that with the volume of engineering and earth science incurred per barrel of oil, the direct costing method of these transaction costs would be in the industries and producers best interests.

Although Figure 3 looks frighteningly complex, the idea is simple. There is an optimal level of transactions that should be undertaken within and between firms. The oil and gas producer is unable to use most of this analysis due to the culture of the industry involving partnerships, or JOC's, for a variety of reasons. Whether it is for mitigation of risk or the need to cooperate with producers in the area, transactions through the joint account are a necessary part of the industry and little to nothing can be done about that. Here Professor Baldwin describes the cost behaviours of more complex transactions and their associated thicker crossing points. This discussion inevitably leads to the relational contracts that are used to deal with the higher associated transaction costs of think crossing points.

The horizontal axis denotes "transaction complexity" the more transfers that are defined counted and paid for in the contract, the more complex it is. Maximum complexity, denoted by the breadth of the horizontal axis, depends on the thickness of the crossing point. Thicker crossing points have combinatorially higher maximum complexity than thin crossing points because (1) there are more transfers to define, measure and pay for; (2) many transfers of design information are unstructured, and each has uncertain and open ended consequences; and (3) in the presence of iteration and trial and error problem solving, there are many more potential paths, i.e. sequences of transfers. p. 29

The black lines in the figure indicate the costs of formal contracts of varying complexity. Mundane transaction costs rise as a function of complexity and are indicated by a linear function. As more transfers are defined, counted and paid for, however, opportunistic costs go down, until, at some point, perverse incentives set in. Thus, opportunistic transaction costs are a U-shaped function of complexity. Total transaction costs are the sum of the mundane and opportunistic transaction costs. pp. 29 - 30

A transaction is worthwhile if its benefits exceed its total costs. In the figure, this occurs in the middle range of transaction complexity. A formal contract of intermediate complexity thus has positive value, but contracts with more or less complexity have negative value and should be avoided. In other works, the two firms would be better off vertically integrating (hence losing the benefits of having the transaction) rather than operating under a poor transaction design. p. 30

1992; Introducing relational contracts changes the graph in two ways, as indicated by the grey lines in the figure. First, relational contracts are adaptive in the sense that many types of transfers will be counted and paid for ("settled") only if their cost deviates out of some normal band. The adaptiveness of relational contracts causes the mundane transaction cost line to flatten out at higher levels of complexity; the parties can achieve a more complex contract more cheaply in the context of an ongoing adaptive relationship. Second, the "shadow of the future" reduces opportunistic transaction costs, including inventive to "game" the contract. Hence the opportunistic transaction cost line is lower for all levels of complexity, and may flatten instead of curving upward. Total transaction costs(denoted by the highest grey line) are thus generally lower for relational contracts than formal contracts for all degrees of complexity. Net transaction benefits are correspondingly higher and thus relational contacts are generally to be preferred over purely formal contracts at thick crossing points. However, relationships are based on prior knowledge and trust hence relational contracts are not always an option for transactors (SakoGulati, 1998). p. 30With Figure 3 we can see how the costs associated with transactions are incurred. To analyze the transactions involved in both the firm and the market of the industry (based on the modular definitions) will help to understand the cost implications of certain activities. To summarize then, the analysis conducted in Figure 1 and 2 will provide the ability to map the transactions between producers and contractors to their optimal system configuration. This analysis will also provide, through the use of thick crossing points and relational contracts, ways to mitigate certain costs, if deemed desirable. Recall the industry operates with partners and that is the case in more then 90% of all activity. Oil and gas is therefore unique and much of the transaction costs will be incurred as a result of the culture of the industry.

To summarize, at thick crossing points in the task network, relational contracts dominate formal contracts of intermediate complexity, which in turn dominate minimal and maximal transaction design. If possible, transactions at thick crossing points should be structured as a relational contracts, and, failing that, as formal contracts of intermediate complexity. If those alternative fail, the transfers should be internalized within a single firm. pp. 30 - 31Modularizing the Network

Professor Baldwin introduces the concept of time and how the interactions between the tasks can change. Recall the review of Professor Langlois' Dynamic Transaction Costs where transactions whose costs were incurred during times of change. Professor Baldwin brings in the process of modularizations and the ability to design them based on using either natural, or a method of design rules. The module specification that has been specified here, consists of the eight defined modules that are able to, based on my experience in oil and gas, manage the process of oil and gas exploration, production and exploitation. Anything within these standard oil and gas classifications can be managed within an individual module or the interaction between modules.

As I indicated in my last post, the Joint Operating Committee is the natural form of organization for oil and gas. Employees are using informal networks to complete their work in a way that occurs naturally. The "natural" way of doing things is the overall design concept used in developing the eight modules. I want to raise this point as Professor Baldwin seems to be stating that the ability of users to rely wholly on design rules will be an effective means of design. And for the purposes here, I want to stress the natural way of getting work done through the modules is the key to maintaining the natural way of doing things. If an individual cannot see where and how a certain element of the oil and gas business is captured in the modules they should ask, as the logic may not be as transparent as it is to others.

Up to this point, I have assumed that the task network's structure is fixed. In this section I consider the possibility of making a thick crossing point thinner through the process of modularization. We have seen that thinner crossing points have lower total transaction costs, thus firms wishing to transact may modularize their task networks to support the transaction. However, modularization can also be undertaken for other reasons. Regardless of their intended purpose, modularization creates new module boundaries with low transaction costs. Competition at the new boundaries may ensue. p. 31

In general, however, it is impossible to say whether it is better to design a contract around a given "natural" set of dependencies or to modularize the dependencies using the method of design rules. Each approach involves different costs and benefits. Modularization, in particular, requires detailed prior knowledge of dependencies - knowledge that might not exist when the parties design their transaction. Thus while modularization is always an option, it is not always a good option. p. 34Recall we are writing software that supports the industries ways, and the ways that people need to do their work. The implications of this change to the Joint Operating Committee are far reaching. As Professor Baldwin begins to discuss the effects these types of changes will have in the industry.

In general, as knowledge about a particular set of technologies grows, the corresponding task networks may be redesigned and modularized for a number of reasons. Such modularization necessarily create new module boundaries, and vertically integrated firms may split apart or new firms may enter at those points. In this fashion, an industry may devolve into several sub-industries coordinated by common design rules (standards) and bridged by intermediate product markets (Baldwin and Clark, 2000; Jacobides, 2005). However, as Chandler (1977) and Fixson and Park (2007) have shown, it is also possible for task networks to become more integral (i.e., less modular) over time. Hence there is no process of technological determinism at work driving the task network toward ever-higher levels of modularity. Instead, the modular structure of the task network at a particular point in time results from the interplay of firms strategies, their knowledge and the physical constraints of specific technologies. Strategies, knowledge and technologies all change over time, and as they do, the location of transactions will change pari passu. p. 37The interactions and transactions that occur within a module may not be a transaction in the sense that we are talking about here. Professor Baldwin introduces the idea of transaction-free zones.

Transaction-free zones are physical or virtual spaces where, by convention, a designated set of transfers occurs freely. the smithy and the kitchen were transaction-free zones, as were the disk drive, laptop, plastic, auto and mold-making companies. Indeed transaction free zones are common in human affairs: every time we strike up a conversation, we are in effect creating temporary transaction-free zone for the transfer of information. p. 39And this may best be described as the collaborative interactions between people who are getting the job done.

Transaction-free zones in which agents freely access and transfer valuable materials and information are necessary for most forms of efficient production. But a transaction-free zone designed to hold things of value can't have any holes or leaks. Thus modern market economies have developed sophisticated institutions that provide for the encapsulation of transaction-free zones within the boundaries of legally constituted corporations. p. 40Corporations: Transaction-free Zones Encapsulated By Transactions.

In this section we learn that the method of organizations, the corporation, provides us with the means to protect and develop our interests. And just as some interactions are carried out in the interest of those corporations, not all transactions can be captured, counted and monetized. Transaction free zones become the means in which the corporation captures their value.

Bringing labor or capital into a transaction-free zone is harder, however. In medieval times, labor would often enter a zone via birth or bondage: the smith's assistant would be his son or his slave (Bloch, 1961). Capital would enter via marriage, inheritance, or as trade credit attached to a goods transaction (Braudel, 1982). In contrast, today, in modern economies, people are hired and capital is raised via transactions. p. 40

By definition, it is impossible to precisely define, measure, and pay for all transfers within a transaction-free zone. Hence the transactions that bring labor and capital into the zone cannot perfectly reflect what happens inside. But the legal form of a modern corporation makes it possible to (1) completely surround a transaction-free zone with transactions; (2) protect the zone from transient disruptions; and (3) determine whether the zone should survive in the larger system of production. These goals are achieved via a complex social technology (Nelson and Sampat, 2001), which I call transactional encapsulation. p. 40

Transactional encapsulation involves creating a legal entity - a corporation - with property rights, whose boundaries are defined by its transaction with customers, suppliers, employees, and investors. By design, many transfers within the boundaries of the corporation are complex and difficult to measure and pay for. Such transfers are economic only if they take place with a transaction-free zone. Property rights allow valuable things - capital equipment, intellectual property, inventory and receivable - to be held within the zone, without disruption, for as long as the technology demands. pp. 40 - 41

Thus in a modern economy, a firm that is legally constituted as a corporation can be completely segregated (hence protected) from its owners' affairs. This in turn means that transaction-free zones can be set up to correspond to the modular structure of the tasks network, rather than being agglomerations of unrelated holdings linked by common ownership. p. 42

This last group of transfers satisfies my definition of a transaction. In this sense, Coase, Williamson and the contract theorists are right: some transactions are internal to firms. But at the task network level of analysis, internal transaction are a very small subset of all the transfers that take place within a firm. Furthermore, I contend, the role of firms and corporations in the economy is precisely to provide transaction-free zones, where complex, but necessary transfers can take place without weighing down the system with the costs of defining, counting and paying for them (Motnteverde, 1995). p. 43Conclusion

As Professor Paul Romer of Stanford says, "Ideas need to be discovered to maintain growth. As economies increase in size, more ideas are required." How, in what is generally agreed is the most difficult and complex of businesses, will the new ideas of the earth scientists and engineers benefit society and the companies that employ them. There is a belief that "meta ideas" or idea discovery systems are the means to make these organizations perform as they should. I have consistently stated that the current hierarchy is unable to accommodate these changes, and at the same time I have offered an alternative vision or model that provides those possibilities with the means to become realized opportunities.

In this paper Professor Baldwin, and over the past year Professor Langlois have enabled our understanding of how this type of transaction and task networks are analyzed and can be made real in the software. But key to making this real is the software development capability that is available for the users and companies. We have seen time and again that businesses change. I think the oil and gas industry is changing in major directions every 18 months, or even faster. This is a fluid process of change that needs to be mirrored by the software, the developers and the systems development capability as proposed here in People, Ideas & Objects, led by the users and driven by their demands for the most effective way of doing their jobs.

The paper makes four contributions to theories of the firm. First, it views systems of production as networks of tasks. Although not completely new, this view is more microscopic than is typical in transaction cost economics or contract theory. At this more microscopic level of observation, transactions are no longer the basic units of analysis but instead are located in more complex network structure. The task network itself provides both thin crossing points (module boundaries) and thick crossing points (module interiors). Although transactions can be placed in both types of locations, transaction costs are lower at module boundaries. p. 46I propose that these transactions and task networks be managed by the firm through the monthly accounting voucher. A concept that I have reintroduced in this blog entry. Vouchers are different from month to month, that is their "nature". The accounting elements that they are documenting are different in some material way each and every month. The voucher is the tool that enables the user and the developer to accommodate the changes that are occurring in the business, and also those changes within the modularity and its associated transactions and tasks.

The second contribution of this paper is to show that many of the opportunistic transaction costs identified in prior work can be traced to the same underlying phenomenon - thick crossing points in the task network. Thick crossing points are places where transfers are complex, numerous and interdependent. Paths of action and flows of information are consequently uncertain and iterative. We have seen that interdependence gives rise to asset specificity. Iterative paths cause some transfers to take place again and again, hence have high frequency. And when iterative paths arise in the process of trial and error Williamsonian (1985) transaction costs. In terms of contract theory (e.g. Hart, 1995), when transfers are complex numerous and interdependent, it is impossible to define, measure, and value each one. Hence any contract written on these transfers will necessarily be incomplete. Furthermore, even when participants can observe and judge what actually happened, third parties must rely on indirect evidence. Such transfers are observable, but not verifiable. Finally, thick crossing points imply that agents are producing multiple, interdependent outputs, hence they are multi-tasking (Homstrom and Milgrom, 1994). p. 47Adam Smith's theory of the division of labor has proven economic growth occurs through an ever increasing division of labor. What the effect of these changes has on the makeup of the oil and gas industry is not known at this time. What we do know is that this is an accelerating process. In ten years the changes may be all that people are concerned with. Nothing will be the same twice. This process of change to enhance the division of labor is something the writings of Professor Langlois has noted. The structured hierarchy and the makeup of the service industry in the oil and gas sector are going to be subjected to many changes. I hope that they are able to foresee the need to address these changes and begin the development of this software in a timely fashion. We have many years ahead of us that will be consumed in the preliminary stages of software development.

This paper's third (and most important) contribution is a theory of technological change that explains and predicts changes in the location of transaction, hence the structure of industries. Indeed, the prediction is very simple: Modularization's, whatever their stated purpose, create new module boundaries with (relatively) low transaction costs. Modularization's thus make transactions feasible where they were previously impossible or very costly. Therefore firms desiring to transact may modularize the task network at the point of their transaction. And firms that modularize their task networks for other reasons should be prepared to face entry and competition at the new module boundaries. p. 47

The paper's fourth contribution is the concept of transaction-free zones as places in the task network where numerous, complex, interdependent, and iterative transfers can take place economically without the cost burden of transactions. Firms can move valuable items into and out of transaction-free zones via transactions, and corporation can set up zones that are legally encapsulated by transactions. However, un-encapsulated transaction-free zones, such as online and open source communities, thrive in the absence of transactions. Such communities produce non-rival goods, hence for them opportunistic transaction costs are naturally low, and almost any level of mundane transaction cost may be too high. pp. 47 - 48

The overall picture that emerges from this analysis is that of an economy wide tasks network where densely connected clumps of tasks take place within transaction-free zones. The zones can be (but are not always) encircled by transactions, which provide defined, counted and compensated transfers between zones. Transactions will tend to be located at the thin crossing points of the network, some of which are created, via modularization, expressly for this purpose. However, transactions at thick crossing points are possible, too, especially when the parties have a longstanding relationship. Speaking metaphorically, this picture is reminiscent of Robertson's view of an economy in which firms are "like lumps of butter coagulating in a pail of buttermilk" (Robertson, quoted by Coase, 1937, p. 388). pp. 48 - 49

As Furubotn observes, there is no guarantee that a system like this will reach anything approaching global optimality or even constrained Pareto efficiency. But each firm participating in the network will have inexhaustible opportunities to gain advantage by redesigning the portions of the task network it controls and the transactions it influences. At the same time, new firms can quite easily attach themselves to the network at the boundaries of modules. As a result, the network's structure and the location of transaction will be ever-changing. p. 49Well stated Professor Baldwin. After all I think Curtis Pavel got it right when he said "People are the killer app of the Internet." And Frederick von Hayek wrote "Societies course will be changed only by a change in ideas."

Technorati Tags: Genesys, Modularity, Change, Collaboration, Firm, Market